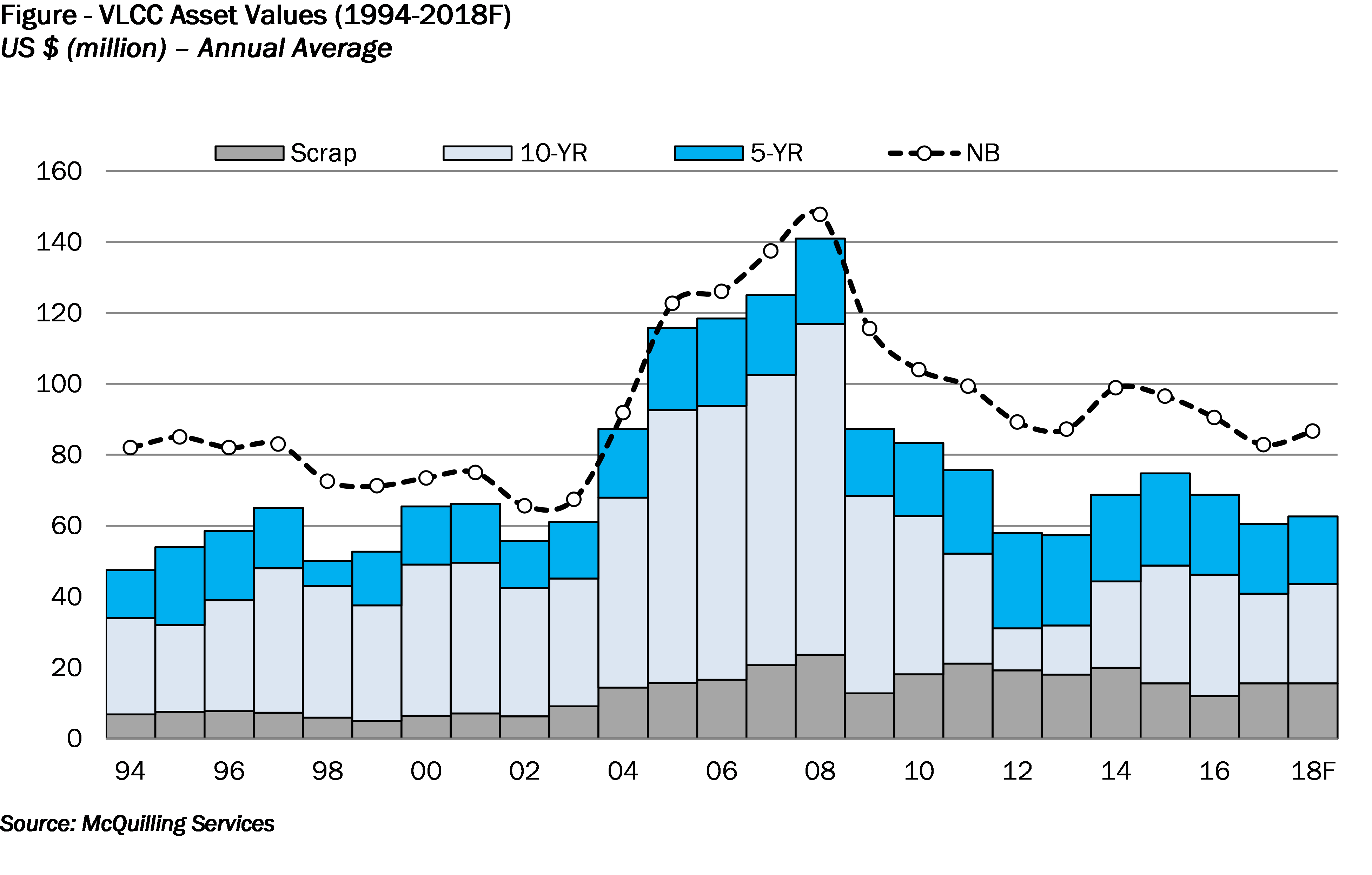

Over the course of 2017, VLCC tanker values exhibited price depreciation for the second consecutive year, as the market fundamentals put pressure on earnings. Newbuilding contracts averaged US $82.8 million (basis Korea/Japan), a decline of 8.5% from 2016 average values; however, the second half of the year is pointing to a firmer market as yard capacity remains constrained and owners, backed with charter coverage, look to capitalize on the lowest annual prices since 2003 (Figure).

