- As IMO 2020 comes into effect from January 1, 2020, it is expected to tighten global distillate supplies and cause distillate prices to rise.

- However, refiners are keen to convert high sulfur bunker fuel into a low sulfur fuel as the primary impact could be on gasoline instead of distillates.

- This move can result in HSFO’s price collapse, as the demand for it as marine bunker oil may disappear.

- Up to 3.7mb/d of high sulphur fuel demand will disappear and the increased diesel demand from shippers implies a potential 1-1.5mb/d deficit.

- The heat/crude spread for 2020 contracts on July 26th averaged 46% (heat over crude), whereas the average for 2009-2018 was 29%.

According to an article published in Seeking Alpha, conventional wisdom is that the implementation of IMO 2020 is going to either cause a shortage of middle distillate petroleum products, or at least drive their prices dramatically up relative to crude, gasoline, and high sulfur fuel oil (HSFO).

What does future hold for HSFO?

Many have predicted that HSFO’s price would collapse, as the demand for it as marine bunker oil all but disappears, except for ships which add scrubbers, which will be only about 5 % of ships.

According to Enerjen Capital, “Up to 3.7mb/d of high sulphur fuel demand will disappear and the increased diesel demand from shippers (on top of base global demand growth) implies a potential 1-1.5mb/d deficit. Given limited refinery capacity to produce low sulphur fuels, we could see a dramatic increase in diesel prices starting 4Q19.”

With just 2 months remaining before the start of 4Q19, there is no indication of a “dramatic increase in diesel prices starting 4Q19.” Perhaps all of the hype is just that, except futures traders, are building-in large impacts for 2020 contracts.

Futures Market Spreads

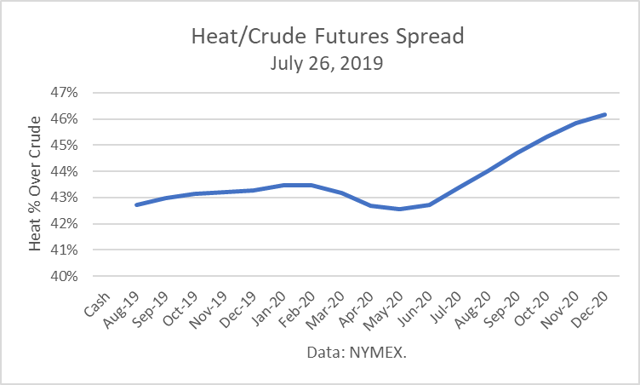

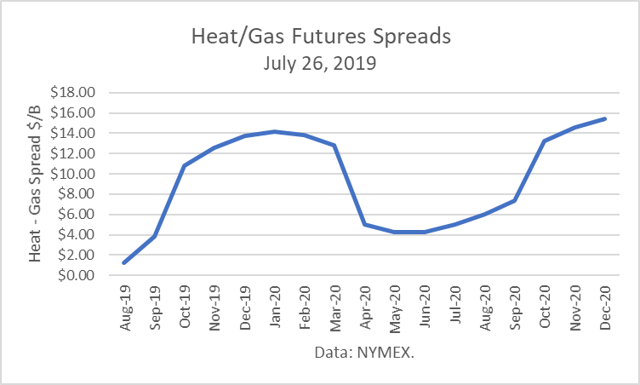

NYMEX futures spreads show that the heat/crude and heat/gas spreads are trading at elevated levels for 2020 contracts v. historical averages.

The heat/crude spread for 2020 contracts on July 26th averaged 46% (heat over crude), whereas the average for 2009-2018 was 29%. Using full calendar year averages takes seasonality into account while using percentages instead of $/b takes into account changes in the underlying crude oil price.

The heat/gas spread averaged $9.46/b for all 2020 contracts on July 26th. Looking back to 2009-2018, the average was minus $2.21/b.

HSFO Price Has Spiked

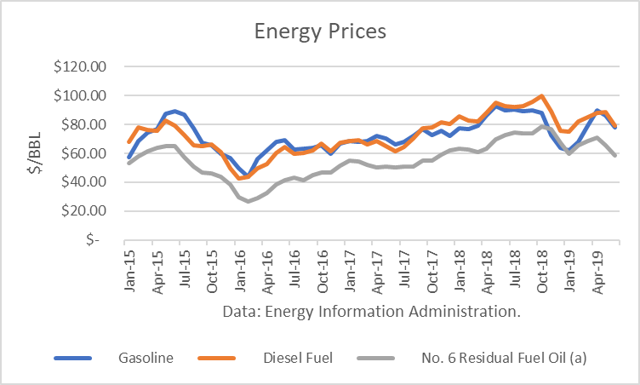

Instead of collapsing, the price of HSFO has spiked over the past month.

HSFO in the U.S. Gulf Coast has risen above WTI. In Europe, HSFO has risen above Brent, and the premium is the highest it has been in over five years.

Gary Simmons, SVP, Supply, International Operations & Systems Optimization, Valero Energy Corp., said in the Q2 2019 Earnings Conference Call, July 25, 2019: “I think you are seeing people start to turn tanks, and that’s one of the reasons you see high sulfur fuel oil strength, is it’s just a, not a very liquid market today and ships are having trouble actually buying high sulfur fuel oil, which is bidding that market up today, so you see the steep backwardation as we approach that January timeline.”

What is the hype about?

All of the hype about IMO 2020 revolves around the expectation that ships, which do not add scrubbers to clean sulfur emissions, must purchase a marine diesel oil, and the global capacity to increase production by 3+ million barrels per day has not been built.

Genoil Inc., the publicly traded clean technology engineering company for the energy industry, recognized shipowners and cargo owners face a dilemma: “Switch to distillates or potentially costly blended marine diesel oil (MDO), pay for an onboard scrubber unit at the cost of millions of upfront dollars in capital expenditure, or invest in LNG, where the global infrastructure and standards for bunkering are currently very embryonic.”

And so, it developed a fourth way to comply, “enabling the conversion of Heavy Sulphur Fuel Oil (HSFO) and crudes into more valuable low sulphur fuel that will be compliant with new International Maritime Organization (IMO) Annex VI Sulphur rules from 2020.”

Genoil’s Hydroconversion Upgrader (GHU®): “its $48.00 charge per ton, including fixed investments, overhead, operating costs, and profit to the shipping industry, on a per ton basis, amounts to about the operating costs of scrubbers so that it is drastically cheaper for the shipping industry compliance.”

Hydroconversion

Since 1897, a variety of different hydro-processing technologies have been developed to enable refiners to meet the continuous tightening sulfur specifications imposed upon the industry. Genco’s process “keeps the heavy oil side but removes the sulphur to make it in compliance because the world’s fleet of ship engines was designed for HFO with high sulphur.”

JBC Energy in Vienna believes that refiners will more likely supply very low sulfur fuel oil than marine gas oil because this provides greater operational flexibility. “We expect VLSFO (very low sulfur fuel oil), at least in 2020, to price at a premium to Brent of over $10 per barrel, which is a level where it can and will compete against gasoline. In our logic, then, IMO 2020 is bullish for gasoline,” they wrote. “For diesel, we see less upside from IMO than gasoline.”

According to a Reuters story: “One refining official based in Seoul said their plant-primarily runs high-sulphur crude oil so they take the fuel oil produced after initial refining and remove the sulphur through a residue desulphurization process. Instead of passing the feedstock through a residue fluid catalytic cracker (RFCC) to make gasoline, they are selling it as VLSFO. This would reduce gasoline output while increasing LSFO output so the gasoline market could recover,” the official said.

Fortunately, gasoline demand in the U.S., the largest market in the world, is soft in 2019, off 0.3% YTD v. 2018. And expectations are that U.S. gasoline use will gradually decline in the future due to better MPG and the growth of the EV industry.

In contrast to JBC’s forecast, HSFO has usually traded at a discount to gasoline and diesel fuel.

Note: (A) Average for all sulfur contents.

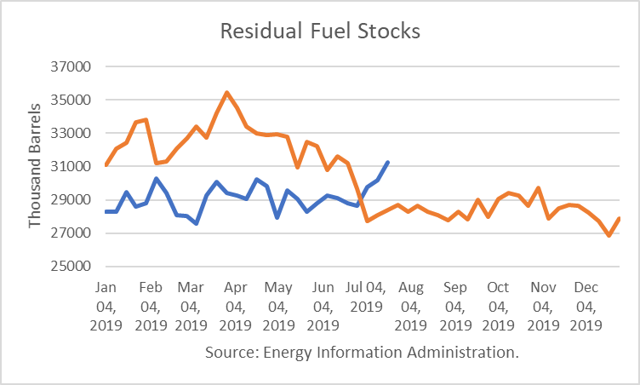

In addition to spiking HSFO prices and a scarcity of the fuel available to ships, another sign that refiners are pursuing hydroconversion of HSFO is the recent build in U.S. residual fuel oil stocks.

Conclusion

A more definitive answer may be forthcoming in the weeks ahead as shippers turn tanks. If JBC’s hypothesis that the main impact will be on gasoline, not distillate fuels, futures price spreads will correct dramatically. The heat/crude and heat/gasoline spreads will drop like a rock.

It could also mean those shipowners who hedged the diesel/crude spread in advance of IMO 2020 will be sorely disappointed by hedging the wrong spread, or who hedged diesel or crude prices outright expecting an oil shortage.

Shipowners who install scrubbers may lose a few ways. The cost of HSFO plus the cost operating scrubbers may exceed the cost of VLSFO, while the ship bears the added weight of the scrubbers, as well as crew devoted to the scrubbing operation, have reduced cargo space due to the scrubbers and may be banned from certain ports, as well as pay a cost for discharging the sulfur in a hazardous waste facility.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha