- Rotterdam’s LNG price driven higher by supply concerns.

- Singapore’s LNG bunker demand sees a sharp uptick.

LNG bunker prices have risen in Rotterdam and especially in Singapore, where demand has grown to put pressure on bunker slot availability, reports Engine.

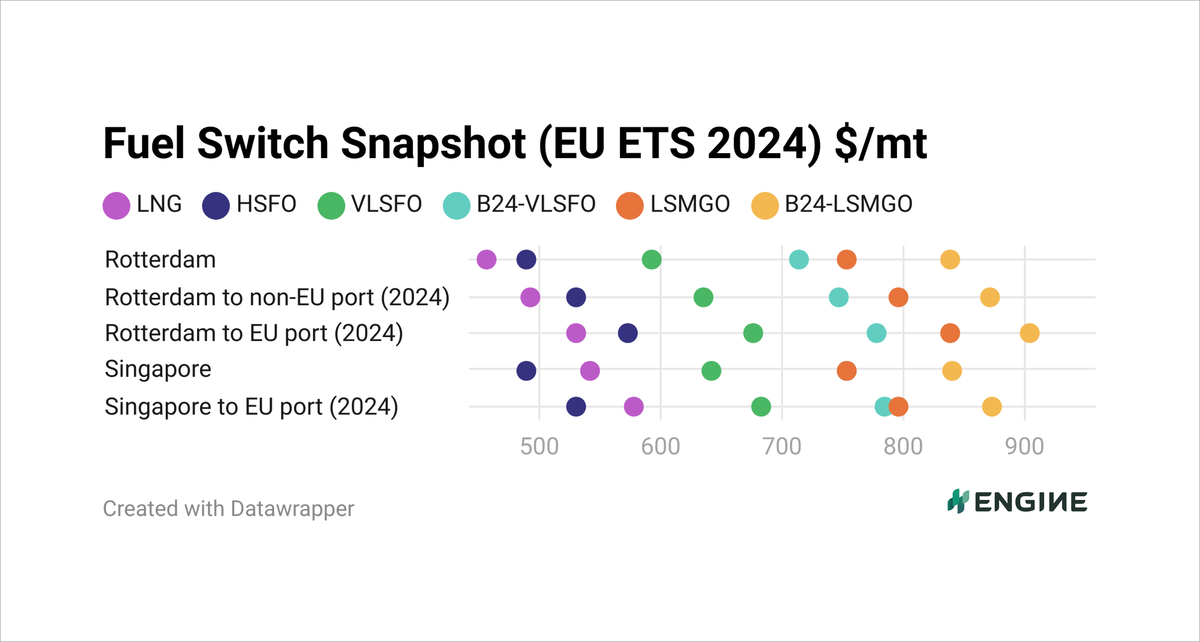

Fuel switch snapshot

All the prices in the chart are adjusted for their fuels’ different calorific contents. This makes each of them VLSFO-equivalent, which means that the same weight of fuels in metric tonnes (mt) will theoretically allow you to sail the same distance because they contain equal amounts of energy.

B24-VLSFO and B24-LSMGO premiums over conventional VLSFO and LSMGO grades are down by $5-6/mt in Rotterdam, and by $3-5/mt in Singapore.

B24-VLSFO is still a pricy alternative to pure VLSFO in Rotterdam, keeping at a $121/mt premium. Including EU ETS costs between two EU ports only shaves off $20/mt on that premium, to make it $101/mt.

Rotterdam’s LNG price has risen against every other fuel, except for HSFO. That has affirmed LNG place as the cheapest alternative in Europe.

The story is different for LNG in Singapore, where it has shot up to a $41/mt wider premium over HSFO in the past week. It is now priced $47-52/mt higher than HSFO, depending on whether carbon costs to an EU ports are included.

VLSFO

VLSFO benchmarks in Rotterdam and Singapore have been steady in the past week. Rotterdam’s VLSFO benchmark has declined by a marginal $1/mt, while Singapore’s benchmark has declined by $5/mt.

VLSFO availability remains good in Rotterdam. Traders still advise lead times of 4-5 days for the grade.

Prompt availability of VLSFO has gotten better in Singapore despite increased bunker demand. Most suppliers recommend up to 10 days of lead time, while some can accommodate stems in as little as two days in the port. This has improved from the week prior, when traders recommended longer lead times of 9-13 days.

Biofuels

Rotterdam’s B24-VLSFO HBE bunker price has made a modest $7/mt drop. This price is for an advanced biofuel that is rebated through the Dutch hernieuwbare brandstofeenheden (HBE) system.

The Dutch rebate for B30-VLSFO bunkered in the Netherlands has gained by $13/mt to $82/mt over the past week. HBE tickets of A-listed feedstocks gained by €1.40/gigajoule (GJ) ($1.52/GJ) on the week to midpoint at €8.55/GJ ($9.26/GJ), according to PRIMA Markets.

Bigger Dutch rebates have added downward pressure on Rotterdam’s B30-VLSFO HBE bunker price benchmark.

Singapore’s B24-VLSFO UCOME bunker price has shed $9/mt in the past week, amid lower demand and additional inflows of Chinese UCOME in the region.

Two sources told ENGINE that there have been few enquires for bio-bunker blends in Singapore in the past week. Additional inflows of Chinese UCOME into Singapore could pull bio-bunker prices lower in the port. The port’s bio-bunker demand has been too low to match increased supply of Chinese UCOME, another source says.

LNG

Rotterdam’s LNG bunker price has remained roughly steady in the past week, noting a slight $4/mt gain. The price tracked a marginal $4.69/mt rise in the front-month NYMEX Dutch TTF Natural Gas benchmark.

The uptick in Rotterdam’s LNG bunker price was primarily driven by a combination of supply concerns and increased spot demand from buyers.

The US Freeport LNG export plant in Texas shut down its liquefaction trains for repairs, increasing supply pressure in Europe. The US is the largest LNG supplier to Europe. It supplied nearly 48% of the total LNG imported into Europe in 2023, according to US Energy Information Administration data.

Shrinking European gas inventories also added to the upward pressure.

Singapore’s LNG bunker price has spiked by $40/mt in the past week, driven by a sharp increase in the region’s overall LNG demand.

A surge in Singapore’s LNG bunker demand has led to a rapid filling of bunker slots. There is already a shortage of slots for April dates, a source told ENGINE.

The price was also supported by higher LNG demand from spot buyers. The price-sensitive buyers from China, India and southeast Asia continued to capitalize on lower prices by increasing their spot LNG purchases, Sparta Commodities analyst, Samantha Hartke told ENGINE.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Engine