Global markets seemed to take a breather this week as things turned slow across the board once again, not only on the shipping side but even the ship recycling side of things, reports MarineLink, citing cash buyer GMS.

GMS Week 42 – Woefully slow!

Currencies fluctuated in moderate tandem, local steel plate prices made surprisingly marginal moves, all while the Baltic Exchange Dry Index (BDI) slipped and oil steadied itself. The BDI reported a declining week that shaved off about 3.2% last week, dropping to its lowest levels since early October as the Cape index took the lead shaving off over 6% of its value, while Supramaxes dipped a comparatively milder 9 points and the Panamax index remained steady for the week even though the overall index is nearly 4% down.

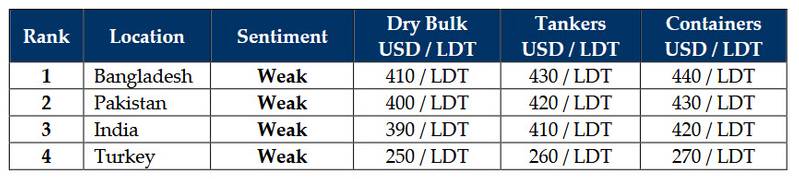

“As the global dark / shadow fleets start to grow, the woeful performance of the Indian sub-continent ship recycling markets continues on, and there are few emerging signs of light at the end of the tunnel (more like an oncoming freight train) for the remainder of this year,” says GMS. “Prices have fallen so low over recent weeks that constant discussions of prices below $400/LDT are comfortably prevalent and it seems increasingly certain that any viable recovery has still not bought a ticket to the sub-continent recycling sector.”

India has endured the roughest times over the last several weeks with levels plummeting on the back of rapidly deteriorating local steel prices and a drastically depreciating currency that continues to suffer on the back of 50% tariffs.

Pakistan has not been too far behind the recent falls with plunging demand due to an influx of cheaper steel imports, all while Bangladesh shows moderate signs of life with a couple of local arrivals.

“Overall, mounting global trade wars and tariff implementations are leaving global corporations confused and fearing the worst, should these reciprocal and seemingly ever escalatory measures continue to unfold thereby stifling shipping sectors, global trade, FX markets, steel products, and overall cost of living.”

Did you subscribe to our daily Newsletter?

It’s Free — Click here to Subscribe!

Source: MarineLink