- The International Monetary Fund (IMF) estimates global economic growth of 2.9% in 2023 and 3.1% in 2024. The Chinese economy is now estimated to grow by 5.2% in 2023, a 0.8 percentage point increase over the IMF’s previous forecast.

- We expect demand growth within the 1.5-2.5% range in 2023, driven by China’s economic recovery. Improvements in consumer sentiment should help solve the country’s real estate crisis and boost bulk demand.

- However, demand growth could weaken to 1-2% in 2024 due to an expected reduction in coal shipments. Import demand should fall as India and China continue to boost domestic mining and Europe transitions away from fossil fuels.

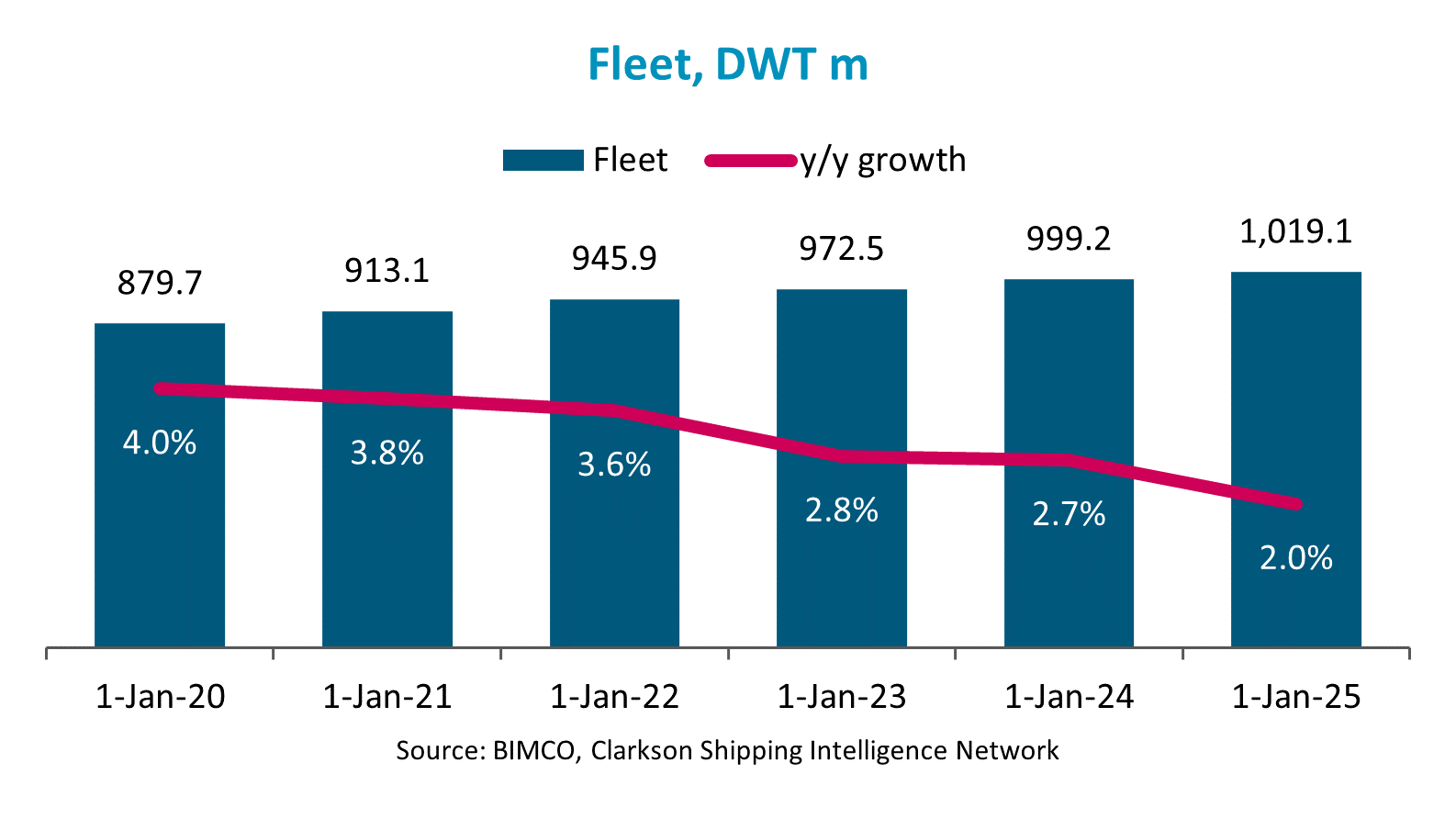

- The dry bulk fleet is forecast to grow by 2.7% in 2023 and by 2.0% in 2024. Deliveries remain limited amid a small orderbook at 7.5% of the fleet.

- Supply is estimated to grow by 0.5-1.5% less than the fleet in 2023 and 2024 due to lower speeds caused by compliance with EEXI and CII regulations.

- The supply/demand balance should improve in 2023, although risks will remain in 2024. We expect rates to start recovering as demand picks up in China.

- Capesizes should benefit from a recovery in iron ore demand, while panamax ships are most exposed to a drop in coal shipments.

Demand drivers

We have revised our demand growth estimate upwards and now expect demand to grow by 1.5-2.5% in 2023 and by 1-2% in 2024.

A recovery in the Chinese economy should cause a pick-up in demand for bulk shipping in 2023. This is expected to make up for the 3.0% y/y decline in transported volumes during the first two months of the year. Despite improved economic conditions, demand growth could slow down in 2024 due to lower coal shipments. Average haul should remain stable, since gains in shipping iron ore, a commodity which involves longer sailing distances, will be countered by a decline in long-distance coal shipments to Europe.

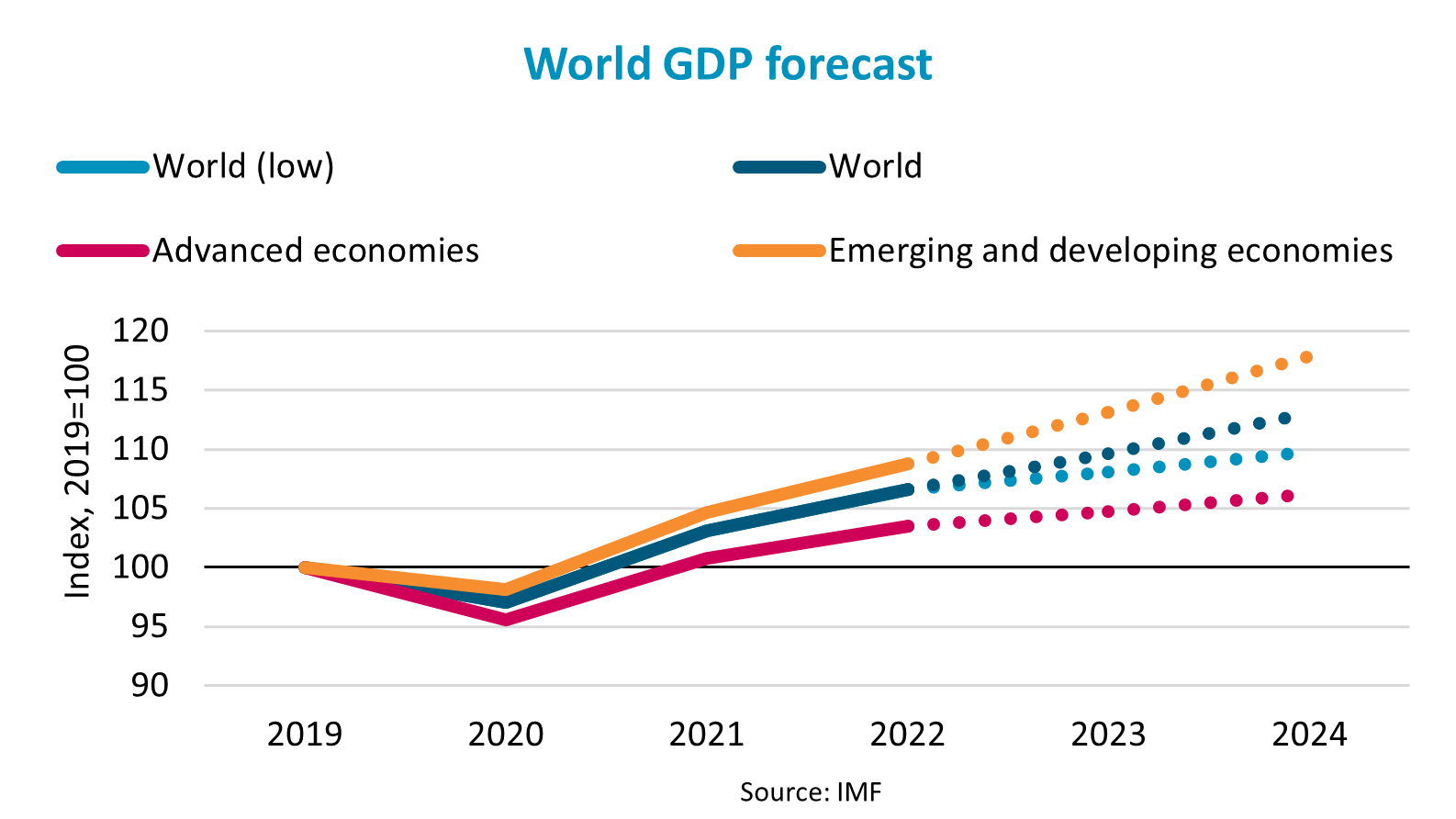

Since the last quarterly update, the IMF’s economic outlook has marginally improved, and the global economy is now forecast to grow by 2.9% in 2023 and by 3.1% in 2024. While this is still significantly lower than the 3.8% average growth recorded in the first two decades of the millennium, the risk of a global recession has diminished. Central banks are expected to continue to raise interest rates in 2023, which is highlighted as the main cause of the slowdown in growth.

The IMF has raised its 2023 forecast for China’s economic growth by 0.8 percentage points to 5.2% and has kept its forecast for 2024 at 4.5%. This is a strong rebound from 2022, when the Chinese economy underperformed and grew by only 3.0% and is the key driver behind the raised expectations for the global economy.

China is leading the improvement in economic prospects due to its decision to end its zero-Covid policy and to focus on growth. To support the Chinese economy, banks lent almost CNY 3.5 billion (USD 510 million) to businesses in January, three times more than in December. Private spending is also expected to rise as savings increased during the lockdown periods, and consumer sentiment is likely to improve following the reopening of the country.

Economic growth in advanced economies is forecast to slow to 1.2% in 2023 and then improve to 1.4% in 2024. While these are smaller markets for dry bulk when compared to China, the 0.2 pp reduction in 2024 growth prospects could still be a concern as these countries collectively account for 28.2% of tonne miles demand.

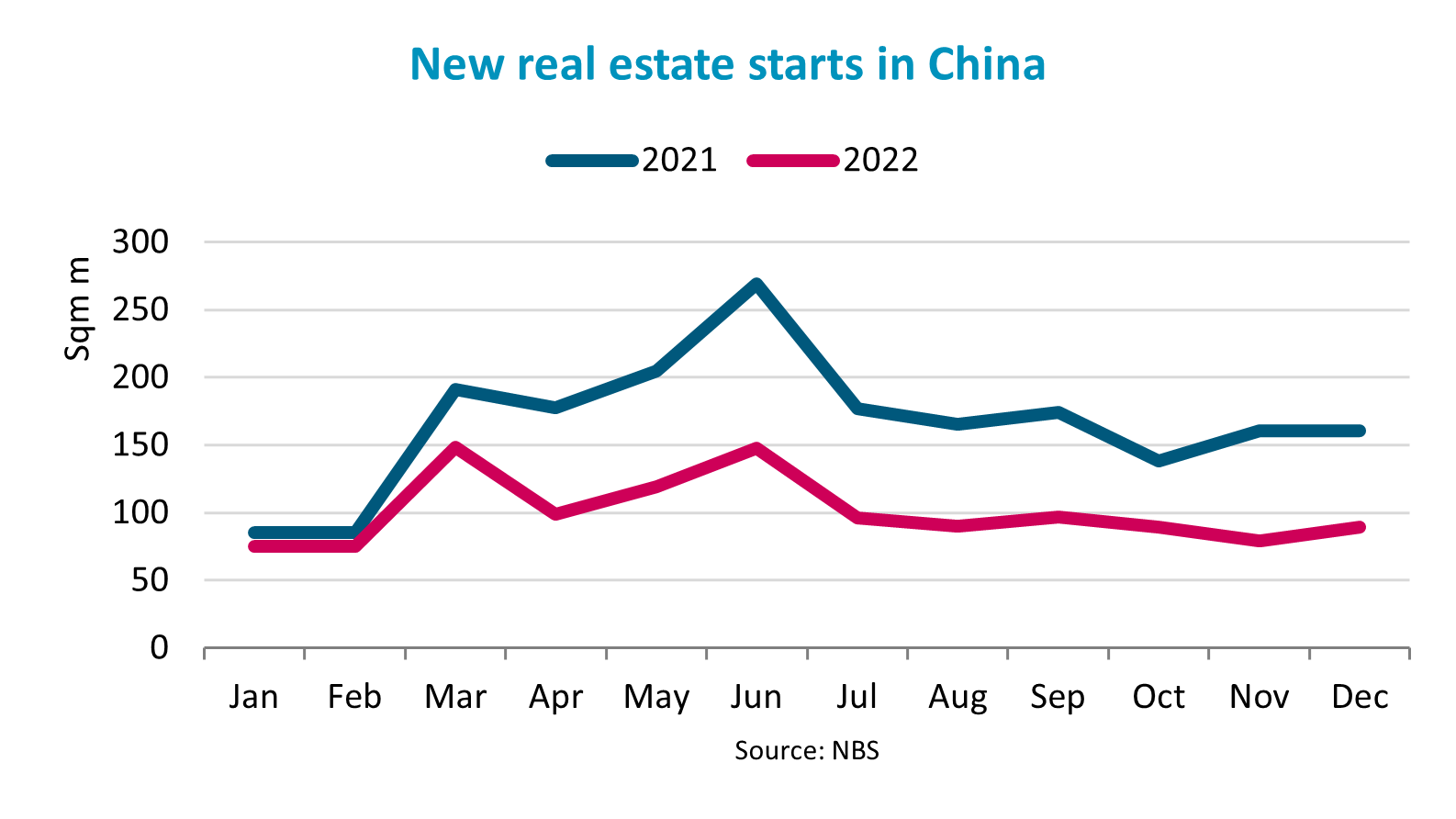

Iron ore shipments stand to benefit the most from China’s economic recovery in 2023. A 1.0% y/y fall in shipments thus far in 2023, combined with a larger fleet than in 2022, has resulted in weak capesize rates. New real estate construction starts fell by 39.4% in 2022, and the government’s spending on infrastructure was key to keeping iron ore demand afloat. While construction activity remains muted, Xi Jinping stated the government’s intention to support the real estate sector this year. The recovery in the sector should come gradually over the first half of the year, and we anticipate strong iron ore demand during the second half of the year.

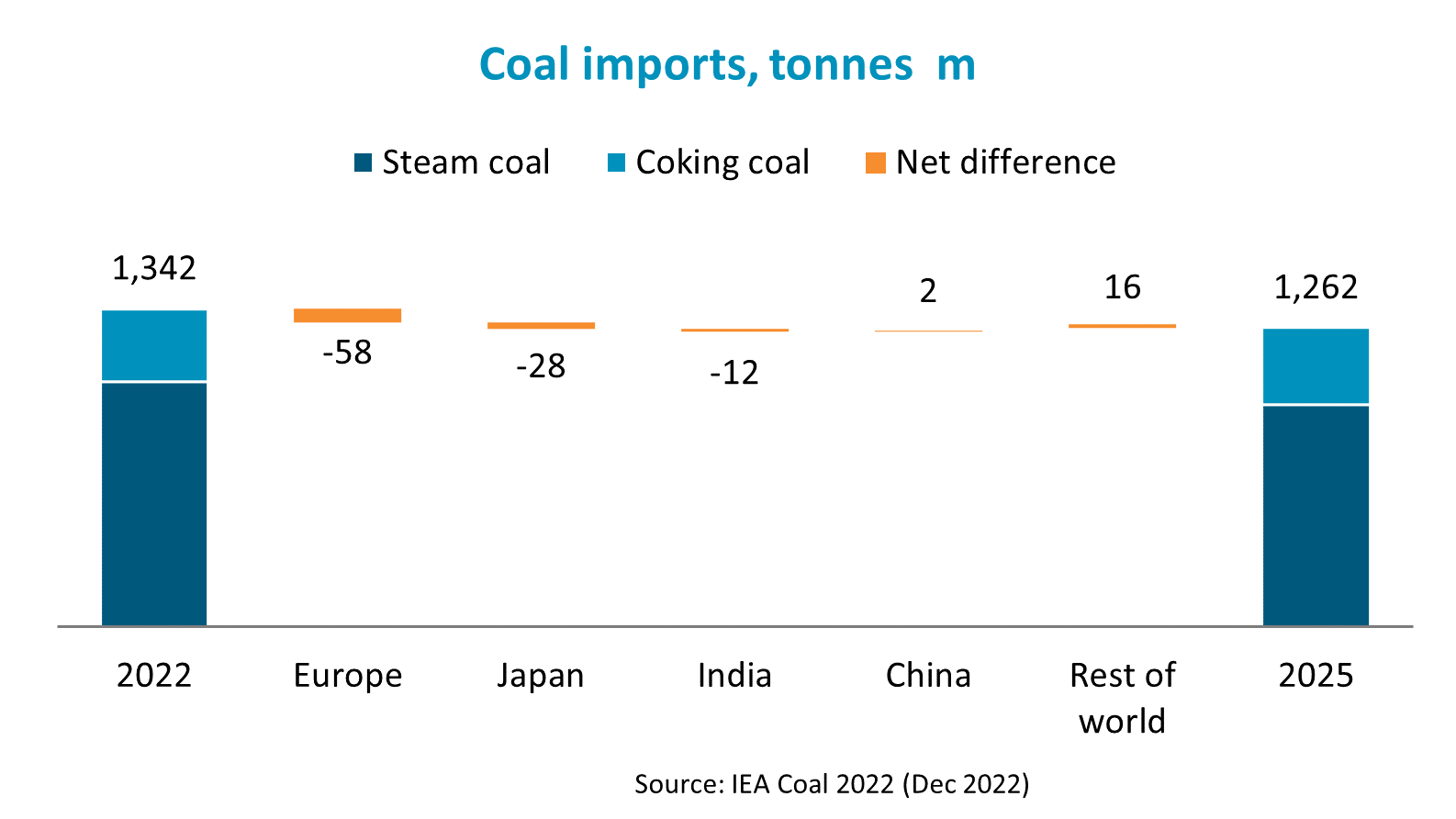

Coal is expected to find strong demand in Asia during 2023 and help sustain the volume increase reported in 2022. However, import demand may begin to soften from 2024 onwards. In the three years leading up to 2025, the IEA estimates that coal imports will fall by 6.0% compared to 2022 levels, led by a 9.6% drop in steam coal import volumes. The energy crisis has accelerated a shift to renewables in Europe, while higher domestic mining in India and China will also cut import demand. In contrast to the outlook for steam coal, coking coal import demand will increase by 6.2% until 2025, in line with an increase in global steel production. Countries with low or zero coking coal exports, such as Indonesia, will be among the first to feel the decline in demand.

Grain volumes are expected to grow marginally in 2023 and 2024. Supplies of wheat and maize have been under pressure since the start of the war in Ukraine, forcing exporters to tap into their inventories, while drought has affected the harvests in major exporting countries such as the US and Argentina. Looking ahead, the United States Department of Agriculture (USDA) forecasts a 0.2% drop in wheat exports during the 2023/24 marketing year and a 1.7% increase in 2024/25. Maize exports could fall by 9.8% in the current marketing year, before recovering and rising by 3.9% in 2023/24 and by 1.9% 2024/25. However, this will not be enough for volumes to return to pre-war levels. The USDA’s forecast does not assume a date for the end of the war in Ukraine and therefore a recovery in Ukraine’s production is not accounted for.

The outlook for soybeans remains more optimistic and volumes are estimated to rise by 9.5% in the current marketing year, with further rises of 1.8% in 2023/24 and 2.1% and 2024/25. The USDA estimates that larger harvests in Brazil will drive the increase in volumes, while exports from the US should remain stable as rising domestic demand for biofuel production limits export growth.

Unlike in past years, minor bulks may not grow at a faster pace than the major bulk commodities in 2023. Volumes have been on the decline since the second half of 2022, and they fell by 7.1% y/y in the first two months of 2023. While we expect China’s economic recovery to cause a pick-up in demand for some of these commodities, weaker market conditions in advanced economies will limit this rebound. In contrast to major bulks, advanced economies are key drivers of demand and account for 37.5% of minor bulks tonne miles. We believe that demand may improve in 2024 as the global economy begins to stabilise.

Despite an improved outlook for global bulk demand, several risks remain, and a more negative scenario could still emerge. A delayed recovery of the Chinese economy could greatly affect how the bulk sector performs in 2023. China must still contend with its ongoing real estate crisis, and government stimulus is required for economic activity to accelerate. Despite some previous government intervention, housing developers are yet to deliver on a large backlog of presold housing and real estate investment remains low, which could delay the recovery.

A few additional uncertainties concerning bulk commodities could affect demand. The ongoing discussions over the extension of Ukraine’s grain deal have the potential to disrupt shipments as early as March 2023. In addition, extreme weather conditions, such as the droughts that affected several grain exporters in 2022 could further constrain the already tight global grain supplies. On the other hand, continued high energy prices could pose an upside risk to our forecast. If oil and gas prices stay high, price-sensitive economies in Asia and Africa could continue to see coal as an affordable energy source, further delaying the phasing out of the commodity.

Supply drivers

The dry bulk fleet will grow by 2.7% in 2023 and by 2.0% in 2024, as both deliveries and demolitions remain low. However, supply is expected to grow by 0.5-1.5% less than the fleet in 2023 and in 2024, due to the impact of EEXI/CII regulations on sailing speed.

The orderbook currently sits at 7.5% of the dry bulk fleet and is limiting fleet growth; this will particularly be the case in 2024. Deliveries of supramax, panamax and capesize ships will be almost equal in terms of deadweight tonnes (DWT), while handysize deliveries will account for only 7.0% of total bulk carrier deliveries. While we expect contracting to remain low in 2023, it could pick up in 2024 as both market conditions and shipyard availability improve.

Recycling is forecasted to reach 7.8 DWT and 7.2 DWT in 2023 and 2024 respectively. We have lowered our recycling estimate to adjust for a higher expected cargo demand than in our previous report and it should be limited to older ships that have been made less competitive by environmental regulations.

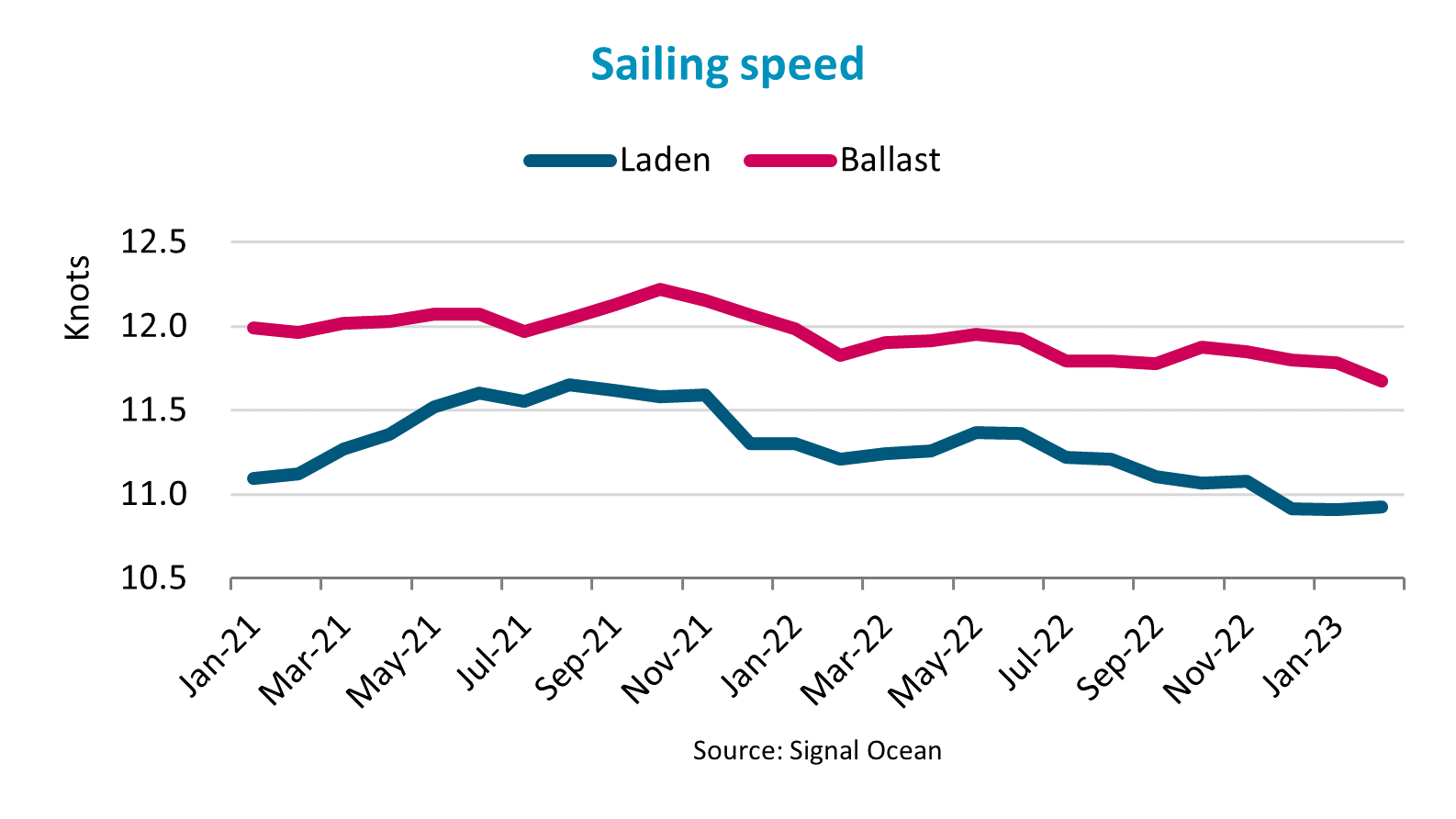

During the first two months of the year, laden and ballast sailing speeds were down 3.0% y/y and 1.5% y/y respectively. These reflect the ship operators’ reactions to the current weak market conditions, which should begin to rebound once demand in China picks up. Nonetheless, we expect that environmental regulations will contribute to lower sailing speeds, and we estimate a 2% reduction in sailing speeds. We have included half the impact in 2023 and the other half in 2024 when the first CII ratings will be awarded.

Congestion fell by 3.9% y/y in the first two months of 2023, despite disruptions to mining in Australia and Brazil. We expect a marginal increase in congestion later this year as cargo volumes increase and end similar to the 2022 average.

Conclusion

We expect freight rates to improve from the second half of 2023 onwards as a pick-up in demand in China drives an improvement in the supply/demand balance. Even though we expect demand growth to slow in 2024 as Europe cuts coal shipments and import demand from India and China stabilises, supply is still expected to grow at a slower pace and market conditions may still improve marginally.

The bulk carrier fleet should grow by 2.7% in 2023 and by 2.0% in 2024 amid limited deliveries. Additionally, we expect environmental regulations to reduce supply growth by 0.5-1.5% as sailing speeds fall. Overall, supply is expected to increase by 1-2% in 2023 and by 0.5-1.5% in 2024, while demand growth is predicted at 1.5-2.5% in 2023 and 1-2% in 2024.

The expected recovery in iron ore shipments should result in a welcome rebound in capesize market conditions that have suffered from the low iron ore volumes throughout 2022. Conversely, the expected loss of coal shipments in 2024 could be a cause for concern for panamax ships since coal accounts for over half of their volume.

The predicted improvement in the overall supply/demand balance is quite marginal as demand will outpace supply by only 0.5 pp in both 2023 and 2024. As such, the improvement is still vulnerable to a variety of risks that could still affect the demand outlook for 2023 and 2024. A slower-than-anticipated economic recovery in China or a delayed resolution of the real estate crisis could have a direct and significant impact on demand, thus impacting overall conditions for the dry bulk market.

Did you subscribe to our daily Newsletter?

It’s Free! Click here to Subscribe

Source: BIMCO