- Short term spike in the tanker market as geopolitical events and coronavirus outbreaks heightens.

- The outbreak caused some short-term tanker rates to fall but still, the IMO 2020 situation looks beneficial for tanker giants like Scorpio

- Analysts don’t know how they will make money out of this rate spike but they acknowledge the supply-demand imbalance has been rectified

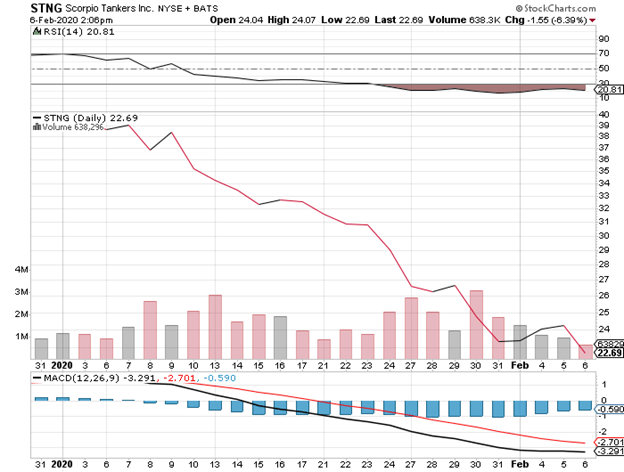

- Scorpio experienced extreme volatility in its share prices as market rates fluctuated.

- The focus is now on long-term new ships that will provide good accurate shipping rates

For long-term investors the recent crash in the price of Scorpio Tankers (NYSE:STNG) presents a good opportunity, says an article published in the Seeking Alpha.

Scorpio Shows the Way

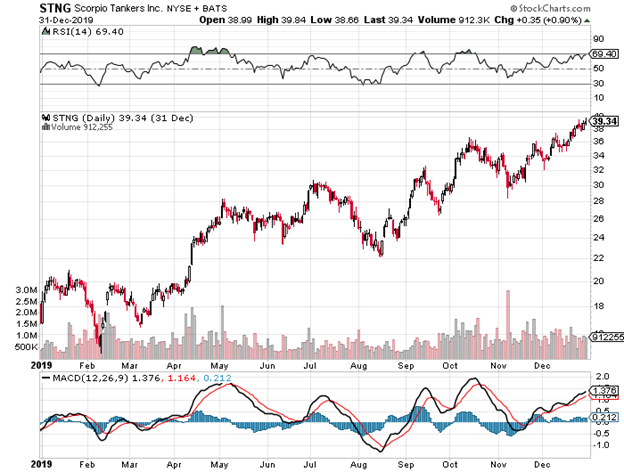

Over the last year, the share price of Scorpio Tankers has both doubled and been cut in half. Investors have extrapolated some of the short-term reasons for the volatility and ignored the dearth of new ships in the industry. Scorpio Tankers is a leveraged bet that the cornonavirus will be contained and that oil demand should normalize.

VLCC Rates Spike

The share price of Scorpio Tankers is highly correlated to the The Very Large Crude Carrier (VLCC) rates. The share price of Scorpio Tankers more than doubled in 2019 as the VLCC rates spiked due to several factors. There was a perfect storm of geopolitical events including the attack of the Saudi Aramco processing facility and an attack on Iranian oil tankers in the Red Sea. In addition, the U.S. placed sanctions on Cosco for smuggling Iranian petroleum. Finally, vessel capacity was further constrained as tankers were docked and fitted with scrubbers in preparation of new environmental standards (IMO 2020) that mandated maximum sulfur contents used in marine fuels.

Due to this perfect storm of supply disruptions, VLCC rates spiked in October 2019. For example, VLCC rates on the benchmark TD3 route from the Arabian Gulf to China, went from $27,300 a day in September to $95,000 a day in October.

News That Helped Scorpio

Another element that added to the euphoria in 2019 was news of insider buying at Scorpio Tankers. CEO Robert Bugbee purchased 1500 call options on September 26, 2019 with a January 2020 expiry. He purchased even more call options on November 19, 2019. It is highly unusual for the CEO of a publicly traded company to make such a large and leveraged short-term bet using the options market.

How much money could they make?

Investors salivated at the prospect of how much money shipping companies like Scorpio Tankers could make at the elevated tanker rates. Speculators bid up the price of the shares to almost $40 per share by the end of 2019.

Source: Stockcharts

After a prolonged bear market of over a decade, investors started to believe that the long-term supply-demand imbalances in the shipping industry had been rectified and that a new bull market was underway.

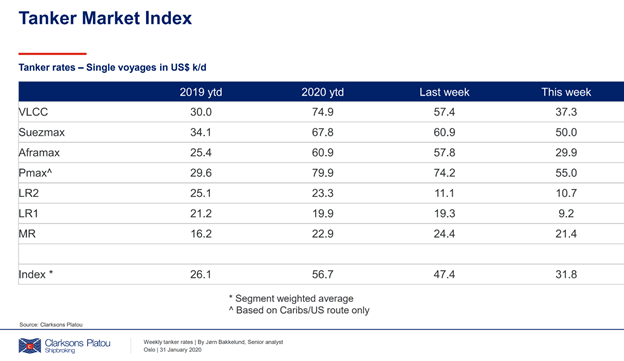

VLCC Rates Plummet

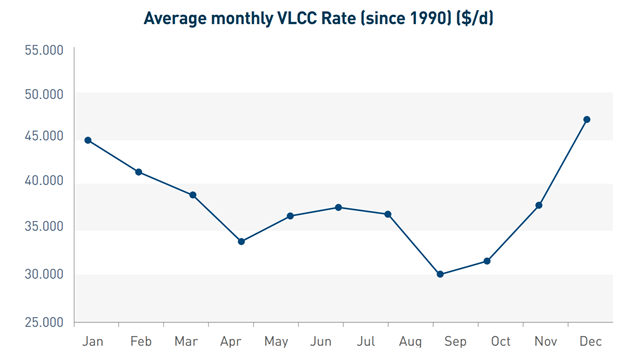

Unfortunately, for shareholders of Scorpio Tankers the astronomical VLCC rates plummeted in January 2020. Shipping rates are seasonal and there is usually a downward move in tanker rates in the winter. The Coronavirus and the reduction in Chinese oil demand simply magnified the seasonal drop in VLCC rates.

Source: Clarksons

Seasonality

Shipping rates are seasonal. It is common for there to be a big rise in the autumn and early winter with a trough in late summer. Thus, one can safely assume that a part of the recent decline in shipping rates was merely seasonal. If you are investing in shipping stocks such as Scorpio Tankers you should expect to see some huge swings in the VLCC rates. Seeing a 30% drop in VLCC rates from peak to trough is normal and not indicative of long-term supply or demand issues.

Source: Clarksons SIN

Coronavirus and Chinese Oil Demand

According to Bloomberg, the cornonavirus decimated Chinese oil demand in the last month. As millions of people are quarantined less oil is consumed. Subsequently, there is less demand for shipping.

Chinese oil demand has dropped by about 3 million barrels a day, or 20% of total consumption, as the coronavirus squeezes the economy, according to people with inside knowledge of the country’s energy industry.

The dramatic plunge in the VLCC rates has been mirrored by a dramatic plunge in the share price of Scorpio Tankers over the last six weeks.

Source: Stockcharts.com

Source: Stockcharts.com

Shipping Rate Spikes Are Common

It should be noted that the shipping industry is known for short-term spikes in VLCC rates.

Here are some examples of monstrous spikes in rates:

- Spot earnings increased from US$57,000/day in September 2004 to US$225,000/day in mid-November 2004 due to a lack of tonnage in the Middle East Gulf.

- In December 2007, an oil spill from a single-hull South Korean tanker sent earnings to US$230,000/day.

- In the winter of 2015 a smaller VLCC spike briefly saw earnings reach US$113,000/day in December.

Investors have often extrapolated short-term spikes into long-term earnings at Scorpio Tankers. It is important to look past the short-term fluctuations and focus on what should drive higher than normal shipping rates over the long term.

Supply and Demand of New Tankers

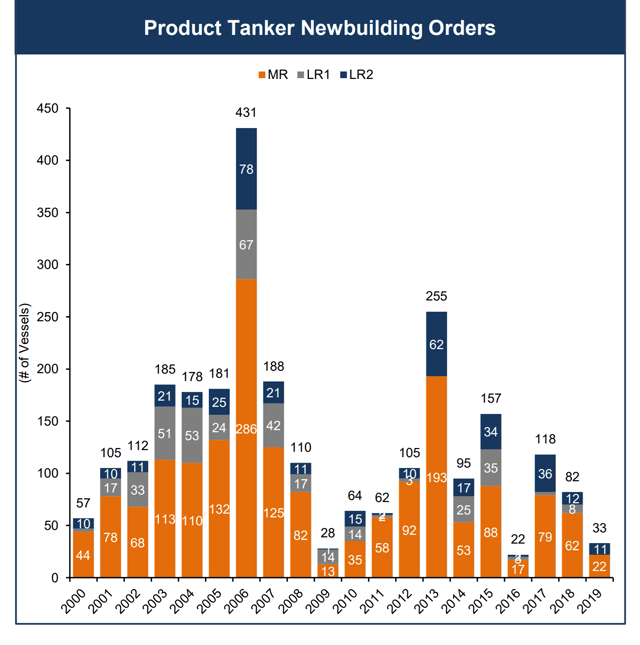

Amid all of the short-term noise, I think the most important number to focus on is the number of new ships being built across the entire industry.

Source: Scorpio Tankers Presentation October 2019

Due to the brutal bear market in shipping, there has been little ship building and a lot of scraping of old ships. This is the long-term factor that should create a long-term supply constraint. The reduction of tanker supply should result in higher tanker rates over the long term that can be sustained.

The new order book is at 25 year lows. The industry has been capital constrained and companies have been reluctant to order new s ships due to the expectation of further environmental regulations. Furthermore, 96 VLCC’s have plans to retrofit scrubbers to comply with IMO 2020. This will reduce the total fleet capacity by 1.9%. In conclusion, the shipping industry should be supply constrained and this should provide a floor in shipping rates.

Valuation

For the nine months ended September 30, 2019, Scorpio Tankers had a net loss of $60.5 million, or $1.25 basic and diluted loss per share. This was a vast improvement from the adjusted net loss of $141.3 million, or $4.57 basic and diluted loss per share in the first nine months of 2018.

Scorpio Tankers is scheduled to report earnings February 19, 2020. The earnings should be significant since VLCC rates averaged $61,700/day in the fourth quarter. The consensus earnings estimate for Q4 2019 is $0.56/share.

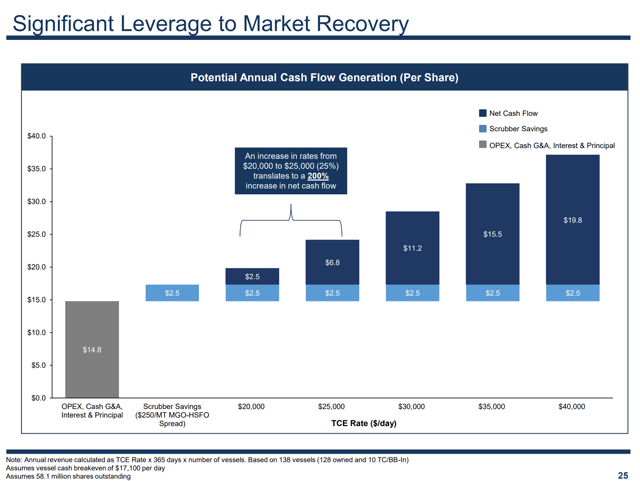

Scorpio Tankers has a lot of operational leverage. For example, a 25% increase in rates translates to a 200% increase in net cash flow. If you believe that the coronavirus will be contained and that Chinese oil demand will soon recover, Scorpio Tankers is one of the most leveraged speculations in the entire market.

Source: Scorpio Tankers Presentation October 2019

The company currently has a market capitalization of $1.18 billion with $2.7 billion dollars of debt. However, the company’s fleet is estimated to have an asset value of over $4 billion based on recent ship transactions. The downside is limited with a Net Asset Value of ~0.7X.

Conclusion

The parabolic rise and fall in shipping rates over the last year has been mirrored by the share price of Scorpio Tankers. Geopolitical events, sanctions and new environmental regulations created a spike in tanker rates in 2019. However, the coronavirus and seasonality contributed to a plunge in tanker rates thus far in 2020.

It has been difficult for investors to determine what are the sustainable tanker rates given these enormous fluctuations. However, the industry is supply constrained which should provide a floor in rates. More specifically, the downside in Scorpio Tankers should be limited by the Net Asset Value.

Investors looking for a leveraged speculation that the the coronavirus will soon be contained and that oil demand will normalize should look no further than Scorpio Tankers.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: The Seeking Alpha