- Gregory Vousvounis provides his opinion on first-quarter earnings and describes what the market is missing.

- Fleet shrinkage is due to product tankers switching to the crude trade.

- They can convert back of course but this is quite more difficult and expensive.

- Scorpio Tankers has the youngest and lowest-cost fleet operations-wise.

- They have the cheapest opex in MRs and LR2s and is efficient in LR1s.

- Scorpio has the biggest fleet of LR2s world-wide and LR2s earn the most money in the product tanker sector.

- Scorpio is the cheapest player trading at about a 40% to 50% discount to its NAV.

According to an interview published in Seeking Alpha, Gregory Vousvounis provides his opinion on the fate of tankers.

Opportunities in tankers series

Our fourth and final interview in this “Opportunities In Tankers“ series is with Gregory Vousvounis. Gregory is a long-time investor in the public markets and an ardent follower of the tanker industry.

You may find the first three interviews in the series below:

SK: Gregory, you’ve shared your perspective on tankers extensively. What are your favorite positions and why?

GV: The shipping sector is a commodity business. The commodity is the rate ships charge for carrying a cargo per day. The main supply driver is the size of the fleet (how many ships and deadweight tonnage are available) and the demand driver is how many tons of product needs to be shipped and how long the voyage will take.

As is logical, I have tried to find the spot where there is the widest supply/demand imbalance (due to less available supply).

Thus, I have perhaps the most aggressive take on the tanker thesis with my favorite position being Scorpio Tankers. My reasons are the following:

Let us start from the sub-sector. I like product tankers over crude tankers because of three reasons:

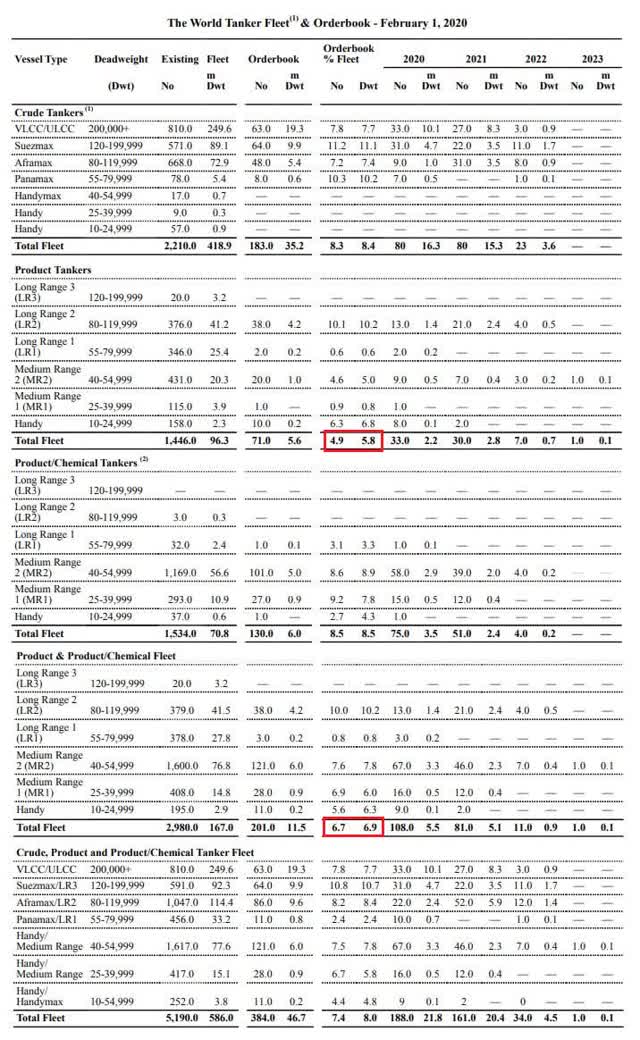

1. Lower order book

This table is from Scorpio Tankers’ 2019 annual report (pages 40-41).

This table is from Scorpio Tankers’ 2019 annual report (pages 40-41).

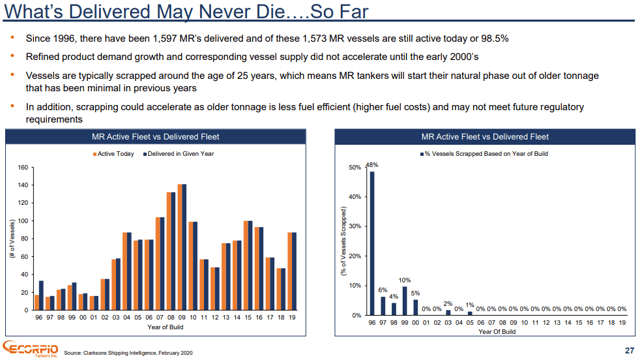

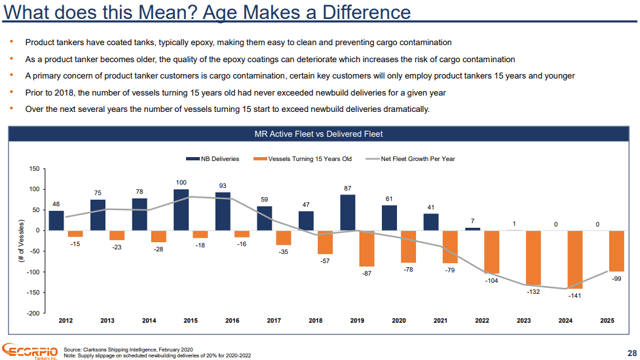

2. Fleet shrinkage due to aging ships and IMO 2020

These are slides from Scorpio Tankers’ February 2020 presentation.

These are slides from Scorpio Tankers’ February 2020 presentation.

3. Fleet shrinkage

Additional fleet shrinkage due to product tankers switching to the crude trade chasing the recent rate spikes in crude transport rates. They can convert back of course but this is quite more difficult and expensive.

Now let me explain why Scorpio.

- Scorpio Tankers has the youngest and lowest-cost fleet operations-wise. This is evident from the numbers they post each quarter. They have the cheapest opex in MRs and LR2s and only Hafnia is a little more efficient in LR1s because they have more of them.

- Scorpio is the biggest fleet of LR2s world-wide and LR2s earn the most money in product tanker bull markets just as VLCCs are the highest earners in crude tankers.

- Scorpio has an extensive scrubber program for its fleet and while now the HSFO-VLSFO spread is compressed at just $50-$75, I expect it to rise as oil demand recovers and average at about $150 over the coming years. This provides them with an additional cost advantage over their competition.

- Scorpio is the cheapest from the biggest players in the tanker market as it is trading at about a 40% to 50% discount to its NAV. This is because they are the more leveraged of the group. But their financing risk is coming down very quickly as they have deleveraging as their number one priority and they are expected to earn between $4-$5 per share in the first half of 2020.

At the helm of the company are Emanuele Lauro (Chairman & CEO) and Robert Bugbee (President & Director). They are both market-savvy veterans and know how to time the market. Robert Bugbee was president of OMI Corporation and along with Craig Stevenson (then CEO) sold the company at the top of the last supercycle in 2007. Of course, there are a lot of things to dislike about management (don’t skip the related transactions part of their fillings) but this is a wide-spread problem in shipping and something every shipping investor should take into account before diving in here.

Earnings and conference calls

SK: What do you think of the Q1 earnings and conference calls for the tankers so far?

GV: Almost all companies with very few exceptions reported great Q1 numbers and even better Q2 guidance. This was expected as there is a lag between the current tanker rates and their appearance in financial statements.

Essentially Q1 earnings reflected rates booked in the second half of Q4, 2019, and the first half of Q1, 2020. What differs from company to company is their ability to better position their ships to take advantage of dislocations and cost management.

SK: What is the market missing on these companies?

GV: Tanker companies have suffered a 10-year bear market since 2008 with a brief respite in 2015-2016. The reason for that was that the sector ordered too many ships. The 2008 order book was at 40%+ of the then-current fleet.

Industry analysts and shipping investors have had nothing but disappointments and false starts from the sector and very reluctant to enthusiastically jump back in.

Furthermore, the market sees a repeat of the 2008 playbook where rates rose due to falling oil and product demand (just like now with COVID-19) and then plunged as the oil and product inventories were coming down.

Industry’s fear

While understandable this fear is ignoring the elephant in the room. The industry’s order book is at historical lows both for crude and product tankers. Plus, even if the companies decided to flood the market with new ships, they simply cannot.

Financing has dried up completely due to the COVID-19 uncertainty and the pressures all lending organizations are facing. Furthermore, IMO has set ambitious carbon emissions goals for 2030 and 2050 that can be achieved only if ships change the type of fuel they use or go fully electric.

This creates a lot of uncertainty as no shipowner wants to order a ship that will be obsolete in a few years. Until IMO clarifies how the intended targets are going to be achieved this will dampen new ship orders. IMO is expected to provide clarification sometime between 2025 and 2030.

New vessel supply will remain tight for a long time

SK: How long does this environment last?

GV: I don’t know. Due to tight vessel supply, product tankers are positioned to benefit from every bit of chaos and disruption that comes their way. Last year it was the COSCO sanctions and the preparations for IMO 2020. This year it was the effects of IMO 2020 at the start of the year, then the Russia – Saudi oil price war and then the COVID-19 pandemic.

In a few months who knows? I wouldn’t say though that the world is anything close to stable right now. We could have a new round in the US-China feud, additional disruptions in the Middle East, a resurgence of COVID-19, or something new completely unexpected.

SK: What about IMO 2020? Does it even matter right now?

GV: IMO 2020 has currently slipped under the radar but I expect it to come back with a vengeance in two fronts. First I expect the HSFO – VLSO spread to rise as oil demand recovers. Second, if tanker rates plunge in really unprofitable territory the older ships will exit the market as they will be very uneconomical to run.

SK: What resources in the industry do you follow?

GV: I follow several news sites like the Wall Street Journal, Bloomberg, Hellenic Shipping News, and Splash 24/7. I subscribe to the daily rates briefing by Poten Partners and follow closely the work of Joakim Hannisdahl of Cleaves and J Mintzmyer and James Catlin of the Value Investing Edge here at Seeking Alpha.

COVID-19 impact

SK: You’re based in Athens. It would be interesting to hear how COVID-19 is affecting your area.

GV: Things are pretty quiet here in Athens as our government was early in applying lock-down measures. So, we had about 150 deaths so far. The economic devastation is yet to be determined as the government has provided some relief measures, but things are expected to be pretty bad going forward for all sectors of the economy.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha