The predominant narrative revolved around the Houthi assaults on more than 80 commercial vessels in the Red Sea since the attacks began. A growing number of tankers opted to bypass the Red Sea altogether and take the significantly longer route around the Cape of Good Hope. This added approximately 30 days to a round voyage from the Middle East to Europe, according to AXS.

Tanker Demand

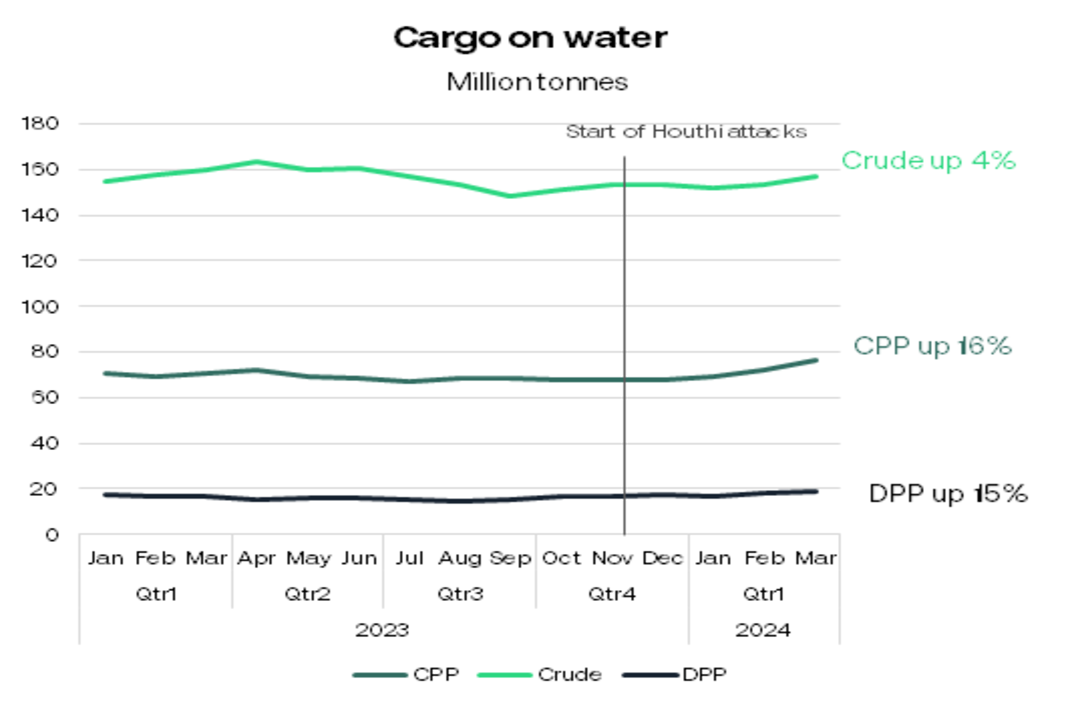

Tanker demand increased sharply during the quarter on the back of tanker diversions to avoid Houthi attacks in the Red Sea, and to a lesser extent, the unsold barrels on board recently-sanctioned tankers. Crude markets were least affected – as not much crude oil was moving through the Suez Canal. Crude oil ‘on the water’ has risen 4% since the Houthi attacks. The volume of CPP and DPP on the water rose by 16% and 15% respectively, as Russian eastbound cargoes avoided the Red Sea, and Mid-East/India middle distillates moved the long way around the Cape to Europe.

Oil Prices

Brent climbed steadily throughout Q1, reaching $86/bbl (currently at $90.8/bbl) by the end of the quarter. Brent was up 13% QoQ. OPEC+ members confirmed they would continue output cuts of 2.2m b/d at least until end of Q2-24.

Tanker Asset Markets

NB orders jumped in the first quarter of 2024, particularly for VLCCs, which saw 29 orders placed, well above the 10-year average of 12 per quarter.

Tanker deliveries were unusually low, with only 29 vessels (>25,000 dwt) delivered compared to a 10-year average of 51 vessels per quarter.

Tanker scrapping. Given the strong prevailing market it was another very quiet quarter for tanker scrapping, with nothing larger than flexi tonnage scrapped.

Secondhand asset values increased slightly during the quarter, despite sales volumes relaxing slightly after 18 months of heightened activity.

NB prices continued to increase for all tanker sizes.

Freight Markets

The tanker spot market has performed well during the first quarter of 2024. Braemar’s spot tanker Index for Q1 2024 was 20% up YoY, 53% up on the previous quarter, and 211% above the 9-year average.

VLCCs experienced a volatile quarter, with spot TCE earnings fluctuating between 40k $/day and 73k $/day, but average earnings for Q1-24 remained almost unchanged from the previous quarter at 48k $/day.

Aframax and Suezmax sectors struggled to maintain their strong performance in Q4 2023 into Q1, with earnings gradually declining from around 70k $/day to around 40k $/day by the end of the quarter.

Average earnings for LR2 tankers jumped at the start of February, peaking at 100k $/day before decreasing to 54k $/day in early March. They closed the quarter up at 90k $/day per day.

LR1s broadly mirrored the peaks and troughs of the LR2s. The robust CPP market boosted the number of LR2s shifting from dirty to clean trades, with a net migration of 10 vessels to clean in Q1-24.

MRs had a reasonably consistent quarter. Average sector earnings picked up from 35k $/day at the start of January to 51k $/day by the end, and then hovered around 50k $/day for the remainder of the quarter. MR clean tankers trading in the West outperformed clean MRs trading in the East by approximately 23k $/day. This is down from an average premium of 29k $/day in 2023.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe

Source: Breakwaveadvisors