- Euronav owns both the Europe and Oceania Ultra Large Crude Carriers, which it operates as floating storage.

- The company also owns 39 VLCCs and 25 Suezmax tankers.

- Most of the fleet is operated in the spot market and is fixed through Tankers International Pool.

- The company ended the quarter with more than $295MM on hand and valued the fleet at a net $3,000MM.

- It reported an average Time Charter Equivalent of $35,700 on its VLCCs and $29,300 on Suezmax tankers.

- Its base rates of $25,000 per day on VLCCs and $20,000 on Suezmax.

- The average rates for these vessel types were $77,800 for VLCC and 50,300 for Suezmax.

- Average rate estimates for the 2nd and 3rd quarters above $200,000 per day on VLCCs and $100,000 on Suezmax.

- These rates drop to around $145,000 per day, $70,000 per day in the 4th quarter.

According to an article published in SeekingAlpha and authored by RockieK, Will the current contango in crude oil markets have a bullish effect on the shares of Euronav NV?

Can traders benefit from the current situation?

Can current investors or traders benefit from a per-share price increase because oil producers and futures traders will seek to store oil on tankers? And, based on its fleet, is Euronav properly positioned to take advantage of this opportunity? Let’s find out.

Introduction

In 1711, the British joint-stock company named The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, also known as the South Sea Company, was granted monopoly power to trade in the “South Sea” or the water surrounding South America. Because of the public’s perception of the monopoly granted, share prices in the South Sea Company skyrocketed.

By the middle of 1720, South Sea Company Stock price went hyperbolic, jumping 10-fold from 100 pounds per share to more than 1,000 pounds per share. Valued in today’s money, the company would have been worth a staggering $4.5 trillion ($4,500,000,000,000.00). Unfortunately for shareholders, Britain was in the midst of a war with Spain, and Spain and Portugal controlled most of South America. So, the South Sea Company never realized much of a profit.

As a result, the share price crashed back to earth. The collapse and public allegations of company corruption resulted in massive losses and an investigation by Parliament. Even Sir Isaac Newton lost money with the company, saying “I can calculate the movement of the stars, but not the madness of men.“

As romantic, adventurous, and profitable as classic seaborne shipping seemed to be, the reality is quite often exactly the opposite. Sometimes, the prospect of profit just cannot be realized, and investors overestimate the opportunity. That was the case with the South Sea Company.

We should not make the same mistake. Therefore, we should know both the strengths and weaknesses of any company we intend to invest in, as well as the threats posed by any potential competitors. So, as we continue to look at a potential trade opportunity in the seaborne tanker shipping segment due to the current crude oil market and global economic conditions, we should look at some of the companies positioned to compete in this sector.

This article will look at one particular company, Euronav NV. We will discuss the financial position and available fleet. This article will cover some of the systemic risks associated with the market and review year to date time charter rates and break-even points based on the current crude oil contango. Finally, we will compare these to financial data provided by the company to project earnings potential over the next 2 quarters. Finally, we will disclose additional considerations that should be known before deciding whether or not to take a position in this company.

The Company – Finances and Fleet

EURN was created in 1995 as a subsidiary of Compagnie Nationale de Navigation. In 2000, the company formed the Tankers International Pool, which still operates the largest VLCC pool in the world. The company was spun out (demerged) in 2004 and has since acquired tankers and floating storage. Current directors include Carl E. Steen – Chairman, Anne-Hélène Monsellato, Ludovic Saverys, Grace Reksten Skaugen, Anita Odedra, and Carl Trowell.

Euronav owns both the Europe and Oceania Ultra Large Crude Carriers, which it operates as floating storage. The company also owns 39 VLCCs (including 3 newbuilds scheduled for delivery in 2020) and 25 Suezmax tankers. Most of the fleet is operated in the spot market and is fixed through Tankers International Pool mentioned above.

EURN pays semiannual “dividends“ that may be subject to mandatory Belgian withholding of up to 30%. Since the second half of 2017, the company has agreed to a minimum payout of $0.12 per year at the discretion of the board. This means that payouts may be classified as a return of capital if there are no sufficient earnings. Since that time, EURN has only paid out the minimum $0.06 semiannually.

EURN last reported quarterly earnings on January 30, 2020. The company ended the quarter with more than $295MM on hand and valued the fleet at a net $3,000MM. EURN reported an average Time Charter Equivalent of $35,700 on its VLCCs and $29,300 on Suezmax tankers. Unfortunately, Euronav NV does not disclose average daily operating expenses but assumes base rates of $25,000 per day on VLCCs and $20,000 on Suezmax. Finally, earnings for the whole year were $0.55 per share.

