- Red Sea crisis resolution: Negative impact on product tanker tonne-miles and rates.

- Strait of Hormuz disruption: Serious consequences for the product tanker market.

- Russia-Ukraine war resolution: Softening of rates due to shift to short-haul routes.

- Dangote refinery delay: Support for MR demand due to increased European refined product exports to West Africa.

Product tanker earnings will moderate in 2025 as demand fears and improving supply weigh on rates, reports Drewry.

Oil demand is expected to remain modest in 2025

The journey of the humble product tanker has been full of surprises with rates surging since the start of the Russia-Ukraine war. Owners benefitted hugely from the surge in tonne-mile demand, but earnings started to fall in 3Q24 when rates began moderating due to slowing demand.

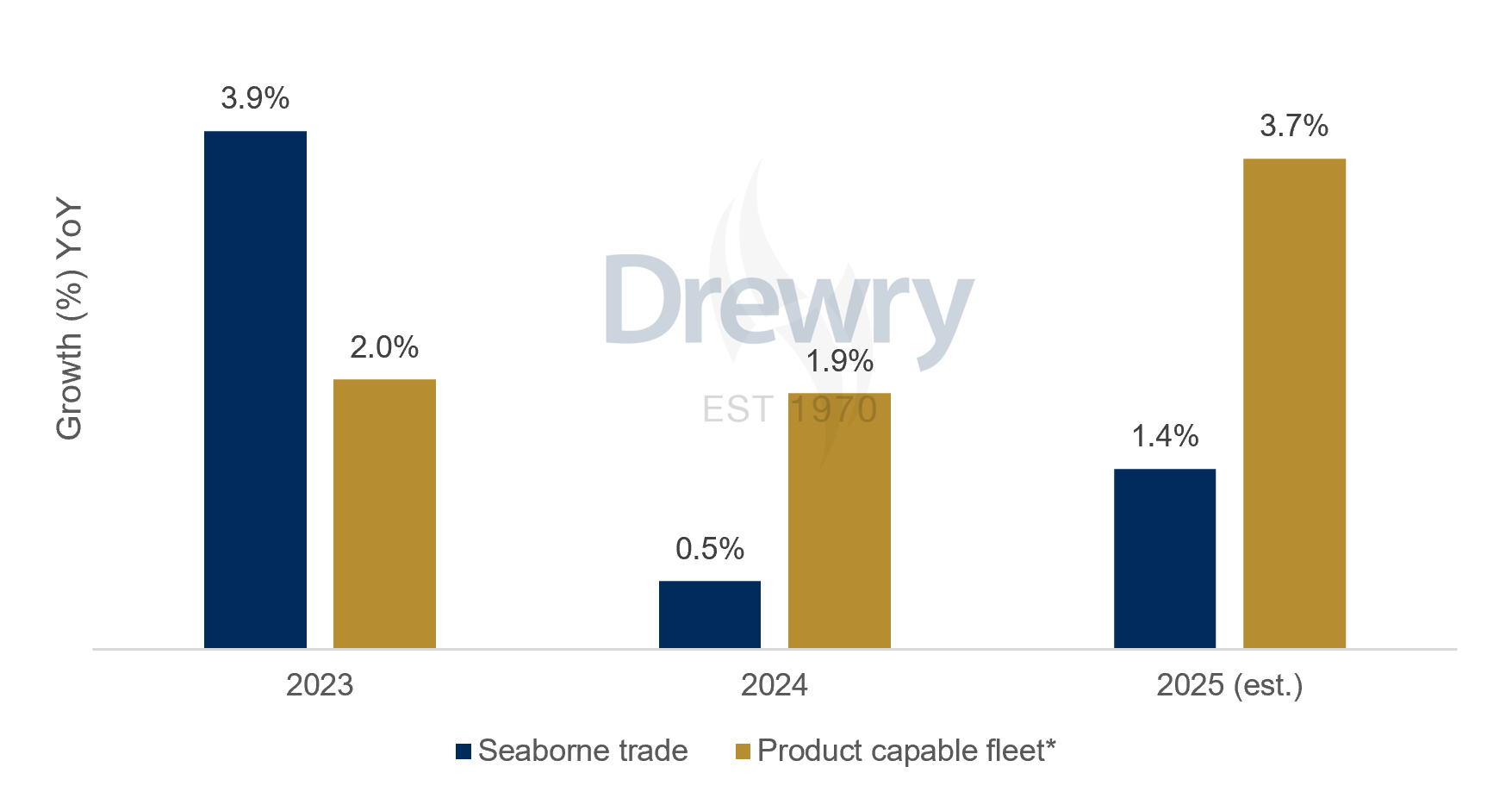

Factors such as high deliveries are likely to get triggered with the onset of 2025 and could derail the high earnings of product tankers, which were supported by tight tonnage amid stretched voyages in 2024. Around 85 product-capable MRs are scheduled to join the fleet in 2025, followed by 60 LRs with demolitions expected to gain momentum but remain soft. As a result, we expect the fleet to expand in 2025.

Meanwhile, oil demand is expected to remain modest in 2025 due to a shift towards clean fuel with most of the growth attributed to naphtha and jet fuel, whereas the growth of diesel and gasoline will remain stable. Although the growth in seaborne trade is expected to be higher next year, fleet expansion could exceed this growth which will weigh on rates.

Major refineries to reshape MR trade

The clean tanker market is threatened by refineries reaching full capacity in 2025 in major importer countries. While Dangote is expected to reach full capacity by 1H25, which will slash the country’s import requirement and could turn it into a net exporter of refined products, the ramping up of refinery runs in Mexico’s Olmeca refinery will affect the US clean product flow, affecting MR demand. However, some support will come from refinery closures in Europe next year, which will increase the region’s dependence on imports, but will fail to lift the rates as European demand will be too soft to impact rates.

Nonetheless, LR rates have softened so far in 2H24 primarily due to the influx of bigger crude tankers into the products trade, but a rebound in LR rates is contingent on firming large dirty tanker rates, which would curb the dirty-to-clean switch.

Conclusion

In a nutshell, the picture doesn’t look rosy for product tankers in 2025 as fleet expansion and modest demand weigh on rates. However, the resolution of the geopolitical issues is the biggest wildcard. Some of the key risk factors in 2025 are:

- A resolution of the Red Sea crisis will restore the transit via the conventional Suez Canal route, negatively impacting product tanker tonne-miles and putting pressure on rates, given recent fleet expansion.

- Any disruption to traffic transiting the Strait of Hormuz will have serious consequences for the product tanker market as it will have significant repercussions on global oil supply and its trade.

- A resolution of the Russia-Ukraine war will switch trade patterns back to short-haul routes, softening rates.

- Any delay in ramping-up the Dangote refinery will buoy exports of European refined products to West Africa, supporting MR demand.

Did you subscribe to our daily Newsletter?

It’s Free Click here to Subscribe!

Source: Drewry