- In 2018, SFL received $1.5 million in profit sharing and in 2017 they got as much as $5.6 million, admittedly with a larger tanker fleet.

- SFL’s charter revenues were slightly down by $5.5 million from $99 million to 93.5 million.

- It is mainly due to scheduled rate reduction in May and lower revenues from the Suezmax tankers trading in the spot market.

- Losses on derivatives also increased by $2.3 million. Earnings per share went down from $0.31 to $0.26

According to an article published in Seeking Alpha, results of Q2 were in line with expectation with the improved market for bulkers will generate more profit-sharing in the coming months.

New deals could come this quarter from affiliated companies and prudent preparation taken for prolonged difficulties in the offshore sector.

Investment Thesis

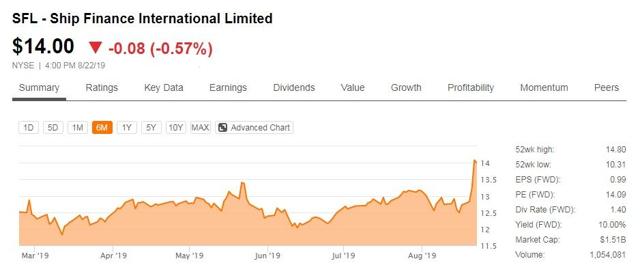

The share price was trading in a narrow band between $12 and $13 over the last four months, only to start to show some improvement over the last few trading days.

Source: SA

Bulk shipping markets, both wet and dry, are showing strong improvements. This will only show up in the results in the second half of this year. Although SFL’s ships are generally fixed out on long term charters, they will benefit marginally through agreed profit sharing over a certain level. All the bulk ships (dry and wet) are currently trading above this threshold.

2nd Quarter 2019 Results

The results were uneventful. You might even say “boring.” Those who follow me here on SA knows that I like “boring.” Especially if I get paid 10 to 11% whilst I wait for something to happen.

SFL’s charter revenues were slightly down by $5.5 million from $99 million to 93.5 million, mainly due to scheduled rate reduction in May and lower revenues from the Suezmax tankers trading in the spot market. Losses on derivatives also increased by $2.3 million. Earnings per share went down from $0.31 to $0.26

Balance sheet and liquidity

- Cash position increased by $58.4 million over the last quarter. The value of their investment in marketable securities also went up by $19.7 million.

- Book value of the fleet was reduced by $20 million. They depreciate the fleet by roughly $29 million each quarter.

- As of December 31, 2018, SFL, including its consolidated subsidiaries, had total debt principal outstanding of $1.44 billion. Now midterms into 2019 this has gone to $1.46 billion.

- As a result of poor, or no earnings in the shipping industry, many companies have had a hard time raising capital. When they do raise capital, the cost of doing so becomes expensive.

- SFL has an enviable position where they have good access to raise both equity and debt at quite a competitive price.

- During last quarter they raised NOK 700 million in a 5-year senior unsecured bond due in 2024.

- The bonds had a coupon of 4.6% above the floating NIBOR reference rates and were subsequently swapped to about $80 million with a fixed interest rate of 6.9%.

- This has been followed up this quarter up by a smaller bond of just $11 million at a fixed interest rate of 5.9%.

Containerships

By far the largest. As all the large ships are on a multi-year charter agreement, we care little about what the charter market is at this moment. What we need to keep an eye on is the ability of the counterparties to continue to pay SFL.

25 containerships are scheduled to be retrofitted with scrubbers. By doing this, charterers of the vessels have agreed to increase the duration of the charters to compensate for the costs SFL incurs. This extension and some adjustments to charter rates resulted in an increase to the backlog by more than $160 million to the container vessels. Some of this compensation comes in the form of a profit share feature, where SFL will receive a part of the benefit in fuel savings for vessels with scrubbers. This is not reflected in the increased backlog.

Scrubbers to be upgraded

- Some additional vessels will be also be upgraded with scrubbers paid for by their charterers.

- The purchase in 2018 of a fleet of smaller container ships were opportunistic moves, with purchase prices very close to residual values.

- SFL bought 18 older small container feeder vessels between 1,100 TEU and 4,400 TEU. Sellers still have to pay all operating costs and maintain the ships.

- These ships are on seven years bareboat charter from delivery, with subsequent purchase obligations.

- It was, therefore, purely a financial transaction with limited risk and also no potential upside upon expiry of the charters.

- Therefore, we are not concerned about how the market for container feeder ship develops. Our only concern would be the counterparty risk.

- SFL neither discloses the name of these ships nor the name of the counterparty, only that they are “a leading container line“.

Capesize

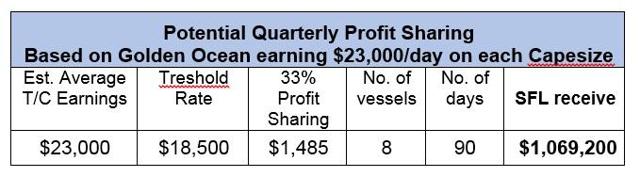

SFL should benefit from their profit-sharing scheme with Golden Ocean on their Capesize ships.

- They have a 33% profit split on top of the base rate of around $18,500 per day.

- Currently, Capesize ships are trading at rates around $29,000 in the spot market. Exactly how much these 8 vessels will earn depends on how well the chartering department of Golden Ocean manages to employ them.

- Some are able to earn a premium above the index level. Let us assume they are just average. That is still a current premium of $10,000 above the threshold where the profit-sharing kicks in.

- Spot rates move around a lot. We use a lower rate of just $23,000 as a more conservative estimate.

- It will result in a profit-sharing of about $1 million per quarter which is not a material difference to SFL’s result.

- Their two Supramax and seven Handysize ships continue to trade in the spot market.

- The rates achieved this quarter was approximately $6,900 per day for the Supramax ships and $5,900 for the Handysize. This is quite poor results.

- SFL’s CFO Ole Hjertaker commented during the conference call that the reason for this rather poor performance was because they do not have the platform to manage these vessels both operationally and commercially without being ripped off by third-party service providers.

Source: Pacific Basin – 2019 Interim Report of 14 August 2019

Tankers

The tanker fleet has been faced out as they have been doing the right thing by selling off older ships. However, whilst doing this they made very few replacements. No new VLCC ship came into the fleet. Only two LR vessels were bought in 2017.

- Frontline (FRO) has just announced the purchase of 10 Suezmax vessels from Trafigura.

- The spot market for VLCC’s are strong with vessels currently earning over $40,000/day

- As stated in my previous article in April, SFL received five loan notes of $18 million from FRO in 2018 as compensation of early terminations of charters.

- With the improving tanker market, there should be no problems for SFL in receiving this outstanding.

- Profit-sharing which was $600,000 in the second quarter of 2019 should also improve.

- In that period the crude oil tankers chartered to Frontline Shipping Limited earned approximately $24,200 on average per day in the second quarter, which is higher than the base rate of $20,000 per day.

- For the tankers, SFL has an even better profit sharing with FRO, than what they have with (GOGL) on the dry side.

- SFL is entitled to a 50% share of profits earned by the vessels above threshold levels.

- In 2018 they received $1.5 million in profit sharing and in 2017 they got as much as $5.6 million, admittedly with a larger tanker fleet.

Offshore

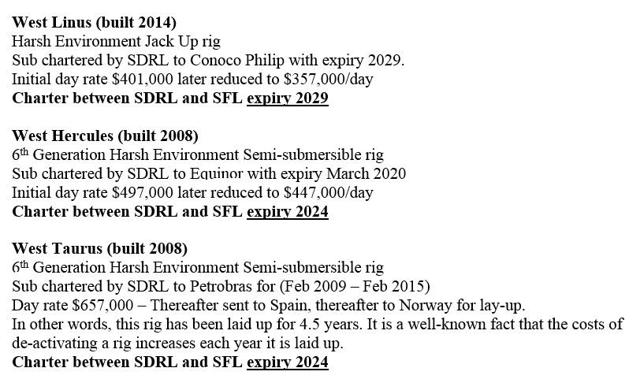

SDRL is still the big elephant in the room, it completed its restructuring in July last year, with a good runway with more than $2 billion in liquidity and no debt maturity due until June of 2022.

- They are going to need this liquidity because they keep losing money. $206 million net loss in the last quarter to be precise.

- Should the offshore market not sufficiently recover by we might again see SDRL needing a second restructuring after 2022.

- Restructuring of SDRL that took place only gave them more time to wait for an anticipated recovery in their market.

- The rate reduction is temporarily reduced for 5 years by 30% until 2022. From 2023 the rates go back to what they were before.

- The charter hire from the drilling rigs in 2 nd Quarter 2019 was $30 million.

- It is easy to calculate how much money is being compounded for future settlement.

- Before the financial restructuring, SDRL paid roughly $ 43 million per quarter to SFL. Now they are paying $30 million.

- The 30% difference equals $ 13 million per quarter. The duration of this postponement is 5 years, in other words, 20 quarters. That comes out to $260 million.

- SFL’s exposure to SDRL is limited and managed to reduce the debt on those rigs from $1.9 billion initially to less than $640 million as of the end of 2nd Quarter 2019.

- Furthermore, only $266 million of this debt is guaranteed by SFL. By the end of 2020, the debt should be reduced to a very comfortable level.

As pointed out by SFL’s CFO Ole Hjertaker said, “They will continue to generate strong net cash flow from these assets due to significantly reduced leverage and corresponding lower debt serving cost and breakeven rates“.

Financial trouble for ownership of 3 drilling rigs

- SFL will get into some financial trouble as a result of their ownership of these 3 drilling rigs.

- It is merely to point out that the likelihood of SFL being “made whole again” through a proper settlement of what SDRL owe them unless the offshore drilling rig market improves substantially.

- SFL’s investment in the Anchor Handling/Offshore Support Vessels, which are bareboat chartered out to Solstad Offshore ASA is quite small.

- Only contributing between 1% and 1.5% of the charter backlog. Solstad is still going through a financial restructuring where creditors have agreed to a standstill period enabling Solstad to try to work out a new plan.

- In view of this uncertainty, SFL is doing the right thing by making a further non-cash impairment of $8.2 million in this Quarter.

- In the 4th Quarter of 2018, they made a large impairment of $35.7 million.

- From a book value perspective, this is, as Hjertaker pointed out “a very marginal investment for SFL because they have amortized down these assets a lot since they were acquired in 2007 and 2008”.

Conclusion

Better results are expected in both Q3 and Q4 on the back of some expected improved contributions from profit sharing on the bulk side of their business. Containerships should be stable, and the effect of what will happen to their exposure to offshore will play out a few years later.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha

![[FAQ] Will Handies Be Handy?](https://mfame.guru/wp-content/uploads/2020/09/Handysize-80x60.jpg)