- LIQT is well-positioned to benefit from strong scrubber demand in the marine shipping market driven by the implementation of IMO 2020 regulations.

- Closed-loop scrubbers are taking share from open-loop scrubbers due to more stringent restrictions placed on wastewater at an increasing number of major ports.

- A strong backlog of sales is leading LIQT to more than triple capacity by July 2020 while, at the same time, significantly improving margins.

- LIQT is introducing adjacent products into the marine scrubber market, including open-loop to hybrid conversion kits and NOx reduction products.

According to an article published in Seeking Alpha, LiqTech International is an exciting clean technology filtration company positioned well to benefit from several significant catalysts that are providing meaningful growth opportunities for this relatively unknown small-cap company.

This stock has been punished due to a misunderstanding of LIQT’s unique position within the marine scrubber market. Additionally, some investors expressed concern over the durability of LIQT’s earning power beyond the implementation of IMO 2020. This uncertainty, combined with a generally soft small-cap market, has contributed to the currently depressed share price.

This article will dispel concern over earnings durability beyond the closed-loop scrubber market by outlining four overlooked opportunities for LIQT. In our opinion, this combination of factors creates a compelling GARP opportunity today.

Background

LIQT is a clean technology company that provides ceramic silicon carbide (“SiC“) filters for gas and liquid purification. LIQT began as a manufacturer of Diesel Particulate Filters (“DPF”) supplying to the European market for large commercial vehicles like trucks and buses. The company continues to sell DPF for large vehicles around the world today with China being the largest current market. Additionally, the company provides filtration of industrial wastewater, pool/spa water, and drinking water. Their first big commercial success is in the marine scrubber market, which is currently being driven by the implementation of IMO 2020 regulations aiming to reduce sulfur dioxide created by the shipping industry.

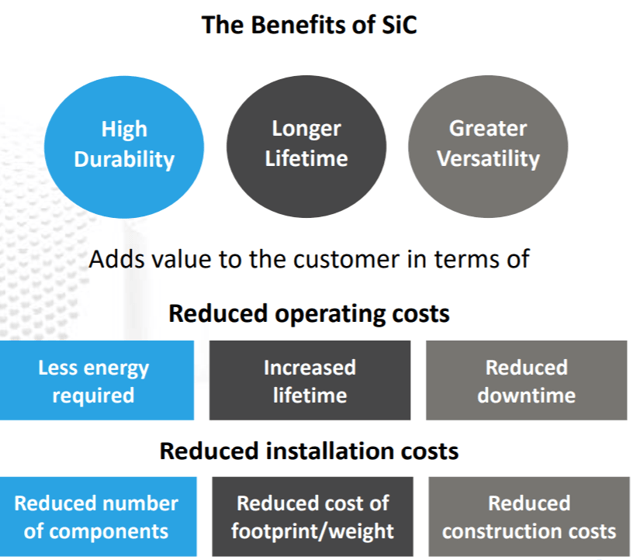

LIQT spent tens of millions and almost a decade developing its filters using its proprietary SiC technology. Behind diamonds, SiC is the second hardest material known to man and can be used for demanding filtering applications. LIQT believes that SiC provides several competitive advantages compared to typical carbon filters, including better durability, longer lifetimes, lower operating costs, and greater versatility than competing offerings.

(Source: Q1 19 Investor Presentation)

In March of 2018, LIQT signed a framework agreement with one of the world’s largest manufacturers of marine scrubbers. This agreement was the culmination of a multiyear effort by LIQT’s management team to position themselves for the emerging marine scrubber market. The demanding specifications are an ideal match for LIQT’s ceramic SiC filter solution. Since this initial framework agreement, the company has continued to sign additional agreements with manufacturers and shipbuilders leading to a strong backlog of system orders.

IMO 2020

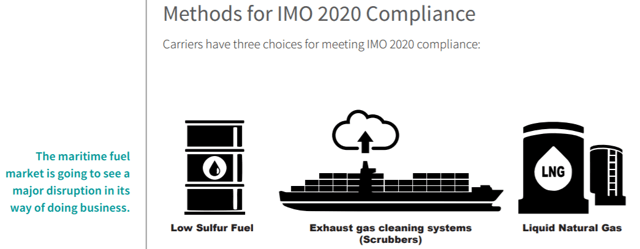

IMO 2020 is changing the marine shipping market by requiring lower sulfur emissions created by large ships. There are three primary methods to comply with the new IMO sulfur dioxide regulations. The first is burning low sulfur compliant fuels, the second is to use an alternative fuel like LNG or, finally, use high sulfur fuel with an emissions scrubber to minimize the sulfur dioxide released into the atmosphere.

The upcoming IMO 2020 rule implementation is causing companies to position their existing fleets to use either lower sulfur content fuel or exhaust scrubbers. However, the available installation capacity for scrubbers is limited. This means that, in the early days of IMO implementation, many shippers will be required to use low sulfur fuels. The lack of installation capacity provides a backlog of scrubber demand for LIQT and increased visibility for their business.

(Source: IMO 2020: What Every Shipper Needs To Know)

The price of LNG is quite low relative to the other fuels. Unfortunately, there is limited fueling infrastructure and conversions to burn LNG are quite costly. This combination of reasons has relegated LNG to niche applications and new build ships.

The spread between low sulfur and high sulfur fuel drives the payback period for ship owners buying scrubbers. By installing a scrubber, the ship can burn cheaper high sulfur fuel while maintaining compliance with the new regulations. Currently, the spread price is expected to drive an attractive payback period for scrubber installation. The resulting strong demand from shipowners trying to take advantage of this spread has allowed LIQT to build a considerable backlog of business that should extend well beyond the initial date of IMO 2020.

Scrubber Market

Wet scrubbers are the primary version available for the marine market. It operates by spraying water into the exhaust system of diesel engines in order to neutralize and capture sulfur dioxide particulates. The method of treating the water further distinguishes the market into three subcategories: open, closed and hybrid loop systems. LIQT specializes in closed-loop scrubbers but has recently announced the development of products that convert open-loop scrubbers into hybrid versions.

Open-loop scrubbers are currently the most widely used variety of scrubber. However, “some local authorities are limiting the use of open-loop scrubbers while in port, including the United Arab Emirates, Singapore, China, and various European countries. In relevant ports, vessels will need to be able to operate a scrubber in a closed mode or switch to compliant fuel.”

Difference between open-loop and closed-loop scrubbers

Below is a diagram of a typical open-loop scrubber. The key difference between open-loop and closed-loop scrubbers is that the wastewater in a closed-loop scrubber is treated and reused in the exhaust capture process. The waste is stored onboard and then discharged at the port. Open-loop scrubbers ultimately discharge their wastewater in the ocean after some treatment. The hybrid scrubber is a combination of scrubber that can operate in open or closed formats depending on the need. While closed-loop systems are typically the most expensive, LIQT’s technology has improved the operating cost and cost of ownership of their system helping to improve payback periods. As seen in the second slide below, LIQT is the “dominant product” in the marine market for closed-loop scrubbers through their agreements with OEM manufacturers, thus positioning the company well for this market.

(Source: S&P Global Platts: Into the Storm)

Payback periods for shippers are a function of the spread between high and low sulfur fuel, the cost to finance the scrubber (if needed), fuel consumption, and initial investment to purchase and install the scrubber. The slide below shows the quick math of the impact of price differentials, or the spread, between high and low sulfur fuel. “Due to the recent rush in scrubber orders, many manufacturers are out of available delivery slots prior to 2020.” This creates a strong backlog for LIQT which, as mentioned above, provides filters to multiple OEM manufacturing partners.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha