According to media reports, shipowners have turned their attention to the second-hand market for dry bulk carriers.

Busy Dry Bulk Week

In its latest weekly report, shipbroker Banchero Costa said that it was “a pretty busy week in the dry bulk sector. Starting with larger units, BULK HARVEST around 176,000 dwt blt 2012 Jinhai is rumoured committed at levels in the mid/high $19mln. Nissen Kaiun in Japan sold the KM TOKYO around 83,500dwt blt 2010 Sanoyas for high $15mln (ship is BWTS fitted with SS due next year) to Greek buyers. whilst a resale Ultramax ex Imabari HULL NR 515 around 63,000 dwt dely Jan 2020 is sold to Japanese owners for price of $28mln and 12 months TC back to sellers. In the busy Handysize segment, Canfornav sold the SHELDUCK around 35,000 dwt blt 2012 SPP for a price of $9.5mln to Chinese buyers. The Seahorse 35 design GRAIG CARDIFF around 35,000 dwt blt 2012 Jiangdong is reported sold for $8.7mln to German interests. Another similar vessel blt 2011 Samjin, China, ORIENT TRIBUTE is reported sold to Oceanfleet for a price of $8.6mln. A modern Japanese Imabari 28 type PRINSESA MAGANDA 28,000 dwt blt 2012 was recently negotiating and now is reported sold to undisclosed buyers for a price ranging between high $7 to mid $8mln (correct price will be advised). In the tanker sector a few interesting sales for Suezmax and Aframax size; Gesco sold the 2000 blt Samsung mv JAG LAKSHITA abt 147,000 dwt for region $16mln and Capital disposed 2 Aframax sisters ARISTODIMOS and AMORE MIO around 113,500 dwt blt 2006 Samsung for $20.5mln each, Buyers are PT BULL of Indonesia”.

Mediocre Trajectory Continues

In a separate note, Allied Shipbroking added that “the dry bulk SnP market continued its rather mediocre trajectory ( in terms of activity) for yet another week. Whether it is the negative path of freight rates right now, or if we have an increased mismatch between sellers and buyers remains to be seen. For the time being the handysize segment seems to be relatively more active, despite the significant softening in earnings and increased volatility of late. It is fair to note however that these latest deals have also noted a drop in prices for this size segment. On the tanker side, a significant boost in terms of transaction volumes was noted during the past few days, nourishing even more the better sentiment prevailing in the SnP market as of late. It was about time that we started to see interest move towards the larger size segments, with the Aframax/LR2s experiencing a tremendous activity boost this past week (albeit helped by the amassed en bloc deals)”.

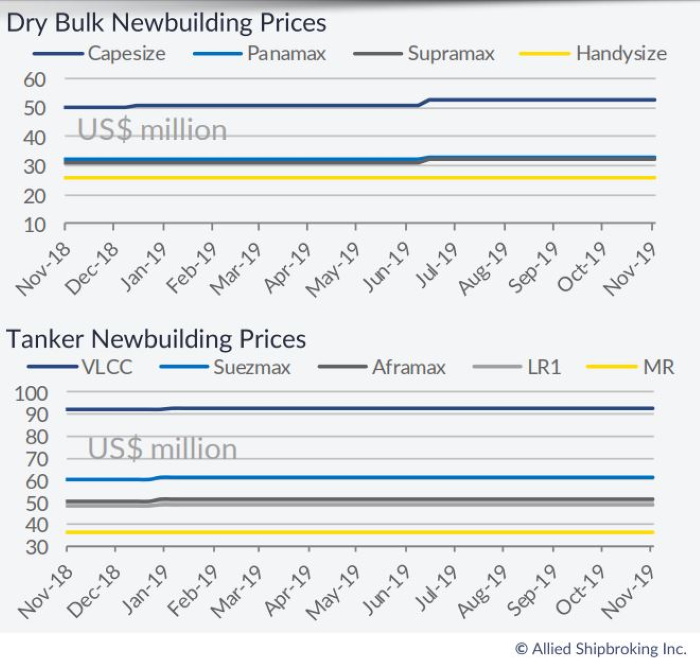

Newbuilding Market Uptick

Meanwhile, in the newbuilding market, Allied added that “an uptick was seen in newbuilding activity last week, without though this showing any impressive uptick in interest amongst buyers. In the dry bulk market, we saw 8 new units added to the global orderbook this past week, a considerable number given the current trends that were prevailing in the market. With the year starting to wrap up, potential buyers are expected to take a step back from the newbuilding market, partially due to the recent correction that has taken place in the freight market as of late. A fresh wave of new orders may be seen early in the new year, especially if the freight market starts to ramp up quickly past the Chinese New Year. In the tanker market, we noticed 8 units as well being added to the orderbook, with product tankers continuing to attracted the vast majority of interest. However, we expect activity to slow down here as well as we approach the end of the year, but with more deals being anticipated for 2020, given the bullish atmosphere prevailing in the freight market right now”.

Dry Market

Similarly, Banchero Costa said that “in the dry market, U-Ming signed 2 x BabyCapes around 100,000 dwt at Oshima for delivery 1st half of 2022. Price reported is $37mln. Another Taiwanese owner, Wisdom Marine Line signed 2 x Kamsarmax around 82,000 dwt at Tsuneishi Zhoushan. In the tanker sector a joint venture between Stena Bulk and Proman signed 2 + optional 2 MR Tankers around 50,000 dwt at GSI with delivery during 1st half of 2022. Vessels to be zinc coated and methanol fuelled; the price reported $41mln each. Eastern Pacific ordered 2 + 2 optional 158,000 dwt dual-fuel tankers at $67mln each. Hyundai Mipo received an order for one LNG bunkering tanker around 18,000 cbm, dely expected Jan 2022”, the shipbroker concluded.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!