Chinese economic data blew expectations out of the water last week, reflecting a strong comeback for the Asian giant as it finally emerges from the world’s most restrictive pandemic-era lockdowns. The positive results are constructive for industries and sectors across the board, but I’ll be closely watching the global luxury goods market, air passenger demand and container shipping in particular.

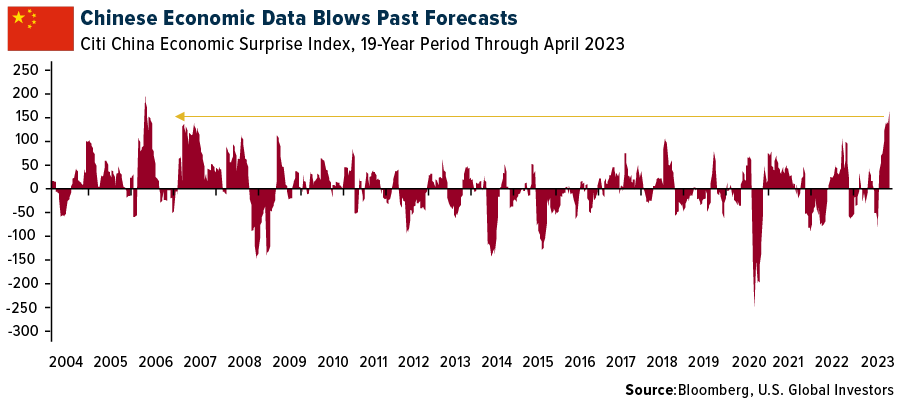

In the first quarter, China’s gross domestic product (GDP) grew a healthy 4.5% year-over-year, exceeding consensus. Retail sales in March jumped 10.6% year-over-year, a pace unseen in two years. As a result, the Citi China Economic Surprise Index, which measures data surprises relative to market expectations, hit a 17-year high. UBS Group raised its 2023 GDP forecast to “at least” 5.7%, with analyst Patricia Lui writing that “consumption will remain the main driver of China’s recovery this year.”

European Luxury Retailers Bracing for the Return of China’s Luxury Shoppers

Again, this is all very constructive for European luxury stocks. Before the pandemic, Chinese consumers were the leading nationality for tax-free luxury shopping worldwide, according to Switzerland-based tourism shopping firm Global Blue. A whopping one-third of global luxury sales, or 93 billion euros ($102 billion), were made by Chinese shoppers in 2019, a vast majority of them while traveling abroad.

It may take two years for a return to that level, but many retailers are already seeing an uptick. The massive luxury conglomerate LVMH Moet Hennessy Louis Vuitton (OTC:LVMUY) (EPA:LVMH) and Hermes International (OTC:HESAY) (EPA:HRMS) both reported a surge in first-quarter sales thanks to the return of Chinese shoppers. The best-performing group in Europe’s STOXX 600 Index so far this year is consumer products and services, up more than 26%. This is followed by leisure and travel, up 24%; and retail, up 22%.

The best-performing luxury stocks, meanwhile, include Hermes, up 38.6% year-to-date; Moncler (BIT:MONC), up 35%; and LVMH, up 32%.

As we reported in a recent Investor Alert, these gains helped Paris, France-listed stocks, as measured by the CAC 40 Index, hit a new record high, a feat that the index repeated on Friday of last week. Besides Hermes and LVMH, the index’s best-performing stocks in 2023 also include L’Oreal (OTC:LRLCY) (EPA:OREP), up 36%.

“Luxury is seen as the highest quality sector by investors, in the same way technology is seen as the best growth sector in the U.S.,” comments Zuzanna Pusz, an analyst at UBS.

