According to a Seeking Alpha article written by the Waltzy, the markets in 2020 have been volatile. We all know that, and we’re all very aware of the many reasons why. That said, volatility can lead to opportunity. It’s your job to identify those opportunities.

Going by his opinion, we currently have significant opportunities to see strong near-term gains in the oil tanker market. There are a number of companies you could consider here. Euronav (NYSE:EURN) – a VLCC focused company – in his opinion is the best investment at this time.

The shipping market

There are lots of sub-segments of the shipping market. Oil tankers, product tankers, container shipping, offshore drillers, LPG, LNG, cruise ships, etc. I won’t attempt to discuss all of these – just to start discussing those that interest me.

Oil tankers

Roughly speaking, we produce approximately 100 million barrels of oil each day. A huge, unfathomable number. We also consume about 100 million barrels each day. These barrels of oil are normally shipped around the world using a number of different types of oil tankers.

For now, let’s ignore ULCC tankers – there aren’t many out there and they don’t trade regularly. VLCC tankers hold around 2 million barrels of oil, Suezmax around 1 million barrels. These ships are normally employed on a day rate to ship oil from one place to another. Sometimes – as may be the case now – they are used to store oil as well.

The oil market is currently heavily oversupplied. Shale oil has been growing quickly the last few years. Fueled by cheap money & new technology, the US is now the world’s largest producer. And more recently OPEC+ was not able to keep to their agreement to curb global oil supplies. So Saudi Arabia has decided to pump more, and fast. The oil price fell, and oil companies and traders needed to get their hands on mobile storage.

Subsequent to this, Covid-19 has had a huge impact on demand. Planes are grounded; cruise ships aren’t sailing; cars are parked and – in a number of economies – even spending time outdoors has been curtailed.

What does this mean for oil tankers?

In short, rates have gone up. And fast.

Part of the reason for this is that the current oil price is low. And the future price is significantly higher. So there is strong demand at present to sell oil forward – purchase it today – store it somewhere – and pocket the difference. The difference – after costs – should represent a ‘profit arbitrage’. This puts huge pressure on the current availability of oil tankers.

As of today (Saturday March 28):

- VLCC ships are trading for $220k/day

- Aframax ships were earning $63k/day.

- And Suezmax ships now cost $65k/day.

These rates are very attractive for oil tanker companies. There’s clearly no guarantee these rates will persist…but you just do not know. IF Covid-19 has a very long term detrimental impact on the demand for oil, then rates will tumble. That said – that does not seem likely. If C19 is a short term event, then things are looking very bright for oil tankers.

Which companies could you consider?

There are 3 oil tankers I think you can consider. For disclosure, I am long all 3.

Euronav

Euronav is based in Belgium, and is a large tanker company. It owns 42 VLCCs and 27 Suezmax ships. It also owns some additional assets. It has a good balance sheet: $1.8bn of total liabilities; $800m of current assets; net position is $1 bn of liabilities. Plus the fleet of just under 70 ships.

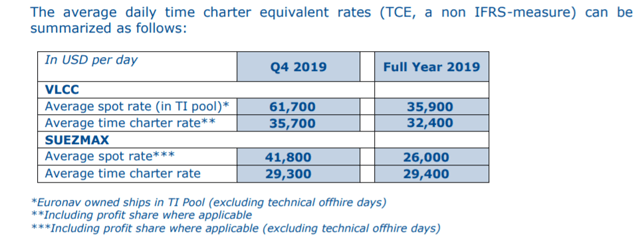

These are the rates that Euronav earned in Q4

Source: Euronav Q4 results

This resulted in earnings of 75c in that quarter. The share price currently sits at $11.79. Rates for VLCC and Suezmax ships are currently significantly above what Euronav earned in Q4.

Euronav is now going to pay a quarterly dividend. In May it’s going to pay a dividend for Q4 2019 and Q1 2020 together. Q4 is going to pay 29c. Let’s assume that Q1 is similar. And now Q2 is teeing up nicely.

If rates persist at $220k/$60k a day for VLCC/Suezmax respectively, clearly Euronav is going to earn a fortune. I’d estimate at these rates Euronav earns about $3 -$3.50 in one quarter alone. It looks cheap on a P/E ratio, it’s paying a dividend, and it has a good balance sheet.

International Seaways (ISNW)

International Seaways is based in the US. It’s a smaller company than Euronav, and has a more diverse fleet. In total it owns 42 vessels, including 13 VLCCs, two Suezmaxes, five Aframaxes/LR2s, 13 Panamaxes/LR1s and 7 MR tankers.

Like Euronav, it has a fine balance sheet. It owes $730 million, but has current assets of $180 million. Its debt payment schedule looks manageable.

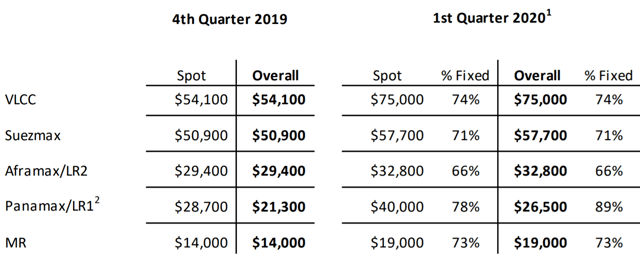

So how did it perform in Q4?

The below is from their Q4 presentation. We can clearly see as well that Seaways is going to have a good Q1. Rates look to be higher in Q1 than Q4 in EVERY SINGLE SEGMENT.

Its share price is $22.71. With the above TCE…Seaways earned 54c in Q4. Q4 had quite a bit going on, and their adjusted earnings are $1.32.

So Q1 2020 will be better than Q4 was. And rates are currently higher than those shown for Q1. Clearly Seaways is doing well at the minute!

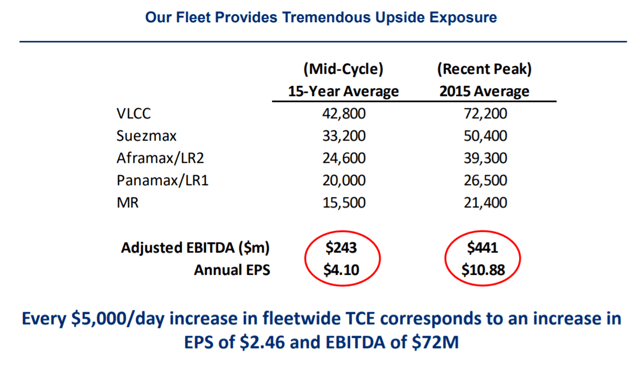

To really illustrate how well they’re doing – look at the slide below. VLCCs are currently SIGNIFICANTLY above the $72k/day shown below.

So Q1 > Q4 2019. And Q2 is looking better again. Seaways recently restructured a lot of its debt. And now it has put in place a dividend payment. It looks like they’re going to use excess cash for a variety of things: pay down debt, buy shares, pay a dividend…and maybe expand the fleet. Seaways is cheap – but they need to show investors more of the money.

Teekay Tankers (NYSE:TNK)

Teekay Tankers is the last tanker company I’m going to look at. The Teekay name is one that many investors shy away from. That said – TNK appears to be doing well at the minute.

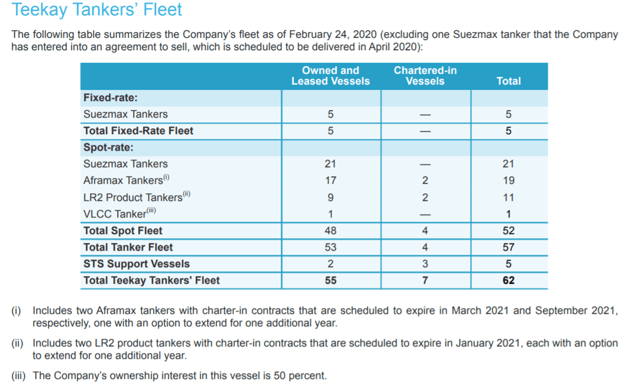

Unlike Euronav or International Seaways, Teekay Tankers does not have as good a balance sheet. It doesn’t operate VLCC ships – rater it focusses on the mid-size segment. This is their fleet as it stands.

