- Rystad Energy reported that oil has been negatively impacted when compared to other fuels.

- Oil prices plunged to historical lows and storage filling up.

- LNG may also face the same fate as the oil industry.

- Europe managed to increase LNG imports by 35%.

- European demand has been rather resilient to Covid-19 as buyers stock up on cheap supplies

According to an article published in Safety4sea, Rystad Energy issued an analysis reporting that oil has been negatively impacted much more quickly in compared to other fuels due to the COVID-19 crisis.

Plunge in LNG prices

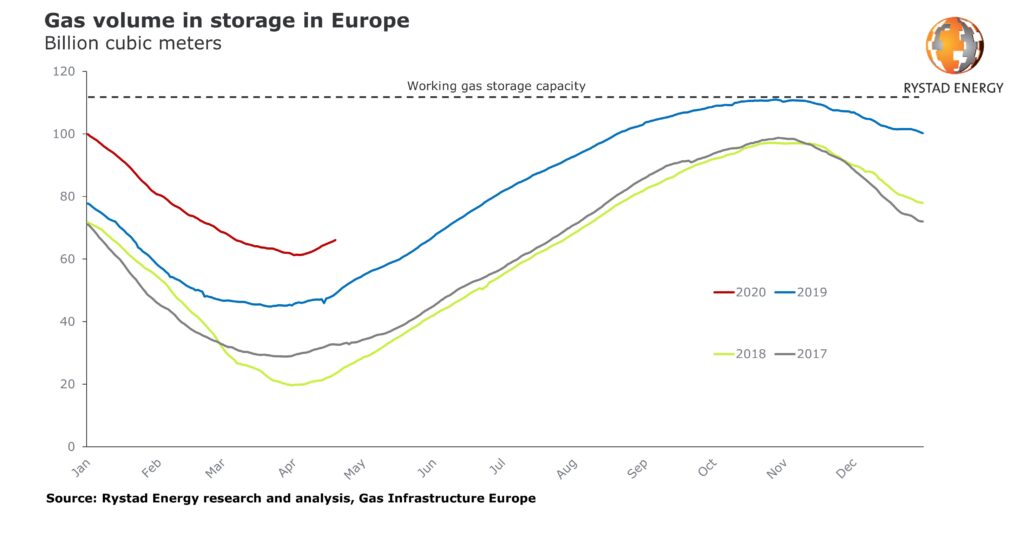

With prices plunging to historical lows and storage filling up, liquefied natural gas (LNG) is next in line, as Rystad reported.

- Namely, the global LNG supply is estimated to reach 380 million tonnes (Mt) in 2020, 17 Mt higher in comparison to 2019.

- Although the demand is expected to increase only 6 Mt from 2019 to 359 Mt, as an industrial activity has declined due to the pandemic.

Rystad reported, “If the world faces a colder-than-forecast winter and lockdowns are lifted faster than expected, then demand will see a boost. The opposite could happen if the winter is milder or if the resumption of industrial activity sees further delays.“

LNG market hit by COVID-19 pandemic

As for the European LNG, in the first two months of 2020, when the coronavirus pandemic hit Northeast Asia heavily, Europe managed to increase LNG imports by 35% compared to the same period in 2019, mainly driven by the UK, Spain, and Belgium.

Rystad added, “European demand has been rather resilient to Covid-19 as buyers stock up on cheap supplies: The continent realized a monthly record-high LNG import of 8.9 Mt in March, a 20% year-on-year increase.“

When will the market recover?

At the moment, it is still not clear when Europe will fully recover from lockdown and the impact will probably be deeper coming into the summer months.

“With gas storage tanks already almost filled to the brim, Europe’s capacity to import and actually use the same amount of LNG as in 2019 seems like a tall order, especially if we see another mild winter“, Rystad concluded.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Safety4sea