The Gulf Cooperation Council (GCC) has seen significant developments in shipowning and newbuilding trends, with key players like Qatar Gas Transport Co., QatarEnergy, and ADNOC Logistics and Services leading the charge, reports VesselsValue blog.

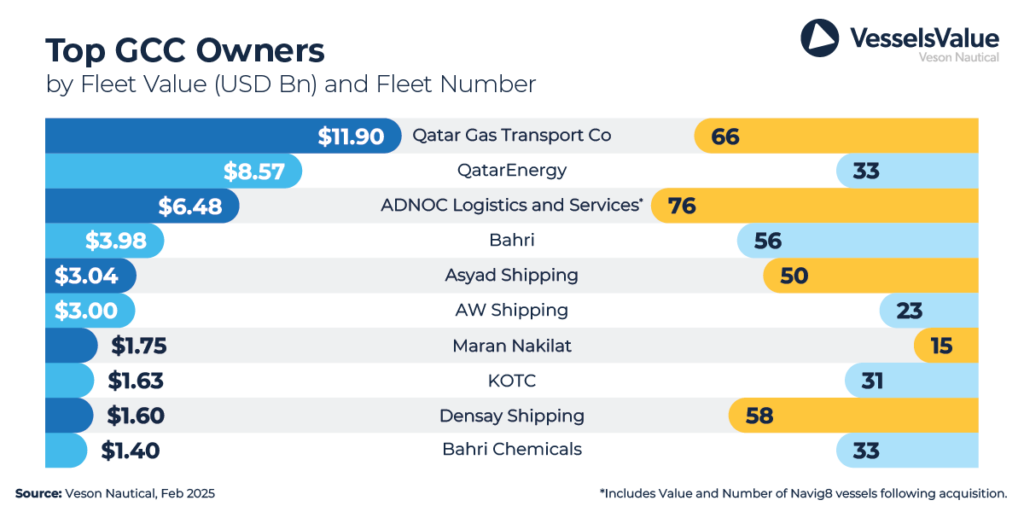

Top GCC Shipowners by Fleet Value

Qatar Gas Transport Co. (Nakilat) stands as the foremost shipowner in the GCC, boasting a fleet valued at $11.9 billion. This comprises 36 operational LNG and LPG vessels, with an additional 30 on order. Notably, in February 2024, Nakilat invested $3.5 billion in 15 large LNG vessels, each contracted at $230 million and slated for construction at Samsung.

QatarEnergy ranks second, with a fleet valued at $8.57 billion, including an order book of 33 large LNG vessels. ADNOC Logistics and Services holds the third position, with a fleet worth $6.48 billion. In terms of vessel count, ADNOC leads with 76 ships, a number set to rise following its acquisition of an 80% stake in Navig8, expected to finalize in 2027.

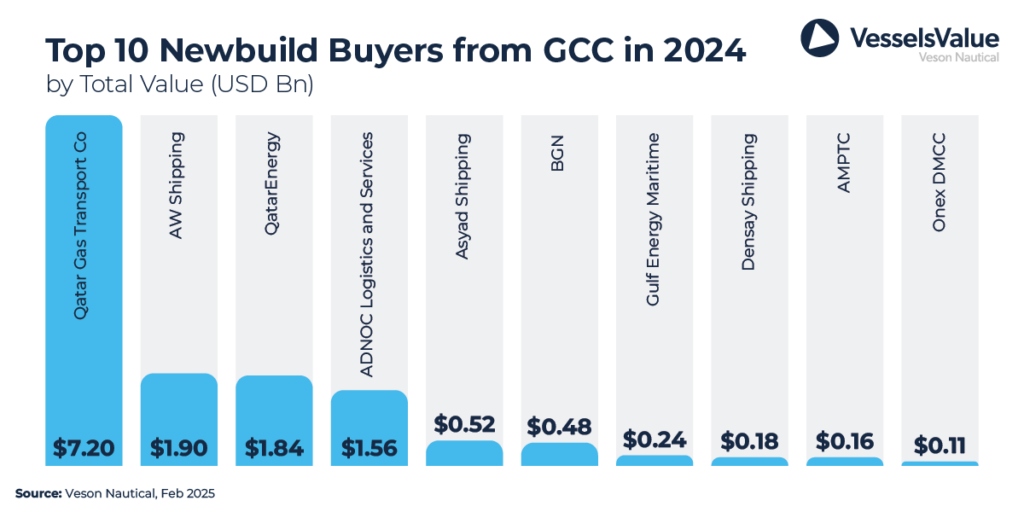

Newbuilding Trends in 2024

In 2024, GCC companies focused their newbuilding investments on LNG, LPG, and tanker sectors, ordering 44, 23, and 15 vessels respectively, totaling $14.3 billion.

Nakilat emerged as the top investor in newbuildings, committing $7.2 billion for 30 vessels. This order predominantly consists of large LNG vessels of 174,000 cubic meters (approximately 57%), followed by QMAX LNG vessels of 271,000 cubic meters (around 30%), and VLGC LPG vessels of 88,000 cubic meters (about 13%).

AW Shipping secured the second spot, investing $1.9 billion in nine Very Large Ethane Carriers (VLECs) of 93,000 cubic meters, to be constructed at Jiangnan Shanghai Changxing with deliveries between 2026 and 2027. They also ordered four Very Large Ammonia Carriers (VLACs) of 99,000 cubic meters from the same yard, scheduled for delivery between 2026 and 2028.

QatarEnergy ranked third, allocating $1.84 billion for eight large LNG vessels of 174,000 cubic meters, set to be built at Hanwha Ocean and delivered between 2027 and 2028.

Second-Hand Vessel Acquisition Trends

The tanker sector dominated second-hand acquisitions within the GCC in 2024, with 156 transactions totaling $5 billion. This surge was driven by the supply-demand imbalance caused by the Red Sea crisis, fueling market sentiment and expectations of high earnings.

The LNG sector followed, with $1.8 billion spent on 12 vessels, primarily large LNG carriers averaging 11 years in age. Bulk carriers were the third most popular, with 51 sales valued at $772 million. Smaller vessels, particularly in the Handy/Supra/Ultramax categories, accounted for approximately 69% of these purchases, while Panamax/Kamsarmaxes and Capesizes represented about 18% and 13%, respectively.

These trends underscore the GCC’s strategic investments in expanding and modernizing their maritime fleets, with a pronounced emphasis on LNG capabilities and a robust engagement in the second-hand tanker market.

Did you subscribe to our daily Newsletter?

It’s Free Click here to Subscribe!

Source: VesselsValue