- The companies Q2 earnings were severely affected by low dry bulk rates. The rates for Capesize were of approximately $8,500 per day, for the Panamax segment.

- $9,100 and for Supramaxes were approx, $8,500 and the same rates currently stand at $30,437, $17,583, and $14,113, respectively.

- SBLK plans to produce some impressive cash flows, which can be used to either continue repurchasing more shares, start distributing a dividend to shareholders or pay down debt.

- Quarter 3 rates have been limited by the 1,610 off-hire days due to dry-docking and scrubber installation (the cost is estimated at about $20 million).

According to an article published in Seeking Alpha, SBLK is a bet on the general dry bulk market and to the spread the IMO 2020 will generate between HSFO and MGO (in-depth article on the dry bulk market fundamentals).

Investment thesis

SBLK’s aggressive take on scrubbers (104 ships fitted with scrubbers at the end of 2019), combined with the fleet ampliation the company has achieved during this last year, can provide tremendous value if the spread between HSFO and VLSFO or other compliant fuels like marine gasoil is high, providing the company with a premium to average market rates.

IMO 2020

IMO 2020 is an International Maritime Organization (IMO) regulation that will limit the amount of sulfur in fuel used by shippers to about 0.5% from 3.5% (by weight) when it takes effect January 1, 2020. The 3.5% limit was established in 2012, reducing it from 4.5%.

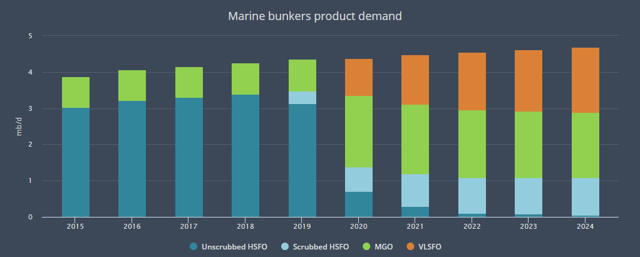

Source: International Energy Agency (IEA) Oil 2019 report

As we can see above, the IEA expects HSFO usage to fall by about 60% while the usage of MGO (marine gasoil) and VLSFO (very light sulfur fuel oil) will skyrocket. This image illustrates what the IEA expects for the whole world (we can see they expect about 750,000 mb/d of unscrubbed HSFO usage suggesting some maritime companies will decide to not comply with the new regulation).

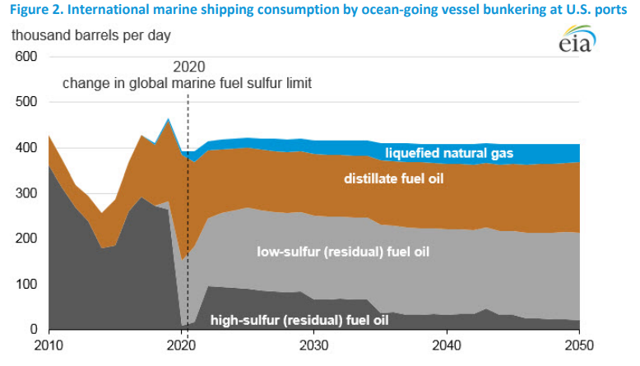

Source: The Effects of Changes to Marine Fuel Sulfur Limits in 2020 on Energy Markets (U.S Energy Information Administration).

The EIA expects about total compliance with the new regulation (at U.S. ports, it does not make worldwide forecasts). The most interesting considerations from this illustration are the gradual acceptation of liquefied natural gas (LNG) as power for the shipping industry and the adoption of scrubbers after IMO 2020 kicks in (that’s the reason the high-sulfur fuel oil usage jumps after the drop the regulation causes).

The fact that the EIA expects the jump on HSFO after the big drop seems to indicate that the spread between HSFO and VLSFO/LSFO will be higher than expected which will make scrubbers a very interesting investment. This also seems to indicate that most companies have taken a wait and see approach. If EIA forecasts are met, SBLK will have benefited greatly from its scrubber investments.

The global maritime industry currently uses high sulfur fuel oil (HSFO) to power their ships. This kind of fuel is a residue from the crude oil refining process. The main reason for its usage as fuel by the maritime industry is its cheapness.

What can shippers do to comply with the new regulation?

- Install scrubbers

- Use lower-sulfur fuel

- Use non-petroleum fuel like LNG

Scrubbers

Scrubber systems are used to remove selective harmful components (in this case sulfur) from the exhaust gasses generated from combustion. The components are then collected with wash water, which can be stored or disposed of (throwing it into the sea).

The main advantage of installing a scrubber is that the ship will be able to continue burning HSFO as fuel (cheaper than other kinds of fuels). The main risk to scrubber installation is that if the spread between HSFO and VLSFO (or equivalent) is not big enough the company won’t be able to generate a return on the money invested in the equipment.

Marine gasoil fuel or VLSFO

Marine gasoil fuel and very low sulfur fuel are fuels that are compliant with the IMO 2020 regulation (they have 0.5% or less of sulfur content). For now, most shipping firms have taken a wait and see approach, which means they will be using this kind of fuel.

The main problem with using marine gasoil or VLSFO is that the sudden rise in demand due to IMO 2020 is widely expected to cause a sudden increase in prices, making these products very expensive and increasing dramatically the operating expenses of the vessels that use them.

LNG as bunker fuel

Some shippers have started equipping their vessels with LNG burning motors. The rationale behind this move is that aside from being compliant with IMO 2020, they also reduce fuel expenses. Though, the adoption of this technology has been very limited (if we exclude the LNG shipping industry, which is mainly powered this way).

Risks to 100% scrubber exposure

The first risk is that the spread between HSFO and compliant fuels is not as high as expected. This would make the scrubber capex a far less interesting investment. Though, it seems very improbable to see a scenario where the spread is so little that the company does not recover the invested capital on scrubbers.

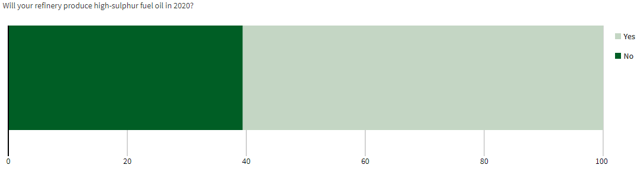

There would be two ways for this spread to be small: “high” HSFO prices or low compliant fuel prices. I view the first option as unlikely due to the fact that we have not seen widespread adoption of scrubbers (which will continue using HSFO) and most refineries plan to continue producing HSFO (even though most of them will be reducing the amount produced).

Reuters: Are refiners ready for IMO 2020?

Reuters: Are refiners ready for IMO 2020?

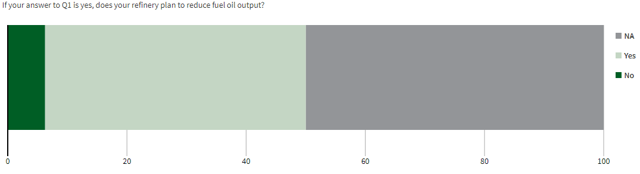

The second question was not answered by half of the participants, possibly because a decision has not been taken as of now (depending on the prices they may or may not maintain the HSFO output).

Low prices on compliant fuels are also unlikely, as the demand for these products will skyrocket (or at least that’s what Euronav (EURN) believes as the company has stored as much compliant fuel as they have been able to on a ULCC (Ultra Large Crude Carrier). EURN will explain their full IMO 2020 strategy on September 5th. Other traders have also been storing compliant fuel betting on high spreads when the IMO 2020 regulation kicks in.

The second risk is that several countries follow a path on Indonesia’s action, which has announced that it will not enforce the regulation. According to Reuters, the country took this path due to the high prices of clean fuels. Indonesian ships will be able to use non-compliant fuels in Indonesian waters (ships with other flags or Indonesian ships on international waters will have to comply with the regulation to avoid penalties).

Star Bulk Carriers sensitivity to spreads

When SBLK presented their second-quarter earnings, the company stated that they plan on having 104 ships fitted with scrubbers by year-end. By August 2019, they stated they had already 58 scrubber towers installed (therefore, it looks likely they will be able to attain their objective).

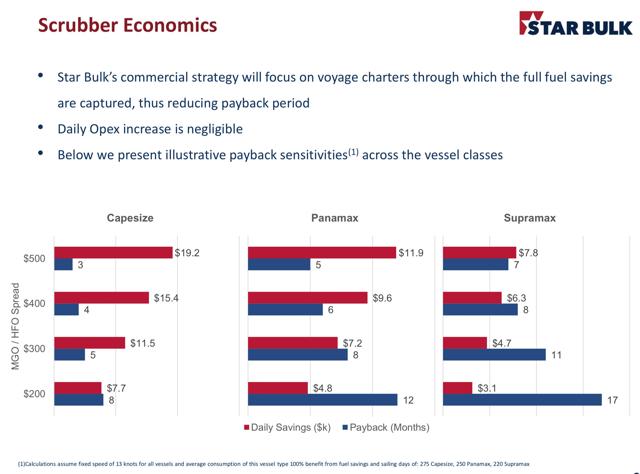

Star Bulk Carriers corporate presentation

As we can see above, SBLK states that with a $500 spread between HSFO and MGO, their payback ranges from 3 months to 7 months (depending on the vessel). As the returns on Capesize/Newcastlemax ships are the most lucrative, SBLK plans on having 36 out of their 38 ships equipped with scrubbers before year-end. On the Panamax/Post Panamax/Kamsarmax front, they plan on having 44 out of their 44 ships in the class equipped, while they will “only“ have 24 of their 32 Ultramax/Supramax equipped.

A spread lower than $200 is very unlikely due to the fact that the production of HSFO is far cheaper than MGO production.

As we can see, if the spread is high, scrubbers will be a very good investment for the company making them. Though the spread is likely to get reduced over time as the demand for MGO stabilizes and other shippers start using scrubbers (therefore, increasing demand for HSFO).

Conclusion

The IMO 2020 can have other effects on the dry bulk market (aside from the spread), such as reducing the average vessel speed (to reduce fuel consumption), which would increase the demand for dry bulk vessels (to move the same amount of cargo in the same time more ships would be needed).

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha