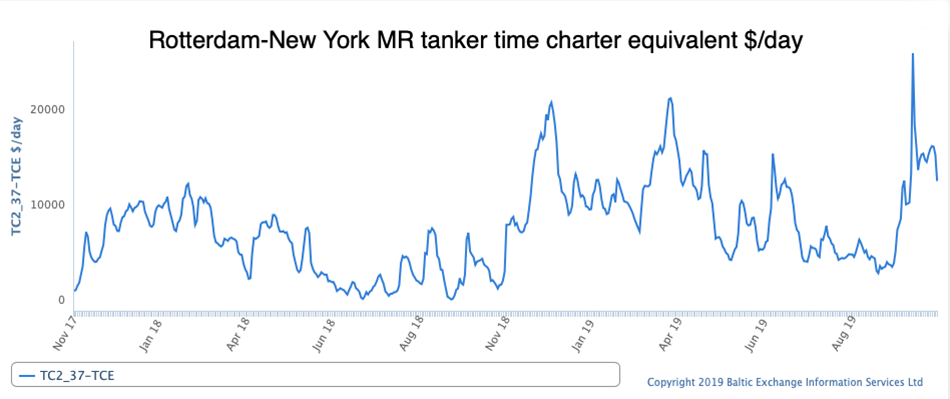

- This higher demand may prolong the gains in earnings for medium-range tankers plying transatlantic trades, which have nearly doubled since early October.

- European shipments to the U.S heading for the Atlantic coast accounted for about 465,000 tonnes monthly, or roughly 128,000 BPD, according to Eurostat data.

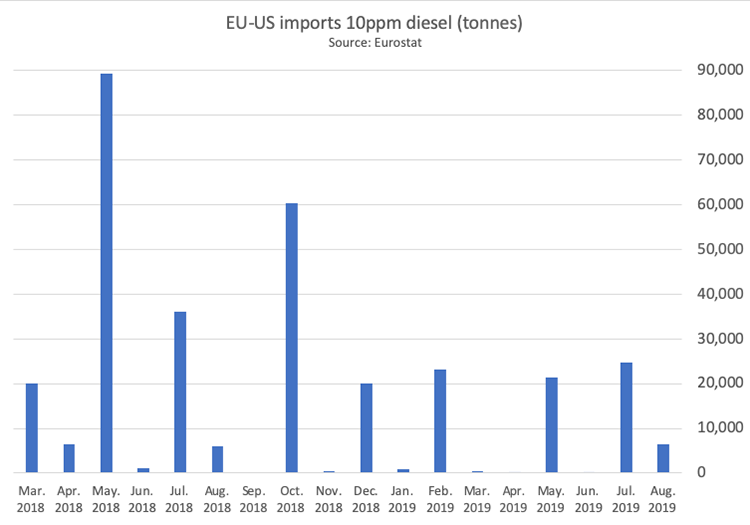

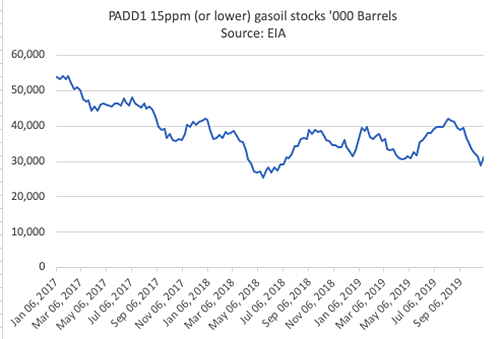

- Diesel imports are not keeping up with demand, as refinery runs fall leading to inventories on the Atlantic coast shrinking.

- Middle East refineries have compensated with increased supplies to northwest Europe, which produces too much gasoline for its needs but not enough jet fuel or gasoil.

According to an article published in Lloydslist, there could be winter gasoil price spikes in New York, opening up reverse arbitrage trades. Higher demand may prolong the gains in earnings for medium-range tankers plying transatlantic trades.

Focus on transatlantic trading

Renewed focus on transatlantic trading follows the June closure of the Philadelphia Energy Solutions refinery, the region’s largest, while strike action at the Bayway refinery at New Jersey could also dent output.

Lower refinery runs on the US east coast alongside middle distillate stocks at 18-month lows are expected to result in winter gasoil price spikes in New York, opening up reverse arbitrage trades for medium-range tankers in the transatlantic region.

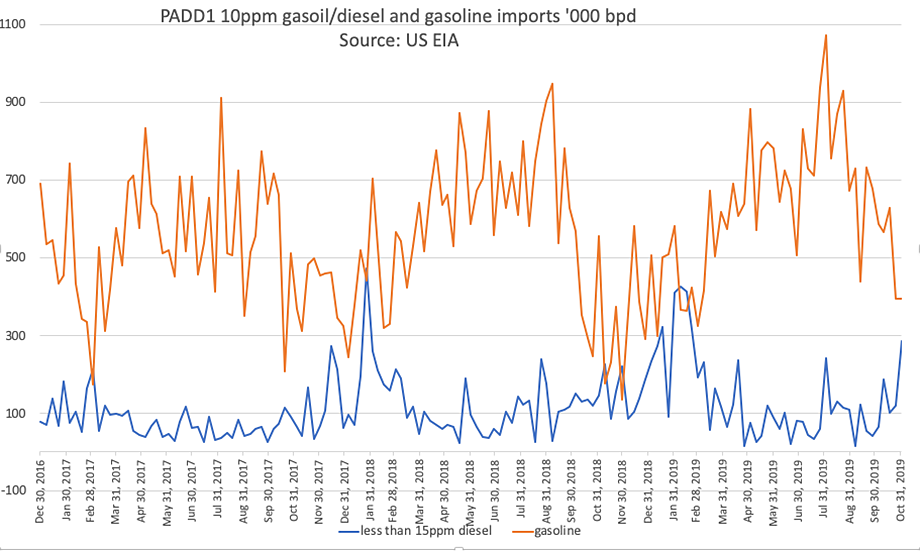

Tankers normally deliver gasoline to the east coast from the Amsterdam-Rotterdam-Antwerp region and then sail to the US Gulf of Mexico to load diesel for shipment to northwest Europe.

But when demand for gasoil used in heating on the US east coast spikes during winter, higher prices open arbitrages that make it profitable to buy and ship diesel from Europe to the US for sale at a profit.

Increased volumes derived mainly from Canada but also Europe, data show.

Overall imports to the PADD1 region (which covers New England to Florida) so far average 627,000 barrels per day this year, US Energy Information Administration figures show.

European shipments to the U.S.

European shipments to the US — most of which head for the Atlantic coast — accounted for about 465,000 tonnes monthly, or roughly 128,000 BPD, according to Eurostat data. Cargo sizes for a medium-range tanker are 37,000 tonnes.

EIA data shows that diesel imports are not keeping up with demand, as refinery runs fall. That has led to inventories on the Atlantic coast shrinking, Morningstar Financial Research highlighted in a report this week.

“That storage deficit versus previous years will increase when the weather turns colder and heating oil demand kicks into high gear,” the report said. “With (gasoil) stocks at historical lows and market prices not attracting new supplies, the shortage may well foreshadow price spikes this winter.”

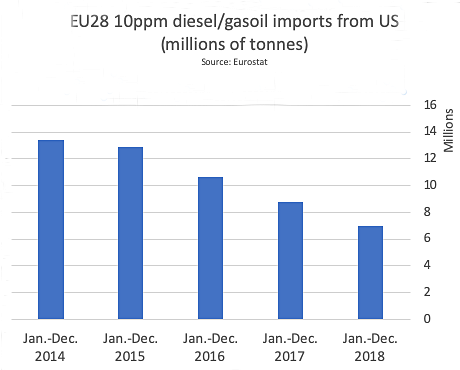

Diesel flows to Europe from refineries in the US Gulf have diminished in the past years, due in part to increased demand from Latin American countries.

Compensation from the Middle-east

Middle East refineries have compensated with increased supplies to northwest Europe, which produces too much gasoline for its needs but not enough jet fuel or gasoil.

These altered trade flows within the Atlantic basin have impacted medium-range tanker earnings, which plunged to loss-making levels during the third quarter on the triangulated route. But the research analyst Morningstar says that the US east coast will be increasingly reliant on outside suppliers, signaling steadier imports from Europe.

The Colonial pipeline, which pumps up refined products from US Gulf refineries, already running at maximum capacity, and it is not economically viable to ship gasoline or diesel to the coast on US-flagged tankers in Jones Act trades.

European Union-US imports of gasoline measured 521,000 tonnes in August, the last month for which Eurostat statistics are available, compared with 575,000 tonnes over the same month last year.

The Baltic Exchange currently pegs MR transatlantic earnings at just under $20,000 per day, well above the loss-making levels of $5,700 daily seen in September. Owners and traders are anticipating arbitrage-related price spikes, as well as increased demand to ship marine gasoil for higher earnings into 2020.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Lloydslist