According to a Lloyd’s List article written by the cost-cutting and the erosion of marine fuel oil premiums are rendering sulphur abatement technology redundant.

Low Fuel Price Effect

Persistent low marine fuel prices will hit the fortunes of shipowners who have invested heavily in fitting scrubbers, warns research outfit Alphatanker

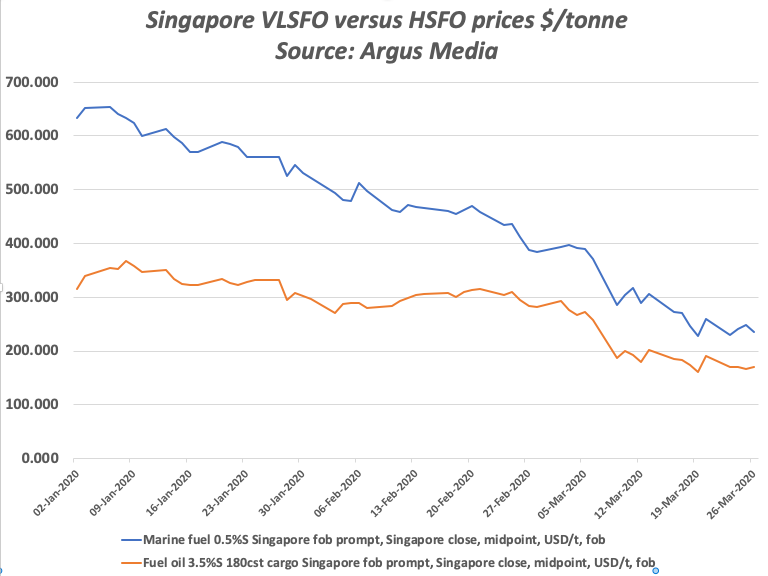

The price of 0.5% very low sulphur fuel oil now used by some 70% of the international global fleet has plunged by 278% in Singapore since the beginning of 2020, when it was as high as $653.75 per tonne, according assessments compiled by price reporting agency Argus Media.

“Persistent low marine fuel prices will hit the fortunes of shipowners who have invested heavily to have their vessels equipped with scrubbers,” said Alphatanker, a research division of Paris-based brokers BRS.

Retrofit Cancellations

DRY bulk and containership owners are among the first to scrap plans to retrofit or install scrubbers, according to Alphatanker, which forecasts a “flood of cancellations” as cost-cutting and the erosion of marine fuel oil premiums render the sulphur abatement technology redundant.

“The question is now rightly being raised over whether scrubber installations will be cancelled,” Alphatanker said in its weekly report.

“Installations due to be carried out in Chinese yards were already being delayed in the wake of Covid-19 and now following stellar returns for tankers, some owners are reportedly delaying or even, where possible, cancelling installations.

The Price Differential

The difference in price between compliant VLSFO and 3.5% high sulphur fuel oil used by vessels with scrubbers has shrunk to $50 per tonne, from more than $400 per tonne earlier this year, according to Alphatanker. Argus Media prices for Singapore today assess the spread as $64.50 per tonne.

- That has reduced the earnings premium for scrubber-fitted vessels and extended the payback time for the $2.5m average investment to four years rather than four months for the largest vessels that have retrofitted the technology.

- Payback time will be even longer for smaller vessels, given the economies of scale.

Tip of the Iceberg

“Reports suggest that owners of bulkers or liners struggling amid the global downturn are also cancelling scrubbers as they strive to cut costs.

We fear that this is just the tip of the iceberg and as the global recession intensifies during the second quarter, this drip of cancellations could turn into a flood.”

Situation Now

- The premium is not expected to widen as VLSFO prices are unlikely to rise given free-falling demand across the oil complex.

- Some 2,753 vessels totalling 328.7m dwt were trading and had scrubbers installed, according to the Lloyd’s List Intelligence database at the start of January.

- A further 580 newbuildings were to have scrubbers fitted. Some 16.4% of crude tankers, including one in five very large crude carriers, and 12.7% of containerships have the technology installed.

- Dry bulk scrubber penetration is just over 12%.

- A backlog of about four months for scrubber retrofits evolved at the end of 2019 before the global introduction of low-sulphur marine fuel on January 1 as yard capacity and material shortfalls doubled installation times.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Lloyd List