The top two biggest spenders

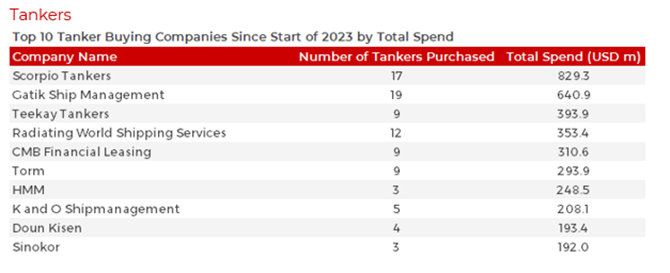

Tankers

Scorpio Tankers ranked first in terms of Tanker spending, following their spree of 17 vessels with a total value of USD 829.3 mil, this included 13 MRs and four LR2s. The new additions to the fleet were very modern with an average age of just four years. Values for four year old MRs have been above USD 40 mil and LR2s above USD 65 mil since September 2022 and these are the highest levels since 2008. This is due to the increased demand for Tankers since the sanctions on Russian oil which have changed trade flow patterns, lending support to earnings and values.

Newcomer Gatik Ship Management purchased an impressive 19 vessels this year to date, bringing the total number of vessels bought since the company emerged in December 2021 to a total of 63. With an average age of fifteen years, the purchases included one VLCC, three Suezmaxes, four Aframaxes, four LR2s, one LR1, four MRs and two Small Clean Tankers, bringing the total spend to USD 640.9 mil. Some of these vessels have already been sold on as Gatik takes advantage of the continued high values for older Tankers.

In third place, Teekay Tankers have a total of spend of USD 393.9 mil with their purchase of one Suezmax, four Aframaxes and four LR2s. The vessels purchased had an average age of 12 years.

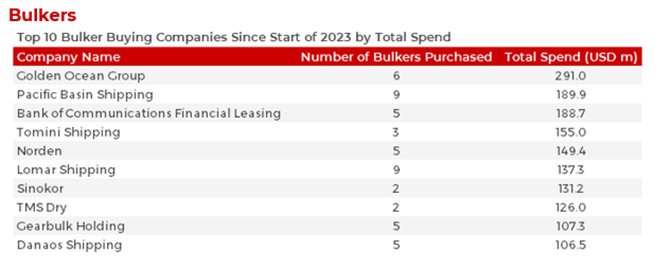

Bulkers

So far this year, Golden Ocean have ranked first in terms of total spend, splurging USD 291 mil on six Newcastlemax Capesizes of 208,000 DWT, with an average age of four years, purchased in February from H Line Shipping.

Pacific Basin’s spree of nine Bulkers puts them joint first with Lomar Shipping in terms of the number of Bulkers purchased. This year Pacific Basin have spent USD 189.9 mil, putting them in second place with their purchase of six Ultramaxes, two Supramaxes and one Handy Bulker with an average age of 10 years. Despite Lomar ranking joint first with the number of Bulkers purchased, their total spend ranked sixth, the five Panamaxes and four Supramaxes had an average age of 12 years which lowered their total to USD 137.7 mil.

Bank of Communications Financial Leasing (Bocom) rank third with a spend of USD 188.7 mil. Overall, the purchases were for very modern vessels which pushed up the total value including one 2021 built Capesize, one 11-year-old Post Panamax, one 2023 built Panamax and two 2023 built Supramaxes.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Xinde Marine News