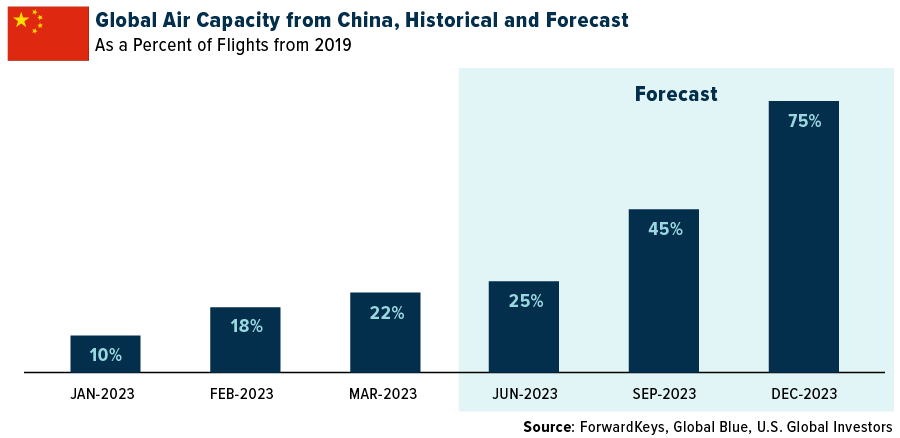

Chinese Airlines Gradually Increasing Capacity, Projected to Hit 75% of 2019 Levels by Year-End

After three years in strict lockdown, many middle- and high-income Chinese shoppers are eager to travel internationally again. The problem is that air capacity is currently only at 22% of 2019 levels. ForwardKeys and Global Blue project capacity to reach 45% of pre-pandemic levels after the summer and 75% by the end of this year. An estimated 110 million outbound trips from mainland China will take place this year, or two-thirds of 2019 traffic, according to the China Outbound Tourism Research Institute (COTRI). Singapore is expected to be the top destination.

In the coming weeks and months, this air travel recovery should be reflected in Chinese airline share prices, which currently lag most other regions so far this year. European carriers are currently the top performers, with budget airline easyJet (LON:EZJ) up a phenomenal 57% year-to-date. Other carriers that are up double digits include Air France (OTC:AFLYY) (EPA:AIRF) (+24.6%), Germany’s Lufthansa (OTC:DLAKY) (ETR:LHAG) (+24%), Ireland’s Ryanair (NASDAQ:RYAAY) (+21%) and American International Group (NYSE:AIG) (+20.7%).

Shanghai Shipping Rates Have Risen for Four Straight Weeks

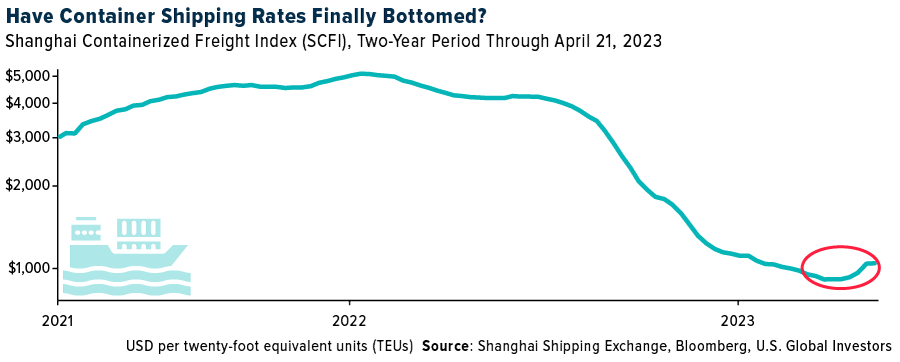

The last industry I’m pointing out here is container shipping. The investment case isn’t as strong as luxury and airlines, but there are signs that conditions have steadied following months of deterioration, making the industry one to keep an eye on.

Shipping rates skyrocketed during the pandemic as socially distancing consumers, flush with stimulus money, spent their earnings on goods instead of services. This resulted in days-long delays at ports across the globe. But since the peak in September 2021—when the cost to ship a forty-feet equivalent unit (FEU) hit an incredible $11,000, according to the Freightos Baltic Index—global rates have been in freefall.

In China, these rates appear to have found a bottom. In the logarithmic chart below, you can see that the Shanghai Containerized Freight Index (SCFI) has turned up for four straight weeks, the longest upward trajectory since December 2021. Outside of another global event, rates aren’t returning to pandemic-era levels anytime soon, but the move is constructive. Shanghai is the world’s largest port, so I consider its data to be a leading indicator.

Morgan Stanley also sees a freight upcycle nearing. In a quarterly survey, shipping companies said they expected global freight demand to improve this year. Nearly three out of four carriers believed inventories would normalize in 2023, with almost half saying it would happen in the second half.

Did you subscribe to our daily Newsletter?

It’s Free! Click here to Subscribe

Source: Investing