PrimeETF aims to simplify investing and eliminate analysis paralysis, requiring less than ten minutes a month to manage. Let’s dive into the portfolio performance and changes for August 2024.

July 2024 Market Overview

July 2024 PrimeETF Portfolio

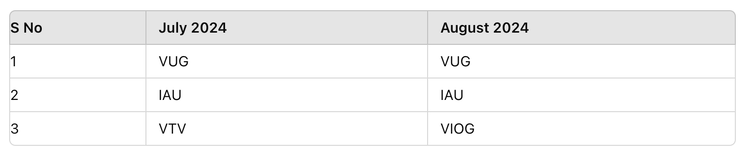

The PrimeETF portfolio included the following ETFs in July 2024:

- VUG – Vanguard Growth ETF

- IAU – iShares Gold Trust

- VTV – Vanguard Value ETF

Portfolio Changes for August 2024

On July 31, 2024, we made adjustments to eliminate the losers and buy the winners. Below are the changes:

PrimeETF Portfolio Allocation

On July 31, PrimeETF picked up VIOG, a Small Cap Growth ETF, and removed VTV, a Value Index ETF.

August 2024 Allocation (Equal Allocation)

- VUG

- IAU

- VIOG

Performance Expectations

PrimeETF is designed to underperform the S&P 500 during bull markets and outperform it during bear markets. Overall, PrimeETF aims to match the S&P 500’s performance across a full market cycle, outperforming the traditional 60/40 portfolio and other lazy portfolios.

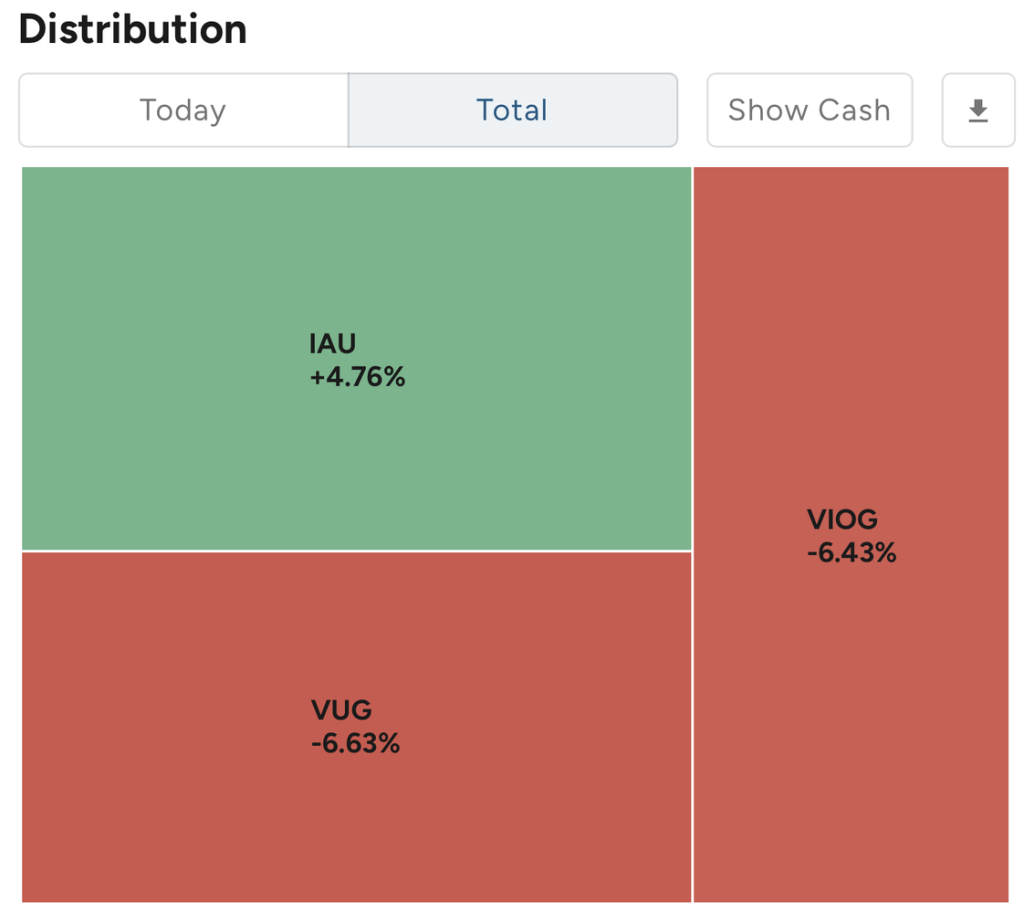

Returns as of August 4, 2024

- VUG: -6.63%

- VIOG: -6.43%

- IAU: +4.76%

PrimeETF’s August 2024 Portfolio Composition & Performance

On July 31, we sold VTV for a 4.85% gain. The realised gains were used to buy VIOG (33.26% of the total portfolio) and increase VUG by 2.9% (32.58% of the total portfolio).

PrimeETF – VTV sold off with a gain of 4.85% in July 2024

PrimeETF – VUG added position // VIOG fresh buy in PrimeETF portfolio

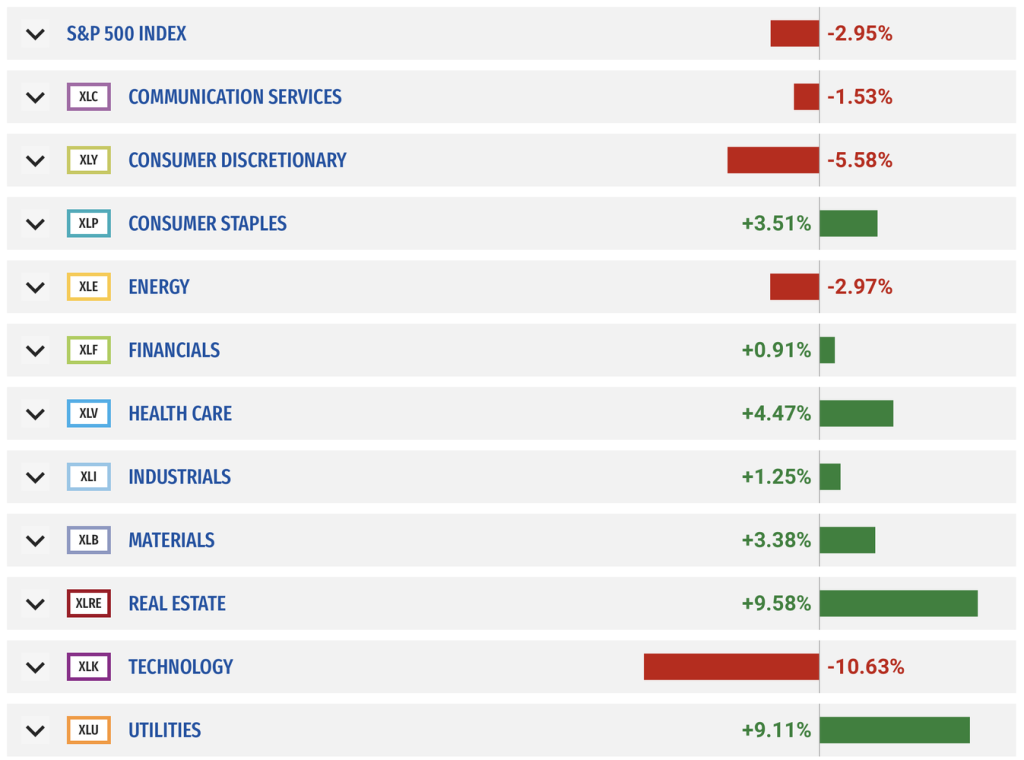

PrimeETF Performance

- PrimeETF: -1.79%

- S&P 500: -2.08%

- NASDAQ 100: -6.34%

As markets turn bearish, PrimeETF experiences a lower drawdown than the S&P 500 and NASDAQ 100, mainly due to holdings in gold (IAU) and value ETF (VTV).

Performance Comparison with S&P 500:

PrimeETF vs S&P500

Performance Comparison with Nasdaq 100:

PrimeETF vs QQQ

Trends to Watch

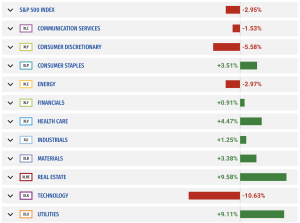

In July 2024, real estate and utilities made a significant comeback, as seen in the charts below. In PrimeETF’s sector ranking, utilities (XLU) and real estate (XLRE) hold the top two positions, followed by financials (XLF) and communication services (XLC).

Source: SPDRSectors

PrimeETF – XLU outperforming VOO

Looking Ahead

Stay tuned for updates and enjoy your investing journey! We will continue to rebalance the portfolio as needed and provide monthly updates.

In Case You Missed It: Highlights from Past Blog Posts

- Launch of Prime ETF: Learn about the official launch of Prime ETF – Read here

- Getting Started with Investing: Find out which apps or brokerage accounts are best for beginners and how to start investing – Read here

- Understanding Fees and Expense Ratios: Discover why fees and expense ratios matter when choosing an ETF or fund – Read here

Don’t miss out on more updates and insights. Join Prime ETF here

Important Disclaimer

This is not a stock/ETF buy/sell recommendation. Invest at your own risk. Following this portfolio may lead to a full capital loss. Always consult a certified financial advisor before making investment decisions.

Conclusion

In investing, the real value lies not in complex patterns but in the stories and trends behind stocks and ETFs. Avoid overanalyzing and focus on the narratives and trends where real opportunities exist.

Did you subscribe to our daily Newsletter?

It’s Free! Click here to Subscribe

Source: PrimeETF