- COVID-19 shutting down the majority of the global economy.

- Capital Link’s two-day forum included 15 different panels covering sectors, funding sources, and analyst inputs.

- Crude tanker owner International Seaways (INSW), is still down nearly 20% YTD.

- LNG, LPG, product tankers, and dry bulk carriers rounded out the mix.

- An extremely bullish supply/demand balance has benefited from temporary sanctions.

- At $200k/day, a firm can generate nearly six years of normal profits in the same stretch.

- VLCCs are getting the major headlines for huge rates of $150k/day or more.

- Teekay is focused on the long-term markets due to its nearly $10B contract backlog.

- Individual stock research and selection is more important than ever before.

According to an article published in Seeking Alpha and authored by J Mintzmyer, with COVID-19 shutting down the majority of the global economy, investing in shipping is not a natural instinct.

Shipping Markets: Unique Opportunities vs. Volatility

However, over a decade of covering this sector, knee-jerk viewpoints are rarely correct. Moreso than any other sector, the best time to look at these stocks is anyways when your neighbor thinks you’re insane. Nonetheless, stock selection is more important than ever in these trying times as there is a high likelihood that a good handful of the 60+ firms in this sector won’t make it to 2021-2022 in their current form.

Those firms who survive are likely to provide outsized returns due to heavily distressed current equity prices. With this bifurcated setup in mind, the author set out to (virtually) attend the Capital Link International Shipping Forum early this week. Capital Link’s two-day forum included 15 different panels covering all of the sectors, funding sources, and analyst inputs. He reviewed all of the sector panels, spoke with numerous management teams over the past weeks, and shared my viewpoints on the analyst panel.

Image Credit: Capital Link

The rest of this report will review the current sentiment and fundamental setup for the six primary shipping segments- crude tankers, product tankers, dry bulk, containerships, LNG, and LPG.

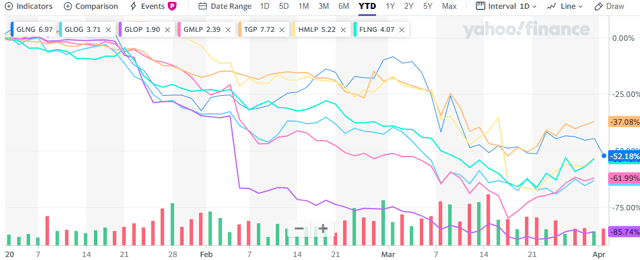

Broad Market Sentiment & Conference Mood

Two words summarize the markets today: volatility & uncertainty. Shipping is hardly the only industry with this sentiment, we can apply ‘uncertainty’ to nearly any corner of the market right now and volatility to most stocks as well, but if we look at a rough sampling of sector leaders, we’ll see the sort of dips only rivaled by horrendous areas like upstream oil and shopping malls. The best performer in the representative basket below, crude tanker owner International Seaways (INSW), is still down nearly 20% YTD. The rest of the basket is down between 44% and 63%.

Source: Yahoo Finance, YTD Performance Comps, 1 April 2020

There is not a single mainstream shipping stock with positive YTD returns as of 1 April. The closest one is Teekay Tankers (TNK), off about 7%. Yes, the broad markets have been rough, the S&P 500 is down about 23% and the Russell 2000 is off nearly 36%, but this is still a clear indictment of sentiment.

Even good news is barely starting to move the needle. Headlines are now starting to scream, and we’ve been pounding the table for weeks: “crude tankers are massive beneficiaries of the recent chaos!“ However, the majority of tanker stocks are down as bad as the broad market and even the best performer, TNK, has still been a ‘loser.’ Market sentiment is terrible!

This sentiment transferred partially to the overall ‘mood’ of the recent shipping forum, but there was a massive difference between the various sectors. Also, the level of sentiment/mood didn’t always correlate to recent stock performance, there are some interesting dislocations building, particularly in the LNG sector. Unsurprisingly, crude tankers had the highest level of positive sentiment between both management teams and active analysts and containerships were panned the most. LNG, LPG, product tankers, and dry bulk carriers rounded out the mix.

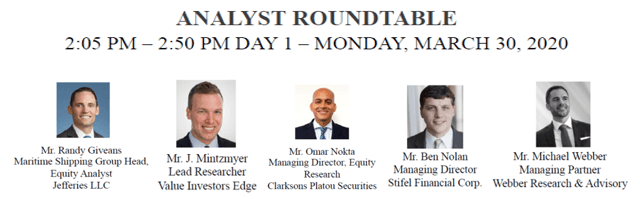

Analyst Viewpoints

Image Credit: Capital Link, edited for size/scale

The analyst panel was hosted on Monday afternoon and featured Randy Giveans of Jefferies, Omar Nokta of Clarksons, Ben Nolan of Stifel, Michael Webber of Webber Research & Advisory (ex- Wells Fargo), and yours truly of Value Investor’s Edge on Seeking Alpha. We reviewed five of the major segments and shared broad market views and our favorite segments.

Capital Link will soon have the full video clips available for review, but until then the primary takeaways:

- Crude tankers are the favorite by far, but the long-term balance at risk.

- Product tankers benefit here but face a scary demand shortfall.

- Dry bulk a China recovery play- sector to watch this summer/fall.

- LNG is the sector where stock selection is more important than ever.

- Containerships look oversold, but counterparty strength is crucial.

We’re looking at similar data, so it is not surprising that the viewpoints were also similar, but some nuances do exist. Omar Nokta was particularly interested in scooping up bargains in dry bulk and he believes they could be due for a “big one“ this summer if China indeed ramps their economy back. Michael Webber is spending most of his time diving into LNG projects, Randy Giveans is a clear crude tanker bull, and Ben Nolan offered a good rundown of the precarious balance faced by product tankers.

Crude Tankers Exceptionally Positioned

Continuing a consistent and heretofore very profitable viewpoint which dates back to early-2019. An extremely bullish supply/demand balance has benefited from temporary sanctions, IMO 2020 implementation, and now an oil price war while the stock prices have been held back by trade war concerns and a broad COVID-19 selloff.

Bears continue to misunderstand the underlying balance and we’re seeing the same sentiment emerging today, which suggests the current strong rates are only temporary phenomena. What this bearish viewpoint misses is that with VLCC rates at $150k/day, a crude tanker company can make about four years worth of normal profits in less than six months. At $200k/day, a firm can generate nearly six years of normal profits in the same stretch.

He is less optimistic about crude tankers due to global structural concerns, but that’s almost irrelevant to the investment case today considering these firms could potentially generate 4-6 years worth of profits in a couple of quarters. He covered this viewpoint nearly three weeks ago (even earlier on Value Investor’s Edge) before it was mainstream, and there are also a few hedge fund managers well ahead of the curve as well, including Harris Kupperman of Praetorian Capital who recently shared his thesis on Real Vision.

Segment Review

The Capital Link Forum also included a full review of each shipping segment with panels featuring top management teams in each sector. He attended these panels and will briefly summarize the current situation of each sector below.

Crude Tankers

The crude tanker panel included six top industry figures representing five publicly-traded companies: Euronav (EURN), Frontline (FRO), International Seaways (INSW), Teekay Tankers (TNK), and Tsakos Energy Navigation (TNP).

Source: Capital Link, Digital Forum Agenda, 31 March

The panel was unanimous on short-term prospects, with both Lois Zabrocky of INSW and Robert MacLeod of FRO, mentioning these were the best markets setups they had seen and a “generational opportunity.“ Longer-term brings more uncertainty and Hugo De Stoop of EURN was more balanced in his views.

There was little interest in newbuild vessels even with these strong rates, and Robert Burke of Ridgebury reminded that the older ships are actually generating much better returns in this market. Teekay reminded us that TNK entered the first upswing of the markets last fall with about “as much leverage as possible“ and they are now delivering. TNK is up about 200% from Summer 2019 lows, illustrating the power of financial and operating leverage.

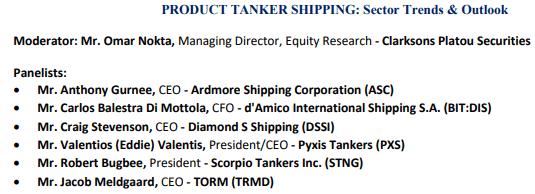

Product Tankers

The product tanker panel was also well represented and included management from five US-listed companies: Ardmore Shipping (ASC), Diamond S Shipping (DSSI), Pyxis Tankers (PXS), Scorpio Tankers (STNG), and Torm (TRMD).

Source: Capital Link, Digital Forum Agenda, 31 March

The sentiment was also very strong in the product tanker sector although there is indeed more uncertainty for medium-term demand depending upon refinery actions. Bugbee of Scorpio, usually known for his boisterous stock promotion, was more reserved and focused on prioritizing the safe and effective operations of his fleet. He warned against getting too ‘cute’ on stock pricing and encouraged delivering and building up cash while rates are strong.

A reminder was made by several management figures that although VLCCs are getting the major headlines for huge rates (i.e. $150k/day or more), on a cargo-capacity basis many of the products tanker segments are nearly just as profitable. Bugbee pointed to surging LR rates and Gurnee of Ardmore illustrated ASC’s huge earnings leverage at current MR rates.

Containerships

The containership panel was smaller and included just three firms, Capital Product Partners (CPLP), Danaos Corp (DAC), and Euroseas (ESEA).

Source: Capital Link, Digital Forum Agenda, 31 March

Uncertainty abounds in this segment, but there is optimism if China can lead the recovery and counterparties remain strong. Many of the top counterparties enjoy domestic governmental support, so there’s a hope that this continues and we don’t see ‘another Hanjin.’ Moreso than any other segment, my personal opinion is these are just derivative finance plays. We need to look at the major container lines such as Maersk, COSCO, CMA CGM, and MSC and consider their solvency and liquidity more so than actual shipping demand.

Dry Bulk

The dry bulk shipping panel included five firms: Grinrod Shipping (GRIN), Safe Bulkers (SB), Scorpio Bulkers (SALT), Seanergy Maritime (SHIP), and Star Bulk Carriers (SBLK).

Source: Capital Link, Digital Forum Agenda, 31 March

Valuations have been beaten down extremely hard in dry bulk and daily rates for most of the ships, especially the largest class of Capesize vessels, have been horrendous all year. Capesize rates, in particular, have been below opex breakevens for over two months.

Several of the firms on the panel, most notably SBLK, but also SALT, SHIP, and SB to varying degrees, have made bets on scrubbers, which will lower their fuel consumption costs in the coming years. Unfortunately for these companies, the scrubber spreads have tumbled over the past 2 months, which reduces their edge. Hamish believes a lot of this is due to the oil price collapse as a similar percentage spread translates to a much smaller nominal level. Plus they also noted that plunging global demand for diesel and jet fuel have reduced the inherent refinery competition for VLSFO (complaint fuel).

Bugbee expects heavier grades of crude oil to dominate the global markets for the rest of 2020, which should drive HSFO (older non-compliant fuel, which requires scrubbers) prices down faster, reopening some of the spread.

For dry bulk markets specifically, all eyes are on China as the primary driver of rates and sentiment. Rates notably lifted sharply early this week and longer-term contracts have also seen an uptick. Many of these firms have higher leverage than other sectors, so they cannot afford too many further delays.

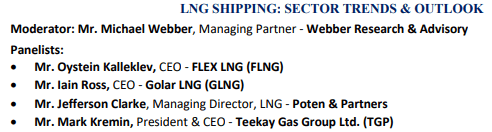

LNG

The LNG panel featured Flex LNG (FLNG), Golar LNG (GLNG), and Teekay LNG Partners (TGP).

Source: Capital Link, Digital Forum Agenda, 30 March

Oystein Kalleklev pounded the table on the cheapness of LNG versus coal, arguing both an economic angle as well as an ESG angle for the sector. Golar plans to take advantage of the globally depressed LNG prices by focusing on their downstream investments, particularly in Brazil. Teekay is focused on the long-term markets due to its nearly $10B contract backlog.

The sentiment was surprisingly upbeat on this panel considering the majority of LNG stocks have been completely decimated YTD, see below for a sample, the basket of main US-listed companies is off between 37% and 86%! TGP believes they are completely stable here (-37% YTD) while GLNG (-52% YTD) and FLNG (-55%) pitch themselves as winners in this environment.

Source: Yahoo Finance, LNG Sector YTD Performance Comps, 1 April 2020

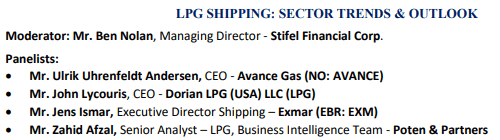

LPG

The LPG panel only featured one US-listed company: Dorian LPG (LPG) along with overseas-listed Avance Gas (OTCPK: AVACF) and Exmar.

Source: Capital Link, Digital Forum Agenda, 30 March

VLGC rates (the largest class of LPG carriers) have been surging over the past year, leading to what was a multi-bagger total return for Dorian during 2019, although the majority of this gain has been given back.

John Lycouris reiterated his support of share repurchases during these times of steep discounts whereas Avance prefers to pay massive dividends and let their shareholders decide. Based on the most recent dividend payout, Avance sports an eye-popping yield of 55%, just 2 weeks ago it was closer to an 80% yield!

The sentiment is strong in the near-term, but more challenging due to obvious structural issues with global demand. Avance expects rates to come off by the fall but pitched this as a potentially better long-term outcome if rates cool off before we see another major wave of new buildings.

Conclusion: Finding Value in the Chaos

In these challenging and volatile markets, individual stock research and selection is more important than ever before. Although nearly all shipping stocks have sold off on similar trajectories, certain sectors are clear winners, others are in flux, and a few are clear losers.

LNG, for instance, has sold off the worst, yet with a longer-term viewpoint, there is a strong investment case. Containerships have sold off by a similar amount, but there is legitimate concern about counterparty stability. Dry bulk is a clear bet on China, while crude tankers ironically perform better the worse things get in the global oil markets.

Understanding the different sectors are important, but this needs to be followed up with reviews of each company’s balance sheet, liquidity, fleet make-up, and market exposure. I shared a list of “12 Maritime Bargains” nearly a month ago and I still stand by this list today as a good starting point. I look forward to an informed discussion below.

Deep Value & Market Opportunities

High volatility and uncertainty often bring indiscriminate selloffs. These markets tend to produce profitable allocation and trading opportunities and deep value research is our specialty at Value Investor’s Edge.

We’ve identified several beneficiaries of the global oil rout and uncertain shipping markets, most recently including the crude tanker sector. There are also beaten-down stocks that are primarily isolated from current market rates. These companies offer unique buying opportunities.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha