- Trafigura’s Infrastructure assets investment strategy received a major boost as Frontline made a $547 million deal for its Seuzmax

- The company will also get 8% percentage of Frontline’s shares

- This deal boosts both Trafigura’s cash inflow and scrubbers investment outlook which made it retrofit 16 suezmax & 17 tankers.

- Frontline is taking the help lending banks and its shareholder Hemen Holding for this project.

- Frontline will charter 5 vessels back to Trafigura after 3 year charter at $28,400 daily charter.

- The deal which allows for 6 more vessel purchase, will make Frontline the largest suezmax operator in the world

- Trafigura has also made a deal with Golden Ocean for a Marine Fuel Joint Venture

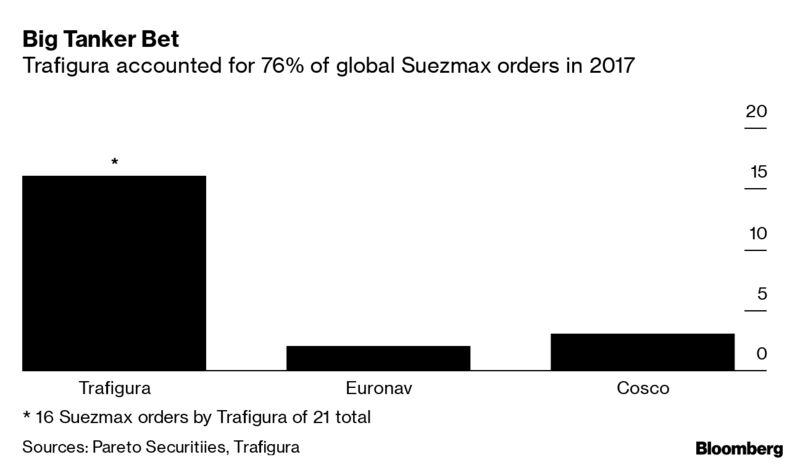

According to a Bloomberg article, commodities trader Trafigura Group Pte Ltd.’s big bet on shipping paid off as it agreed on a tanker sale that will give it much-needed cash and a stake in one of the world’s largest oil-freight firms.

Frontline Opts for Trafigura Suezmax

Frontline Ltd., the Oslo-based oil tanker company backed by billionaire John Fredriksen, will buy 10 newly built Suezmax tankers from Trafigura. In exchange, the commodity trader will get between $538 million and $547 million in cash as well as 8.48% of Frontline shares worth about $128 million.

What does this mean for Trafigura?

The agreement announced on Friday validates Trafigura’s 2017 decision to back a $1.55 billion order for 16 Suezmaxes and 19 oil-product tankers fitted with units known as scrubbers, which are needed to comply with new environmental regulations coming in 2020 to reduce sulfur emissions from shipping.

“This marks a continuation of an approach that has long been integral to Trafigura’s strategy, namely investing in infrastructure assets in support of commodity flows and then collaborating with a market leader like Frontline to maintain sufficient access to those assets for our trading business,” Rasmus Bach Nielsen, