- As the oil prices keep tumbling due to COVID19 the shipping is faced with a gripping question to install scrubbers or not

- Scrubber users are at a disadvantage now as fuel price differential is narrowing

- The payback time of scrubber is getting longer and several shipowners are stalling scrubber installations

- At present, the scrubber economics seems to be hit by the fuel spread

According to a Lloyd’s List article written by their London-based Shipping Analyst and Markets Editor, , the price spreads being seen have extended the payback period for a scrubber Capesize bulk carrier beyond five years, and more than three years for a very large crude carrier

Weakening Scrubber Arguement

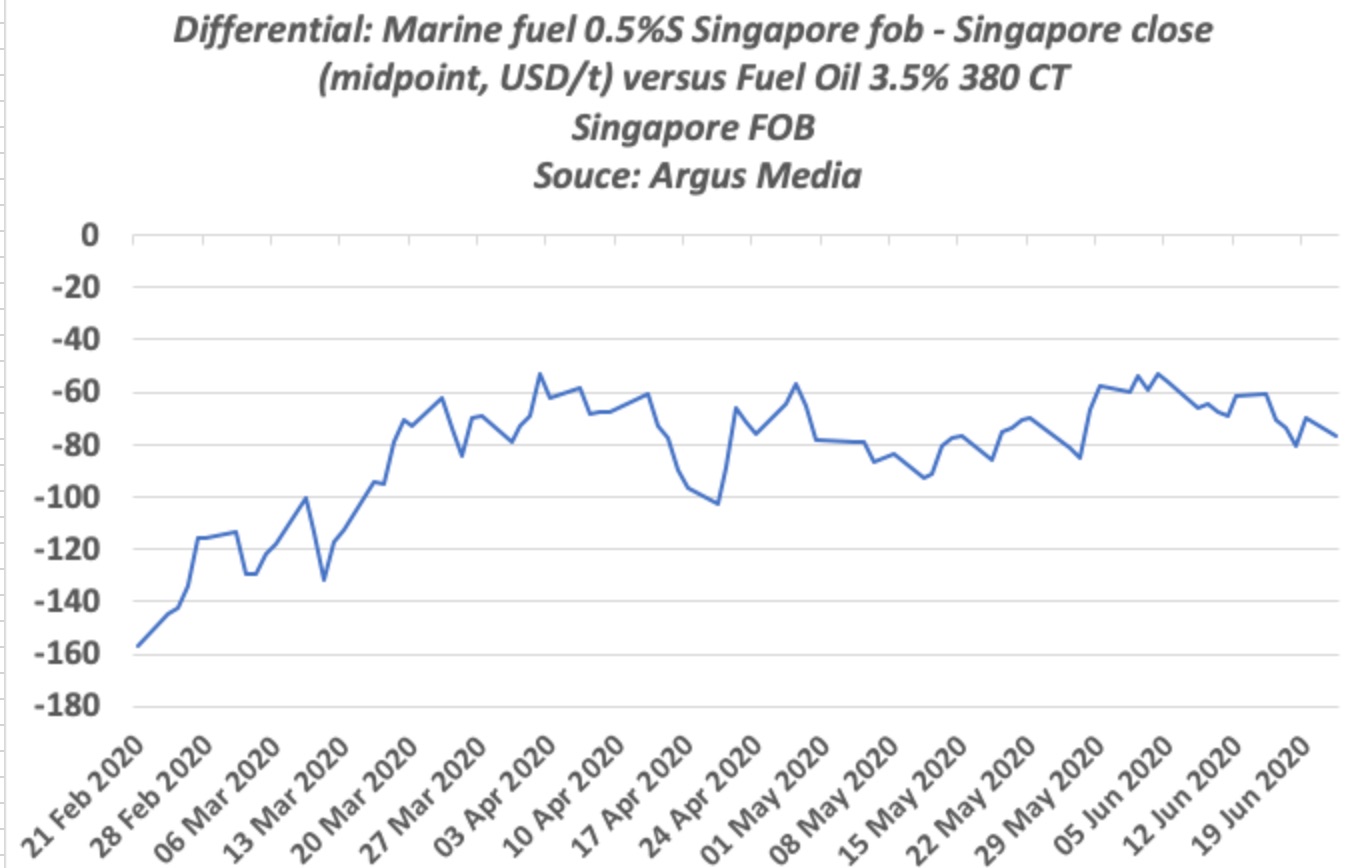

The difference in price between high-sulphur fuel oil and the compliant 0.5% sulphur fuel oil is weakening the economic argument for scrubbers

The difference in price between high-sulphur fuel oil and the compliant 0.5% sulphur fuel oil was priced $52 per tonne in northwest Europe and $77 per tonne in Singapore, according to the latest data from price reporting agency Argus Media.

These spreads have extended the payback period for a scrubber capesize bulk carrier beyond five years, and more than three years for a very large crude carrier, based on calculations from Norwegian investment bank Cleaves Securities.

The Fuel Price Differential Scenario

- The differential between 0.5% very low sulphur fuel oil and high-sulphur fuel oil of 3.5% sulphur has averaged $65 per tonne in Singapore over June and $47 per tonne for northwest Europe, Argus Media data show.

- A spread of $89 per tonne saves $1,979 daily for a capesize ship, falling to $1,000 for a panamax and $909 for supramax bulk carriers, Cleaves’ calculations show.

For VLCCs, savings are higher, at $3,000 daily, and just over $2,000 daily for a suezmax tanker. Aframax-size tankers save $1,590 daily at this differential.

Scrubber Installations Stalled

Prominent shipowners have deferred or cancelled scrubber installations throughout 2020 as spreads between the two fuels shrank dramatically from the large differentials seen at the beginning of the year as new international regulations mandated the use of lower-sulphur bunkers from January 1.

Falling oil prices as the coronavirus pandemic weighed on global demand alongside the greater-than expected availability of compliant fuels has diminished the economic arguments made during 2018 and 2019 for investing in scrubbers.

Some 2,750-plus vessels totalling nearly 329m dwt are now trading with scrubbers installed, according to the Lloyd’s List Intelligence database.

A further 600-plus newbuildings were on order or under construction and will have scrubbers fitted, with the largest vessels in the global shipping fleet showing greatest uptake. Retrofitted vessels are excluded from this figure.

- Some 16.4% of the trading crude tanker fleet, 12.2% of bulk carriers, 12.7% of containerships and 7.5% of product tankers have scrubbers when measured by deadweight tonnes, according to data.

- At a spread of $100 per tonne, it takes 2.9 years to recoup the investment in scrubbers for a VLCC, and 4.3 years for a suezmax, according to Cleaves Securities calculations.

That figure was far more favourable at the end of 2019 when the different between VLSFO and HSFO exceeded $300 per tonne, reducing payback times to less than a year for a VLCC and just over a year for an aframax tanker and capesize bulk carrier.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Lloyd’s List