Year to Date Time Charter Rates

The company recently provided an investor update presentation on April 9, 2020. Although EURN did not disclose any fixtures for the first quarter, the company has claimed that every $5,000 increase in charter rates improves EBITA by more than $112MM.

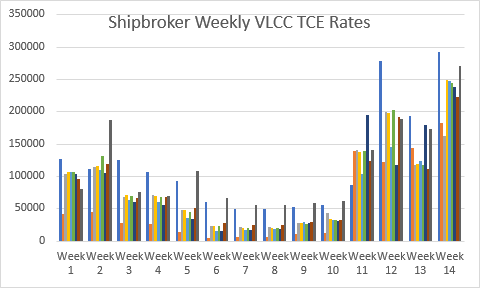

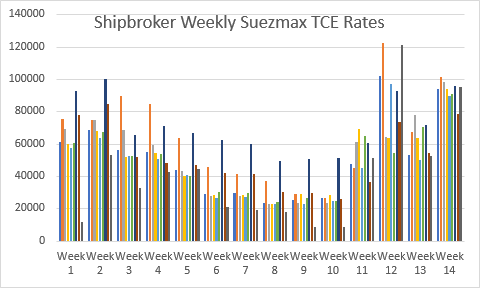

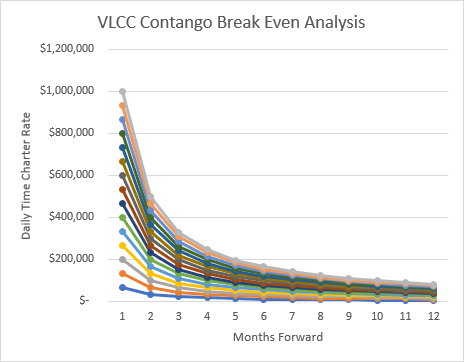

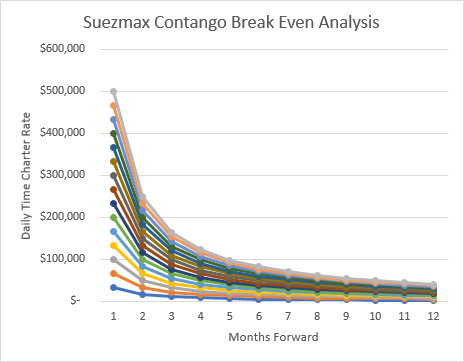

With that in mind, data gathered and presented in the article Contango With Me – Tanker Breakeven Analysis looked at different weekly time charter rates reported by shipbrokers (Affinity, Gibson, and Charles R. Weber). These rates were filtered by size and standard route and included data on both VLCCs and Suezmax rates.

First-quarter fixtures correspond to weeks 1-13 in the above graphs. The average rates for these vessel types were $77,800 for VLCC and 50,300 for Suezmax.

Crude Oil Contango

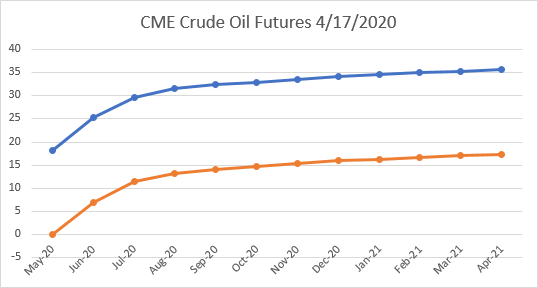

Also discussed in the investor update was the current crude oil contango. EURN reported that the current contango has been quicker and steeper than previous occurrences in 2008-2009 and 2015-2016. The company suggests that up to 70 VLCCs or more than 20% of the global fleet could be taken out of transient service for crude oil storage.

Additionally, the article Contango With Me – Tanker Breakeven Analysis discussed the current market conditions of crude oil and current contango. Because of ongoing high production rates and depressed consumption, futures contract prices are above the expected future spot price. This means that producers or traders can purchase crude oil today, pay to store for a period, and sell it at a higher price in the future, guaranteeing an arbitrage profit.

However, that is assuming the carry cost (storage, insurance, etc.) is not greater than the spread between the current spot price and the guaranteed future price. Because arbitrage cannot exist for an extended period of time, the carry cost, or specifically, the cost to store the crude, will have to come up. Hence, the positive price pressure we have been seeing in the tanker markets.

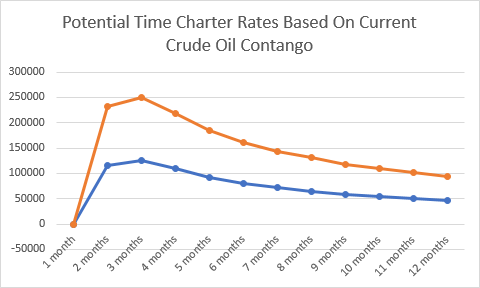

As of this writing, the spot price of light sweet crude was $18.25. On the CME, the spread on futures prices ranging from zero at one month out to more than $15 seven months out. Graphically, we see the futures prices in blue, with the spread between spot below, in orange.

Breakeven Analysis

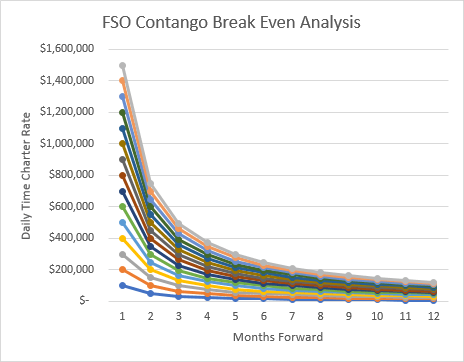

Now, it is rational to say that charter rates for voyages will move in a manner consistent with vessels chartered for storage if that happens. Historically, Very Large Crude Carriers, Suezmax, and Aframax tankers are used for temporary storage. And, since EURN only has a fleet of VLCCs and Suezmax, we will limit our analysis to those vessel sizes. But, because Euronav owns the ULCC’s Europe and Oceania, we will include breakeven data on FSOs.

Again, going back to the article Contango With Me – Tanker Breakeven Analysis, based on the spread in crude oil futures and vessel size, it is possible to calculate the maximum charter rate a producer or trader can afford to pay. Because the FSOs, VLCCs and Suezmax tanker carries on average 3MM, 2MM and 1MM barrels of oil, respectively, and futures contracts are listed in 1-month increments, we have the following graph and matrices:

Earnings Potential

Assuming average charter rates will be fixed at a rate that mostly eliminates crude oil trader arbitrage, we can estimate the most generous time rate available to EURN at this time.

The company will not be reporting earnings until next month, scheduled for May 7th. But, the first quarter is gone, and the company is now operating in the second quarter. However, because we do not have numbers for the first quarter, all we can do is speculate.

First-quarter time charter rates started out fairly strong but weakened as February came to a close. In March, however, rates bottomed and began to pick back up to close out the quarter strong.

We will wait for EURN’s first-quarter numbers to know for certain, but we also know that average time charter rates increased in the 1st quarter as disclosed above. Also, based on the charts above, we have average rate estimates for the 2nd and 3rd quarters above $200,000 per day on VLCCs and $100,000 on Suezmax. These rates drop to around $145,000 per day, $70,000 per day, respectively, in the 4th quarter. But, there are still a lot of unknowns.

Additional Risks

Probably the biggest unknowns in this whole picture are the macroeconomic factors.

Saudi Arabia and Russia have been bantering back and forth about oil cuts, but every time there seems to be an agreement it falls apart. But, what happens if they do come to an agreement and are able to sufficiently cut production? If this happens, the demand for storage would decrease, as would the demand for dirty tankers. This could have a negative impact on charter rates, EURN earnings, and the stock price.

Next, there is a depressed economic activity. Some estimates have oil demand down 2MM barrels per day on an annualized rate in North America. OPEC estimates between 8-9MM barrels, while the U.S. Energy Information Agency predicts 5MM bpd. However, what if the expected rebound does not occur and the most pessimistic scenario of global depression is realized. That would certainly have a negative impact on stock prices.

On the other hand, what about price inflation? If we see a dramatic increase in crude oil prices eliminating the current contango all while consumer demand is down, demand for tankers and time charter rates could collapse. That would also have a negative impact on earnings and stock price.

Conclusion

So, does that mean that this opportunity is too risky? That is actually a question that only you can answer. The objective here is not to convince you one way or another, but only to provide insight and information about the situation.

As things currently stand, the world is producing too much oil. Demand for oil is off and there is very little storage capacity left. The oil has to go somewhere, and in some areas of the world, it is going to go onto tankers at anchor. That, in turn, will take those vessels out of the shipping pool. Globally, rates should reach an equilibrium based on the amount a producer or trader would be willing to pay to store the oil.

If average rates received by Euronav NV increase 70,000 to 100,000 or more over its base rates, the next couple of quarters could see a significant positive effect on the stock price.

But there are risks associated with this strategy. Whether those risks are worth the profit potential is an individual decision left up to the person. However, remember the investment timeframe associated with this opportunity is only a couple of quarters.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha