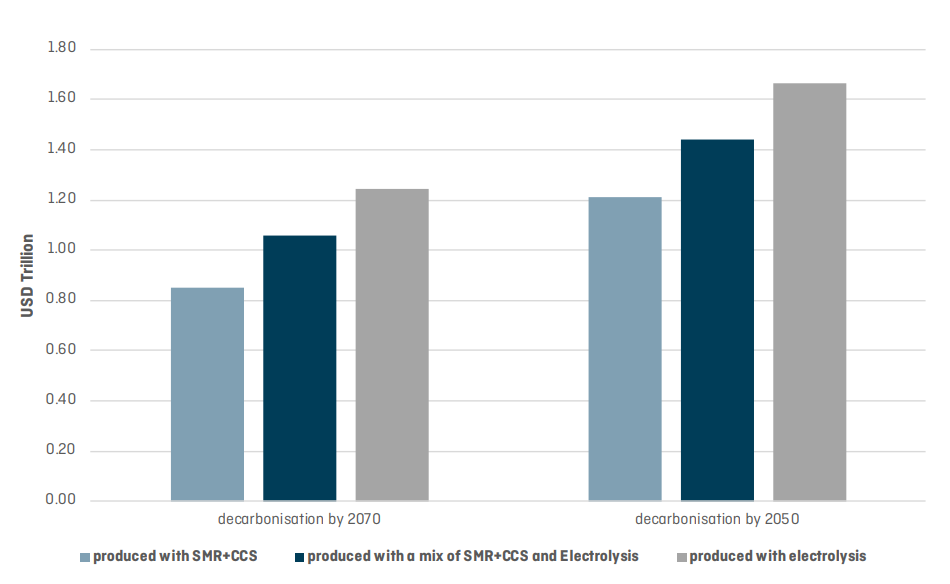

- $1 trillion of capital investment in land-based and ship-related infrastructure is required to reduce the GHG emission target by 2050.

- on an average between USD 50- 70 billion investment needed annually for 20 years to reduce the carbon emission by 50%.

- Additional investments of about USD 400 billion over 20 years, taking the total investments to USD 1.4-1.9 trillion dollars to dully decarbonize by 2050.

- Modeled capital investments in ship infrastructure including CCS, hydrogen and ammonia production and scaling up fuel production.

- Land-based storage and bunkering investments and ship based investments such as the engine, onboard storage the key.

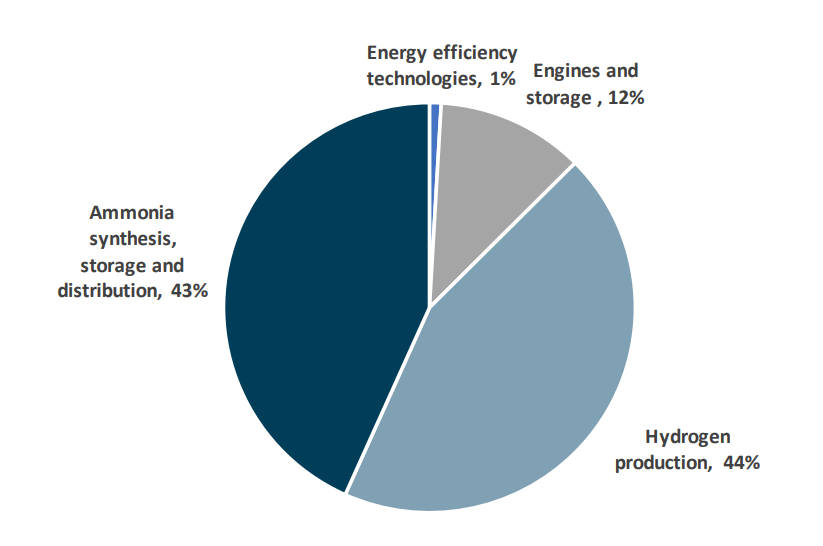

- 87% investments for land-based storage and fuel production while 13% will be needed for ship up-gradation.

- Ammonia and hydrogen fuel production needs 43% and 44% investments respectively.

- Capitalizing on the data, electrification and energy efficient technologies holds the key.

Several reports across the globe is a buzz with shipping decarbonisation infrastructure investment prediction. Leading shipping news websites such as the Ship Technology, Safety4Sea etc. have highlighted the study which predicts that the shipping industry will need to invest at least $1tn in land-based and ship-related infrastructure in order to meet the International Maritime Organization’s (IMO) targets to cut greenhouse gas emissions by 2050.

The Zero Carbon Shift

- Stakeholders in the maritime industry are currently undertaking new measures, imposed by the IMO, to shift to a zero-carbon system within the next three decades and reduce the sector’s total emissions by at least 50% compared to 2008 levels by 2050.

- The report – published by University Maritime Advisory Services (UMAS) and the Energy Transitions Commission (ETC) – estimated that the cumulative investment needed between 2030 and 2050 to halve emissions would amount to circa $1.4tn.

- According to the study, a further $400bn will also be required in order to fully decarbonise the sector, bringing the total capital needed to $1.9tn.

- Breaking down the share of investments, researchers specified that 87% of the total funds will have to be invested in land-based storage, bunkering infrastructure and production facilities for low carbon fuels

Modeled Capital Investments

The graph above presents the modeled capital investment needed for two different situations of decarbonization:

- 50% GHG reduction by 2050 on the way to 100% by 2070, as per the IMO mandate;

- 100% GHG reduction by 2050, as per a 1.5°C scenario.

Moreover, the graph presents three different ways for hydrogen production:

- pure electrolysis production

- production based on pure steam methane reformation (SMR) with carbon capture

sequestration (CCS), - and a mix between the two

Need for investment: upstream in energy and fuel production

In the meantime, the study addresses that investment needs can be divided in two main categories:

- Ship related investments: include engines, on-board storage and ship-based energy efficiency technologies;

- Land-based investments: include investments in hydrogen production, ammonia synthesis and the land-based storage and bunkering infrastructure.

The majority of the share is needed in the land-based infrastructure and production facilities for low carbon fuels, which make up around 87% of the total investment.

Only 13% of the investments needed are related to the ships themselves. These investments include the machinery and onboard storage required for a ship to run on ammonia both in newbuild ships and, in some cases, for retrofits. Ship-related investments also include investments in improving energy efficiency, which are estimated to be higher due to the higher fuel costs of ammonia compared to traditional marine fuels.

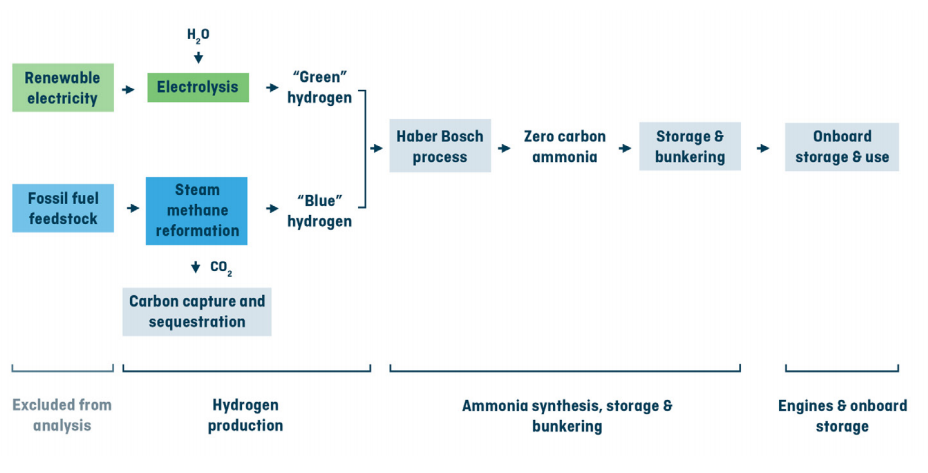

Green and blue hydrogen potential feedstocks for zero carbon ammonia

The investments rely on the production of low/zero carbon hydrogen, which can either be produced from natural gas using steam methane reformation (SMR) combined with carbon capture and storage (blue hydrogen) or from renewable electricity and water through electrolysis (green hydrogen).

The competitiveness between the two options is based on investment costs and the prices of electricity and natural gas and will be significantly influenced by technology development and policy choice.

Referring to the study, Johannah Christensen, Managing Director, Head of Projects & Programmes at the Global Maritime Forum, a partner of the Getting to Zero Coalition commented that

“The investment needed should be seen in the context of global investments in energy, which in 2018 amounted to $1.85 trillion. This illustrates that shipping’s green transition is considerable, but certainly within reach if the right policy measures are put in place.”

Also, the development of technologies will result to decrease of CCS costs, while acceleration of cost reductions for CCS would allow for a competitive marketplace between green and blue hydrogen, likely influenced by contextual geography and policy.

Key Points of the Study

- The reduce of overall costs of decarbonization can be achieved in the upstream production of fuels, making urgent the need to involve stakeholders across the full fuel value chain to make the transition possible in the most economically efficient manner.

- Hydrogen and ammonia have multiple applications in today’s economy and likely increasing roles in the global economy across energy storage, low carbon heat, transport fuels and, in the case of ammonia, as a key input in the production of fertilizer. This means that investments in hydrogen and ammonia production can serve other purposes than supplying fuels for shipping, which can create synergies and reduce the investment risk, especially in the early phase of the transition.

- the significant investments needed to decarbonize shipping can only be expected to happen if there is a long term commercially viable business case. Technological developments alone – although very important – are not expected to be enough to create such a business case as the costs of zero emissions fuels are expected to be significantly higher than traditional fossil fuels used in shipping in the coming decades.

Read the full study report here

Investments for Ship Upgradation

Furthermore, 13% of investments would have to be used for the ships themselves, which will require new machinery and onboard storage in order to run on low carbon. Ship-related spending would also include investments in “improving energy efficiency, which are estimated to grow due to the higher cost of low carbon fuels compared to traditional marine fuels,” the study added.

The study was conducted on behalf of the Getting to Zero Coalition, a non-profit alliance that includes the Global Maritime Forum and World Economic Forum, and based its estimates on ammonia, a primary zero-carbon fuel.

Appetite for Sustainable Investments

“Sustainable investing is here to stay,” Citigroup chairman of global shipping logistics and offshore Michael Parker wrote in the study.

“There will be a great appetite for investments in sustainable infrastructure projects that help reduce greenhouse gas emissions.”

Understanding the Challenge & Investing

Echoing a similar sentiment, Global Maritime Forum managing director and head of projects and programmes Johannah Christensen said that it is important to understand the scale of the challenge to solve it.

“Shipping’s shift to zero-carbon energy sources calls for significant infrastructure investments,” Christensen added.

“The investment needed should be seen in the context of global investments in energy, which in 2018 amounted to $1.85tn. This illustrates that shipping’s green transition is considerable, but certainly within reach, if the right policy measures are put in place.”

Intensive Capital Asset Investments

University College London’s (UCL) Energy Institute also participated to the study. Highlighting the importance of using low-carbon fuel, UCL energy lecturer Tristan Smith said that the next three decades will witness a rapid change with “fossil fuel aligned assets becoming obsolete or needing significant modification.

“Energy infrastructure and ships are long-life capital-intensive assets that normally evolve slowly,” he added.

“Even though regulatory drivers of this system change such as carbon pricing are only starting to be debated, the economic viability of today’s investments and even the returns on recent investments will be challenged, and the sooner this is factored in to strategies and plans, the better.”

Capitalising on the Data

In response to the study, GeoSpock head of maritime business Mark Porter told Ship Technology that the industry must first and foremost capitalise on data ahead of pumping in trillions of dollars.

“Gathering and monitoring maritime data is the most effective first step in curbing emissions. The sector generates hordes of data, but it lacks the means to ingest, analyse, report and optimise journey and fuel usage,” Porter adds.

“By collecting location, fuel and emissions data from ships, companies, ports and governments can have real-time visibility into operations and decide what works and plan accordingly.”

Porter believes that if the data collected is pooled, the industry will be better enabled to “establish a baseline of emissions and other initiatives, such as new fuels, can be introduced, tested and optimised”.

“The maritime industry is siloed. However, as a collective, it has an opportunity to tackle sustainability. By embracing data and developing a hub for maritime intelligence, we can understand emissions and tackle them as efficiently as possible,” he adds.

Electrification As A Viable Way

Building on the importance of using technology to achieve sustainability, Danfoss Editron’s marine director Erno Tenhunen says that electrification is another suitable way that shipowners must delve into. He adds that it is a “short and long-term solution for cutting carbon emissions as it utilises different types of energy sources with hybrid variants such as batteries, supercapacitors and fuel cells”.

Tenhunen says that electrification’s benefits go beyond just cutting carbon emissions. “The first electric ship was built back in 1838 and electrification has been a solution for many types of ships since then, increasing safety, reducing fuel consumption and improving operational performance,” he says.

“Additionally, fully-electric ships with shore charging are becoming more prevalent for many types of vessels, such as ferries and small-scale autonomous ships.”

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Safety4Sea, Ship Technology,