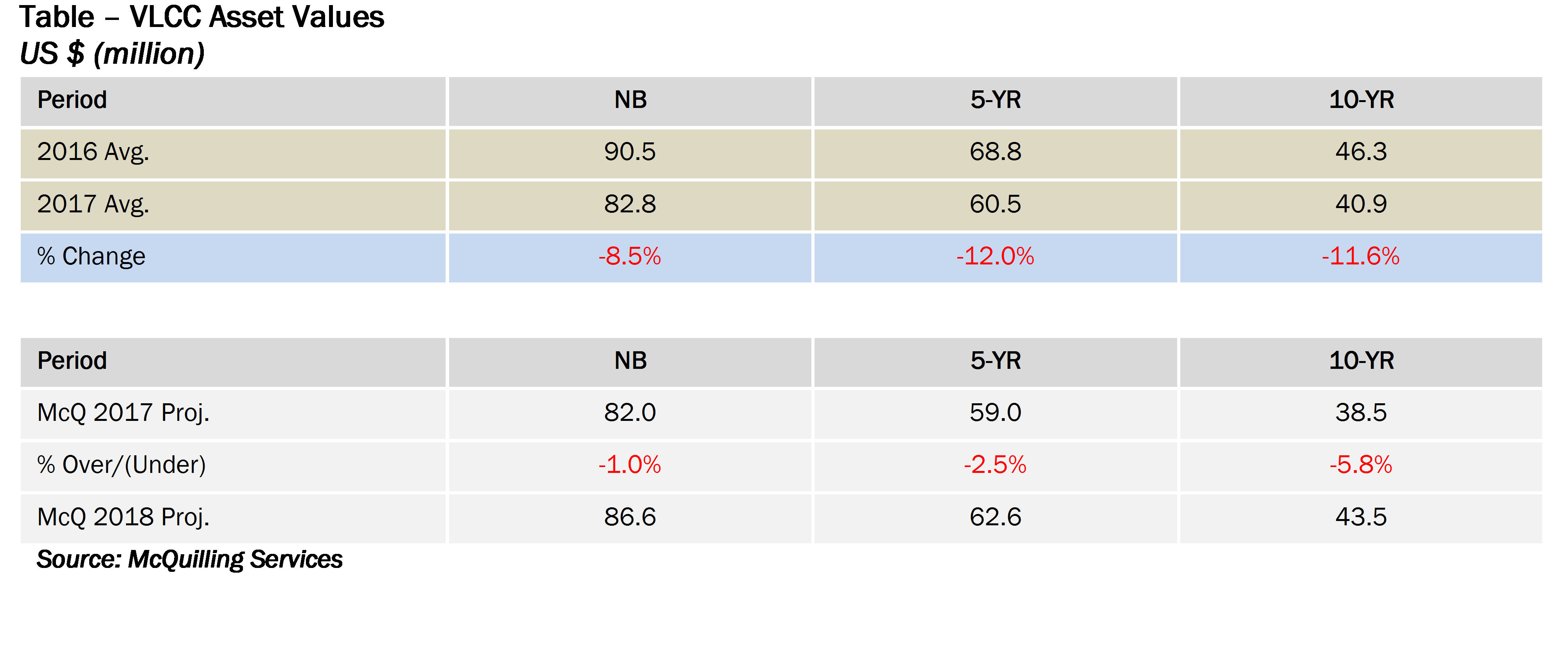

In 2017, 5-YR old tankers averaged US $60.5 million experiencing pricing pressure through the year, with a low of US $56.5 million recorded in February. On a year-over-year basis, this represented a 12.0% decline from 2016 levels. The 10-YR old tanker depreciated at a similar pace, falling 11.6% in the year, averaging US $40.9 million (Table).

In January 2017, we called for Newbuilding values to average US $82.0 million, with our projections falling only 1.0% below actual levels. Our 5-YR old vessel forecast of US $59.0 million (annual average value) was 2.5% below the actual recorded average value of US $60.5 million. The 10-YR old average value of US $40.9 million in 2017 was 5.8% above our original forecast.

Did you subscribe for our daily newsletter?

It’s Free! Click here to Subscribe!

Source: McQuilling