European importers have been avoiding crude oil shipped from Russia, as a response to the invasion of Ukraine. This has driven a rather remarkable switch in the direction of Russian crude oil flows towards Asia, mostly India and China, reports IHS Markit.

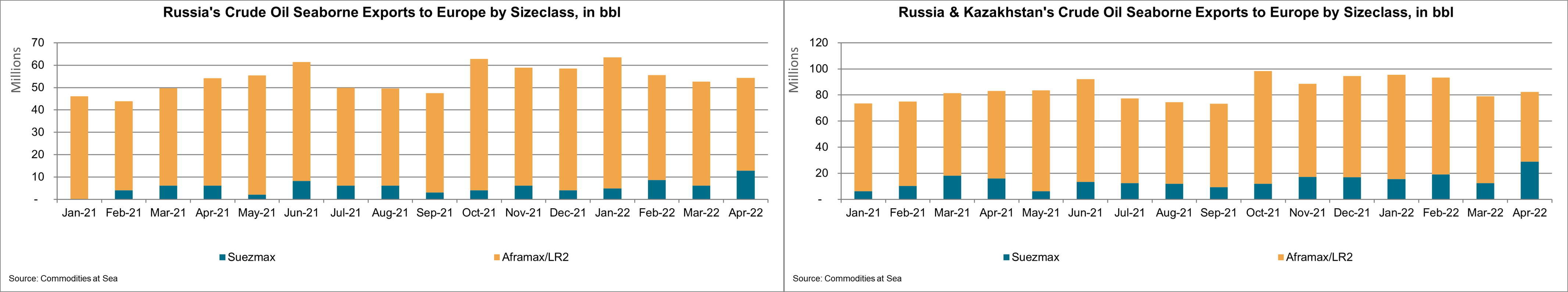

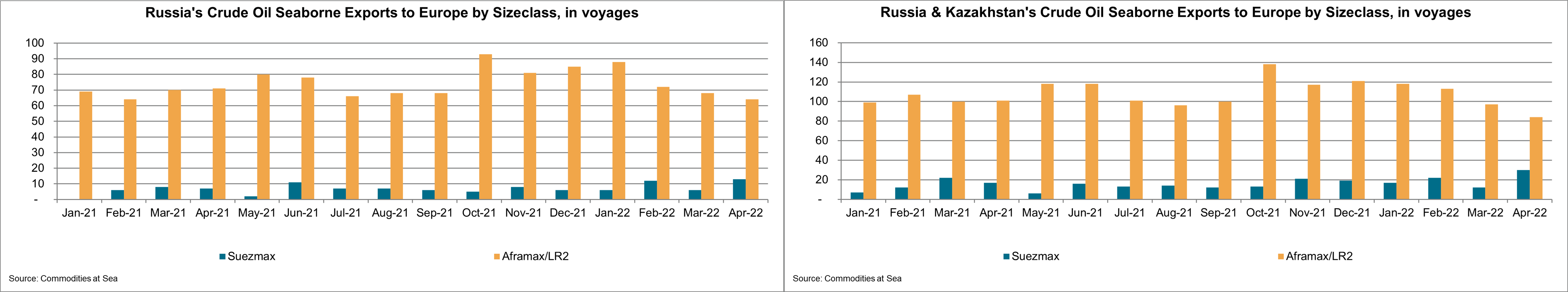

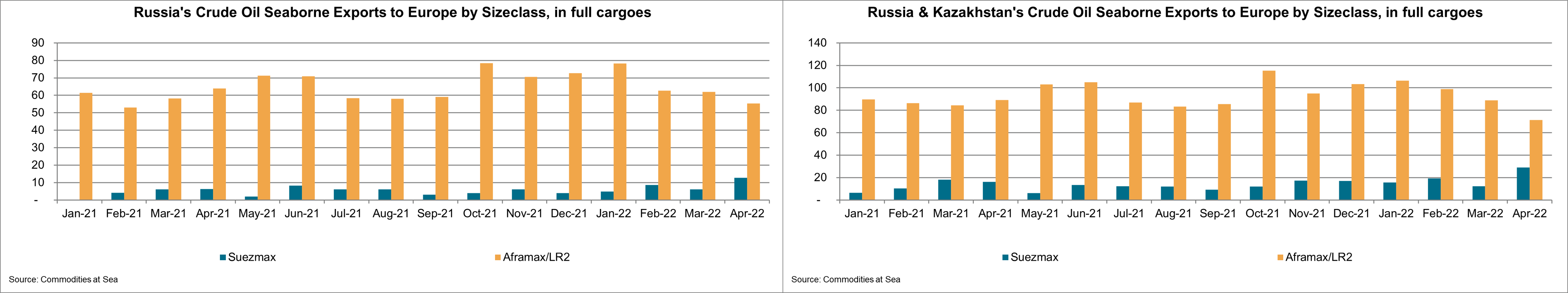

Assuming the Continent will fully avoid Russian seaborne flows at some point, this would affect average monthly flows of 55 million barrels (around 1.8 million b/d), or up to 85 million barrels (2.8 million b/d), if barrels of Kazakhstan are included.

Global demand for crude oil tankers rise by 3.5%

With India already having increased the volumes it absorbs from Russia to more than 900,000 b/d (from just 30,000 b/d last year), it becomes rather probable for the country to be able to import 30 million barrels of Russian crude oil on a monthly basis (or around 1 million b/d). Meanwhile, China could increase its imports from Russia (primarily referring to additions in shipments from Russia’s European ports) by 15 million barrels on a monthly basis versus last year’s activity, equivalent to additions of half a million b/d.

This scenario would increase global demand for crude oil tankers by 3.5% (1.8% related to India and 1.7% driven by additional flows to China).

A more optimistic scenario, where India increases its flows from Russia to 45 million barrels per month, or 1.5 million b/d, and China to 25 million barrels per month or 830,000 b/d, would cause global demand for crude oil tankers to expand by 5.6% (2.8% related to India and 2.8% to China).

Meanwhile, European importers are expected to gradually avoid supplies of refined products shipped from Russia, which could drive a growth near 4.2% for clean tanker shipping demand.

Demand for clean tanker shipping climb

According to S&P Global Commodities at Sea, Russia was typically shipping around 30 million barrels of refined products to Europe on a monthly basis, based on last year’s activity. From these volumes, around 20 million barrels each month referred to gasoil/diesel, equal to up to 700,000 b/d.

The average journey from Russia to Europe lasts 8 days, while those to West Africa and Latin America last 25 days and 30 days respectively, on average.

Assuming 60% of these volumes will be shipped to West Africa and 40% to Latin America, then this would drive an increase in demand for clean tanker shipping by around 2.2% and 2% each, or 4.2% in total versus last year’s levels.

MRs have been primarily used for clean flows from Russia to Europe, typically requiring 106 MR voyages each month, with 3 for LR1s and 3 for LR2s.

The switch would provide a boost to flows on LR1s and LR2s instead.

There is no doubt that the change of direction in Russian oil flows, for both crude oil and refined products, will have a significant impact on the demand for tanker shipping.

The insurance ban

The insurance ban adds pressure against Russian shipments

Meanwhile, the tension between the West and Russia, after the invasion of Ukraine, extends into other parameters shaping the operations of the shipping industry.

A major issue to consider has been the recent news on the potential insurance ban, by both the UK and the European Union, on any tankers carrying Russian oil around the world, which could sharply affect the global shipping industry fundamentals.

This ban, which would come into effect half a year after the oil ban, could cause severe pressure against Russian oil exports from the Black Sea and the Baltic, potentially driving a decline in exports, down up to a million b/d.

Without insurance, buyers would not ship the oil, unless governments establish mechanisms to cover insurance domestically, as it happened before with Iranian cargoes.

The alternative observed so far, with Russia shipping mostly to China and India, would have to rely on tonnage controlled or owned domestically.

This justifies the recent decision by Unipec to charter more than 10 tankers so far, to transport more Russian oil to China.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: IHS Markit