The introduction highlights the purpose of the Cancelled Sailings Tracker, which provides insights into blank sailings announced by different shipping alliances compared to the total number of scheduled sailings.

The introduction highlights the purpose of the Cancelled Sailings Tracker, which provides insights into blank sailings announced by different shipping alliances compared to the total number of scheduled sailings.

Further to the snapshot below, you may be interested in an annual subscription to our Container Capacity Weekly Insight which provides detailed assessments and analysis by main trade and alliance. Weekly reports include port waiting time events for Los Angeles and Long Beach and year-on-year comparisons.

Weekly Analysis of Cancelled Sailings

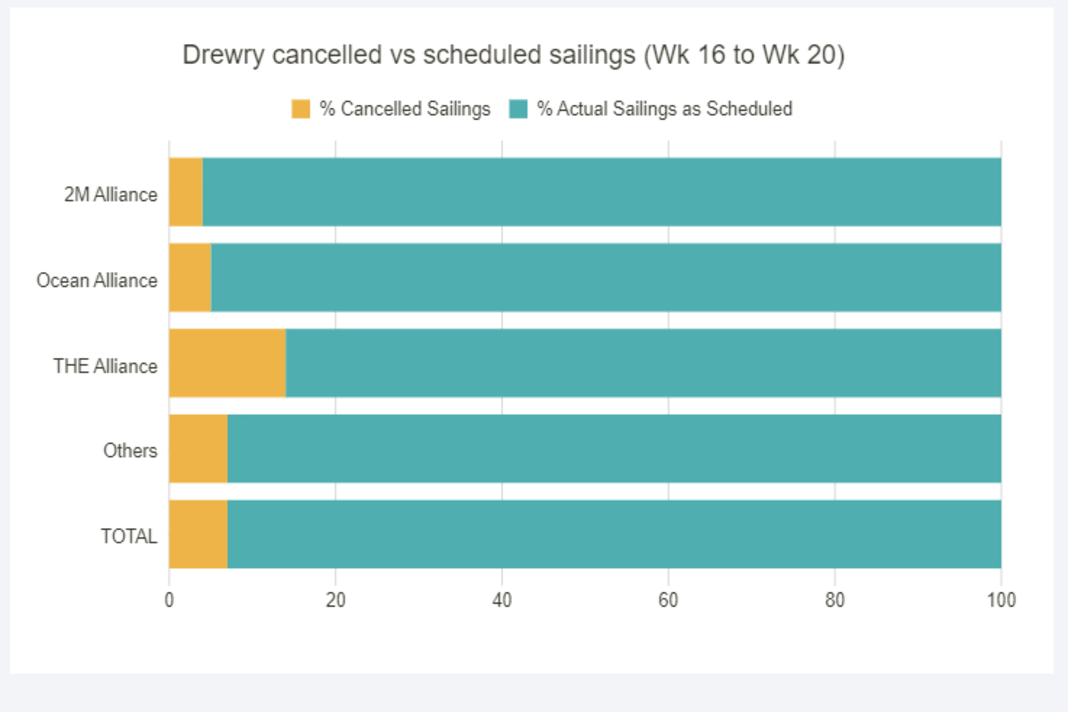

Across the major East-West headhaul trades: Transpacific, Transatlantic, and Asia-North Europe & Med, 46 canceled sailings have been announced between week 16 (15 Apr-21 Apr) and week 20 (13 May-19 May), out of a total of 645 scheduled sailings, representing 7% cancellation rate.

During this period, 41% of the blank sailings will occur on the Transpacific Eastbound, 37% on the Asia-North Europe and Med, and 22% on the Transatlantic Westbound trade.

Over the next five weeks, THE Alliance has announced 17 cancellations, followed by OCEAN Alliance and 2M with 8 and 5 cancellations, respectively. During the same period, 16 blank sailings have been implemented by non-Alliance services.

As can be seen above, we expect a modest improvement in carrier service reliability: on average 93% of the ships are expected to sail as scheduled.

On the ocean freight side, Drewry’s World Container Index contracted 1% WoW to $2,795, yet it remained 81% higher than the December 2023 average ($1,548). Transpacific rates dropped 3%, while rates on Asia-Europe and Med routes remained steady WoW, and Transatlantic rates experienced a modest 1% decline.

The disruption to USEC supply chains caused by the collapse of the Francis Scott Key Bridge is compounding ongoing issues such as Red Sea diversions and the Panama Canal drought. However, there has been no immediate impact on freight rates. Importers in the USEC may encounter further obstacles caused by possible industrial action/labor strikes in 2H24.

Did you subscribe to our daily Newsletter?

It’s Free! Click here to Subscribe

Source: Drewry