Their net debt position is $930 million. So they do owe more than either EURN or INSW.

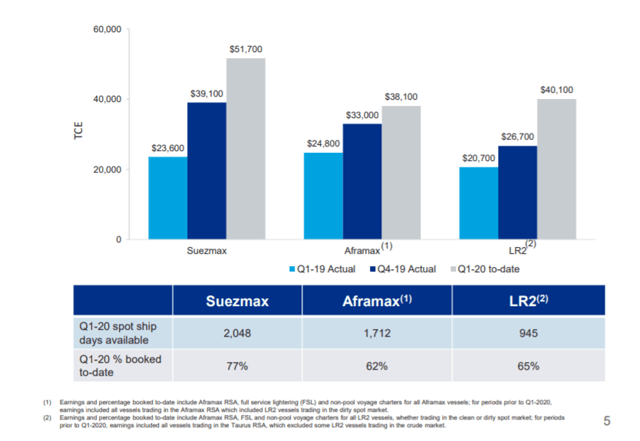

Their share price is currently $21.96. Their adjusted earnings for Q4 2020 were $2.50. So clearly on an earnings per share basis…TNK is cheap. Its Q1 looks better than Q4 2020 as well:

If rates persist at $65k/day for Suezmax and $63k/day for Aframax – then TNK will do very well indeed!

TNK is cheaper than EURN or INSW. But it needs this money to firstly reduce some of its debt. Once it reduces its debt, it should be in a position to pay good dividends to stockholders.

Which would I choose?

Euronav.

Compared to net asset value, Euronav is probably the most expensive of the 3 here. But it has a lot going for it.

- great management team

- it’s currently committed to paying a strong dividend. I want my money back!

- it has the most VLCC exposure of the 3. VLCC rates are off the chart

2nd up is International Seaways. Personally I think they’re going to start returning more capital. But I want them to do this soon! If current rates persist, they’re priced between 1x and 2x earnings.

Teekay are the cheapest of the 3 compared with NAV. But for a reason. They are going to pay down debt for now. And once they are up and running they can consider returning capital to equity holders. If you think these rates will persists, or that Suez/Afra rates will increase…then Teekay may be the one to choose. If you want a short term bet – Euronav. For something in the middle…there’s only one left!

Will rates persist?

Tanker day rates are volatile. They peak in Q4, dip in Q1 and start to climb back up. The last 12 months have been a bit more volatile. First the US applied sanctions on some tankers, then they were removed. The trade war also had an impact. The Coronavirus is eating into demand. And now OPEC are flooding the market. By flooding the market, we need more storage for oil. Short term – this means we have expensive day rates. Plus the current contango in oil means oil storage is a popular bet for traders.

Q1 results for all of the above will be great. It’s looking as if Q2 will be good as well. Happy days!!

If the Coronavirus grounds the world’s fleet of planes; plus most cars, buses, etc., for months on end…then all bets are off. This is a potential outcome. It’s a scary one and frankly not the most likely end outcome.

If you read the presentations from any of the companies above they constantly and consistently tell us that the order book for each of these ships is at an all time low. And I think this is the real underlying reason for the current high rates and the huge amount of volatility. At current levels of demand for ships, the global fleet is slightly less than demand.

C19 and IMO2030 are also – in my opinion – going to defer investment in new ships. Which could mean that strong rates persist for longer than many people imagine.

Should you invest?

Tankers have a troubled history. I cannot give you investment advice, and everyone’s situation is unique. But I am happily long all 3 of the names above.

Euronav is my favorite current tanker stock, for the reasons outlined above.

I would encourage any readers to consider an investment in this market, in the near term. The market is volatile, so you could consider ‘stepping in’ to an investment, over a number of weeks. I would also suggest to keep an eye on the size of any individual position. And finally, I would encourage you to keep an eye on the underlying markets themselves. VLCC, Suezmax, Aframax rates go down as well as up.

Overall: I see a number of these companies earning a significant proportion of their market cap, in just a few months. Their balance sheets are improved & still improving. Governance is relatively solid. Large dividend payouts beckon. For me these look like Buy Signals; I expect to see large capital appreciation in the near term

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Seeking Alpha