- Capacity constraints have driven up rates for international shipments.

- This includes all modes of transport – sea, air, and land.

- The cost of moving goods by ship has climbed 12% in 2020.

- Ocean-liner rates have benefited from the industry being more disciplined with idle capacity.

- Limited passenger flights have created a significant reduction in available belly capacity.

- This scenario has helped drive rates higher despite a decline in demand of about 19%.

- Air-cargo rates from Hong Kong to North America almost tripled from the start of March.

- U.S. demand for trucking capacity climbed a record high.

According to an article published in Bloomberg, capacity constraints have driven up rates for international shipments this year whether by sea, air, or land, further complicating matters for supply-chain managers dealing with the effects of Covid-19 on their businesses.

Increase in logistics rate

The cost of moving goods by ship has climbed 12% in 2020 to the highest in 5.5 years, according to the Drewry World Container Index.

“Ocean-liner rates have benefited from the industry being more disciplined with idle capacity, coupled with support from general rate increases and peak-season surcharges,” said Lee Klaskow, a senior analyst with Bloomberg Intelligence. At the same time, “Asian exports are showing signs of improvement due to U.S. restocking activity.”

Limited flights to handle huge capacity

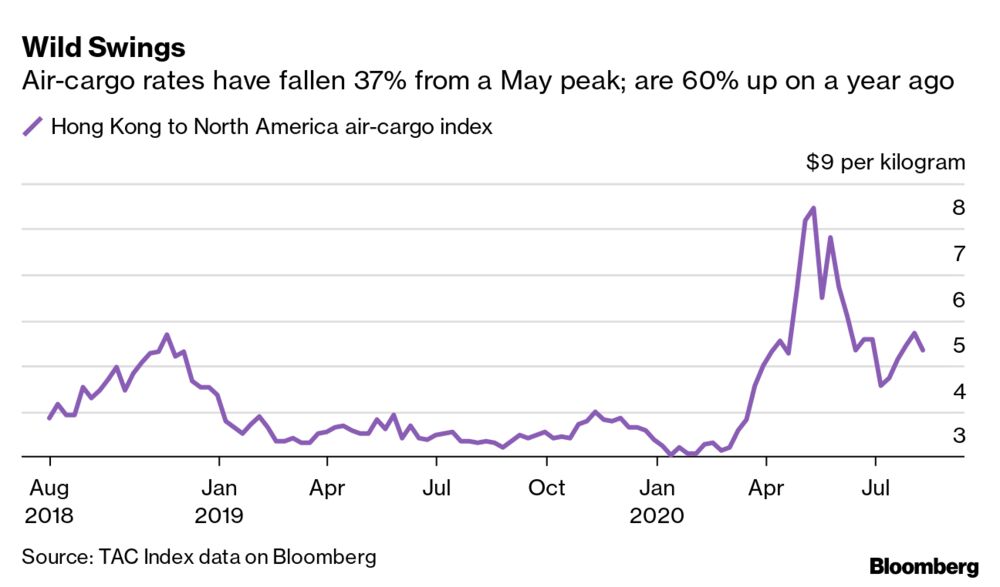

Limited passenger flights, which handle about half of the world’s airborne cargo, have created a significant reduction in available belly capacity, which has helped drive rates higher despite a decline in demand of about 19%.

Air-cargo rates from Hong Kong to North America almost tripled from the start of March to a record in mid-May as flights were grounded in worldwide lockdowns, TAC Index data show. While prices have fallen about 37% from the May peak, they’re still 60% higher than a year earlier.

Even though airlines have parked thousands of jets as travel collapses because of the virus, there’s still strong demand for moving goods, according to David Einhorn, a hedge-fund manager at Greenlight Capital. He bought a stake in Atlas Air Worldwide Holdings in the second quarter, betting that the cargo carrier will benefit from the shortage of airfreight capacity.

Demand for trucks reach a new high

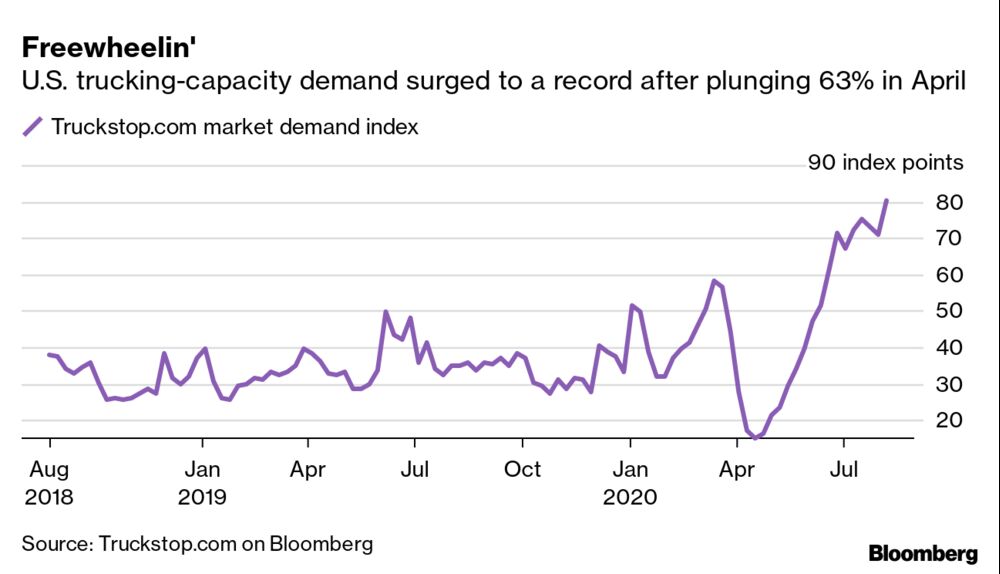

U.S. demand for trucking capacity climbed a record high last week, after plunging 63% in April, Truckstop.com data showed. That may have to do with American manufacturing picking up the pace to replenish lean inventories; production expanded in July at the fastest pace since March last year as more factories boosted output in the face of firmer orders and low stocks.

Growth in truckload rates, excluding fuel surcharges, has accelerated in each week since the start of July, with dry-van charges per mile surging 49% since 2020 low reached in May, according to Truckstop.com.

“We believe a gradual reopening of economies and environment of rising costs should support higher contractual pricing,” Klaskow said. “Higher trucking rates should push railroad rates higher, especially as it relates to the movement of containers.”

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Bloomberg