- Oil and LNG prices are likely to shoot up if Iran is to block Strait of Hormuz leading to a spike in inflation.

- The Iran and Israel conflict has escalated over the last few days.

- Crude oil prices have hovered around $ 90 per barrel since the conflict.

ING’s Inga Fechner, a senior economist at ING in Germany, Rico Luman is a senior sector economist with a focus on transport, and Warren Patterson is Head of Commodities strategy based in Singapore. They explain, for Safety4sea, why if the Strait of Hormuz is in any way disrupted, the impact on oil and global trade could be huge.

According to the authors, it’s a stark fact: more than 80% of global goods trade is transported by sea. And any disruption in maritime trade can have a profound impact on the worldwide economy. The latest potential flashpoint is the Strait of Hormuz. It’s a vital artery that carries around a fifth of the world’s oil. It’s been at the centre of numerous geopolitical tensions for many years. Any disruption could have yet another negative economic impact on the global economy, hampering vital trade routes and lengthening transit times, resulting in production delays and higher inflation.

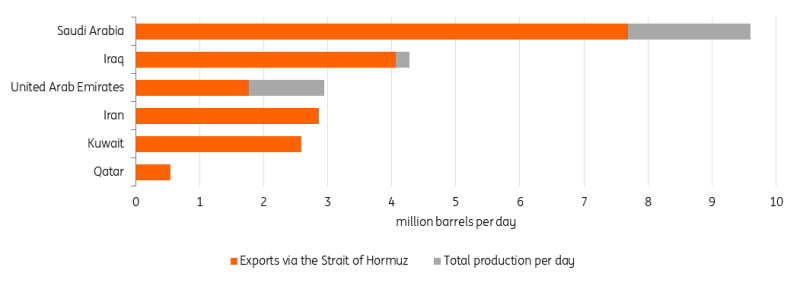

Production and export of crude oil via the Strait of Hormuz in 2023

Exports via Strait of Hormuz based on AWR Llyod analysis estimates from 2021. Million barrels per day.

For the time being, oil supply remains intact, although the risk of tensions in the Middle East making things much worse is growing. The lack of any significant price reaction following Iran’s recent attack on Israel is largely due to a large risk premium already having been priced into the market. ICE Brent rallied from a little more than $86/bbl at the start of April to over $90/bbl in anticipation that Iran would respond to Israel’s suspected airstrike on its embassy in Syria.

Secondly, the market is also in limbo, still waiting to see how Israel will respond to the aggression. The longer the market waits, the more likely the risk premium starts to fade. Risks to oil supply are at their highest since October last year. Any further escalation would only bring the oil market closer to actual supply losses. We believe there are three key supply risks facing the oil market as a result of current tensions, which we discuss in this article.

On the demand side, ongoing economic headwinds might also offset supply restrictions to some extent, with the Chinese and eurozone economic growth path improving but remaining subdued overall. With plenty of risk facing the market, we will not be the only ones closely monitoring the tensions in the Middle East and those crucial maritime choke points.

In addition, a significant amount of LNG passes through the Strait of Hormuz. Qatar, the third largest LNG exporter in 2023, shipped 108bcm of Liquefied Natural Gas through the choke point, which is around 20% of total global LNG trade. Given that Qatar is set to boost capacity to more than 170bcm by 2027, the Strait will become even more important for LNG flows. Clearly, with Europe increasingly more reliant on LNG since the Russia/Ukraine war, any disruptions to the LNG market will be felt more in Europe.

Did you subscribe to our daily Newsletter?

It’s Free! Click here to Subscribe!

Source: Safety4sea