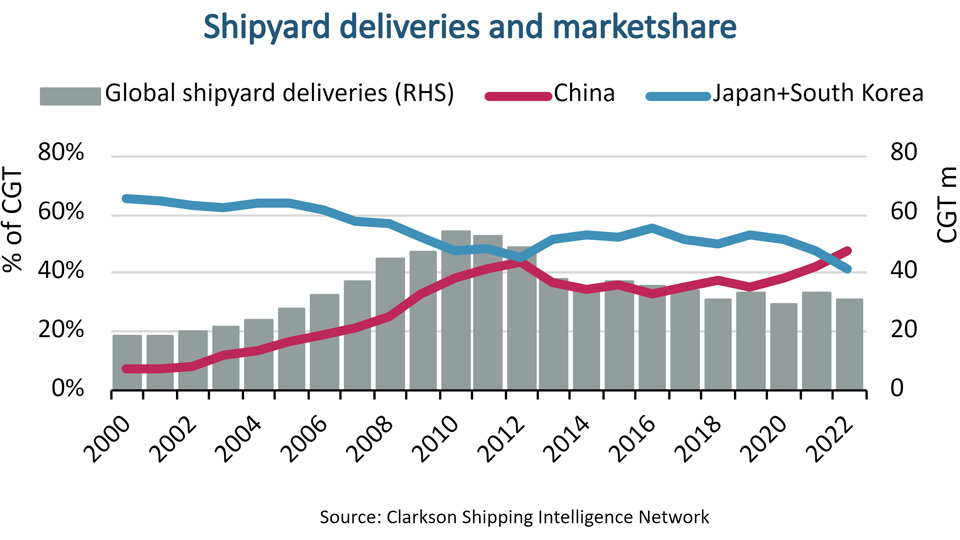

In 2022, Chinese shipyards reached a 47% market share, surpassing the combined market share of Japanese and South Korean shipyards for the first time, says Niels Rasmussen, chief shipping analyst at BIMCO.

Massive capacity expansion

Ships delivered from Chinese shipyards to new owners in 2022 totaled 14.6 million compensated gross tons (CGT), a measure of shipyard activity, out of the 30.8 million CGT delivered worldwide. The other two major shipbuilding nations, Japan and South Korea, shipped 4.8 and 7.8 million CGT, respectively.

“Twenty years ago, Chinese shipyards had a market share of less than 10%, but a massive capacity expansion in the 2000s propelled the country to first place as early as 2009,” says Rasmussen.

Also, in the coming years the shipyards in China will dominate the order book for ships that are delivered. The global order book currently totals 109.1 million CGT and 45% of these orders are held by Chinese yards, compared to 34% and 10% by South Korean and Japanese yards respectively.

Europe to Japan and on to South Korea and China

The success of the Chinese shipyards has been achieved by maintaining a leading position in dry bulk carriers and, more recently, establishing themselves as a leading location for the construction of container ships. They also hold a large share of orders for most other ship types but have yet to establish themselves as key players in the gas carrier sector.

“LNG carriers are currently the second largest shipping sector in the global ship order book and South Korean shipyards remain the market leader in this sector, holding 79% of the order book,” says Rasmussen.

Currently, Chinese shipyards only hold 15% of the order book for LNG carriers, but they could also enter this sector as they gradually attract orders for ultra-large container ships. In the short term, however, shipyards in other countries are unlikely competitors and China, South Korea and Japan are likely to hold their combined market share of almost 90%.

“In the search for lower costs, countries like Vietnam and the Philippines could become bigger competitors in the future; much like the center of shipbuilding has historically shifted from Europe to Japan and on to South Korea and China,” says Rasmussen.

Did you subscribe to our Newsletter?

It’s Free! Click here to Subscribe!

Source: BIMCO