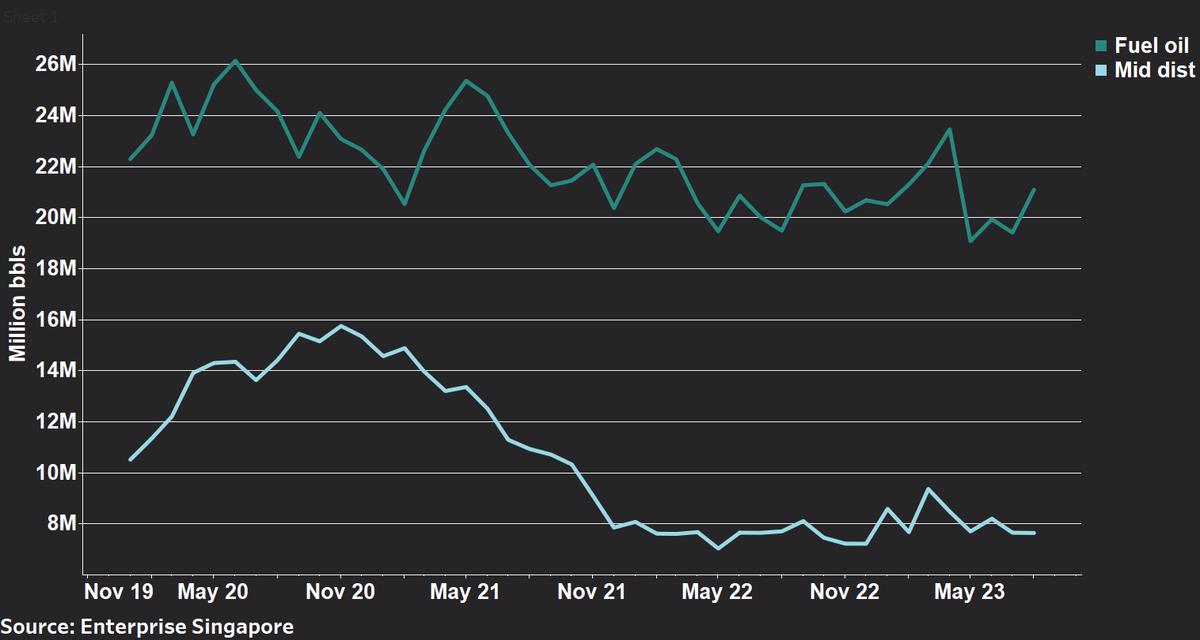

Singapore fuel oil and middle distillate stocks since January 2020

Changes in monthly average Singapore stocks from July to August:

- Residual fuel oil stocks up 1.68 million bbls to 21.10 million bbls

- Middle distillate stocks down 10,000 bbls to 7.64 million bbls

Despite the port’s net fuel oil imports declining by 14% in August, Singapore’s fuel oil stocks grew above 21 million bbls in August. Overall there was less cargo trade, with fuel oil imports slumping by 13%, and exports by 9%.

Most of HSFO cargo volumes arrived in the port from the UAE (44%) and Russia (29%), followed by Malaysia (10%) in August, according to cargo tacker Vortexa. While HSFO exports largely departed for Bangladesh (37%), China (23%) and South Korea (12%).

The bulk of low-sulphur fuel oil (LSFO) arrived from Brazil (29%), Malaysia (19%) and the UAE (8%) in August. LSFO cargoes out of Singapore were mostly bound for China (36%), Malaysia (16%) and Taiwan (13%).

The Southeast Asian hub’s middle distillate stocks remained roughly steady at above 7 million bbls in August.

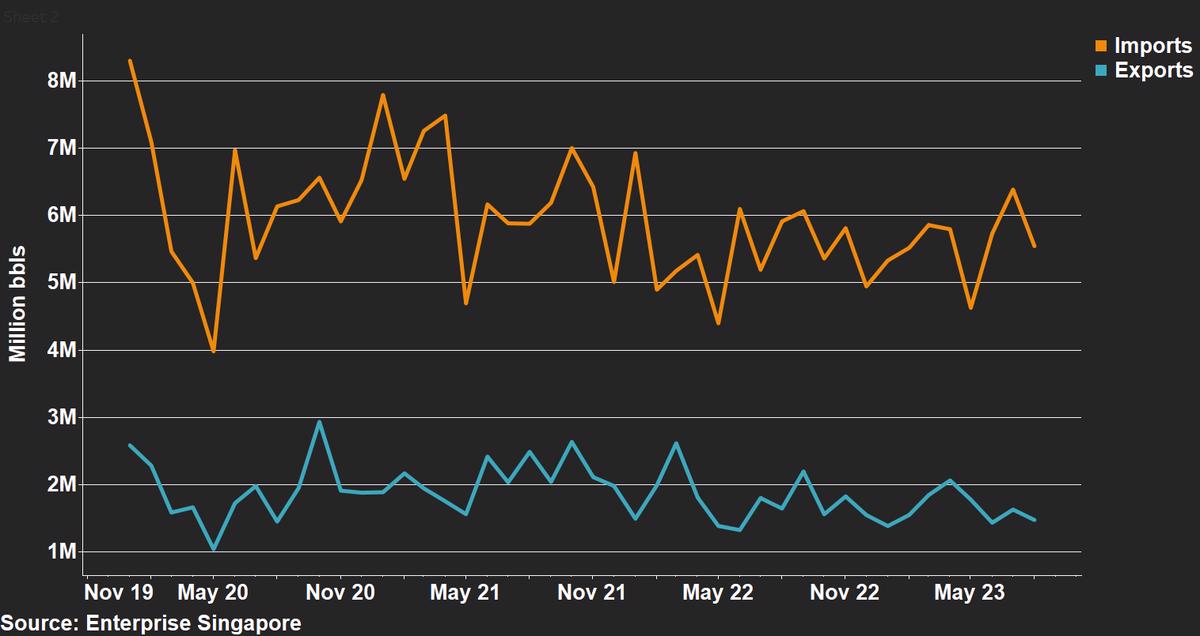

Singapore fuel oil imports and exports since January 2020

Changes in monthly average Singapore fuel oil trade from July to August:

- Fuel oil imports down 840,000 bbls to 5.54 million bbls

- Fuel oil exports down 155,000 bbls to 1.47 million bbls

- Fuel oil net imports down 685,000 bbls to 4.07 million bbls

Availability of VLSFO has been getting tighter in Singapore, with most suppliers recommending lead times of 11-13 days, up from 7-11 days last week. Lead times of HSFO remain virtually unchanged from last week at 6-9 days. LSMGO remains readily available, with shorter lead times of 2-4 days advised.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: ENGINE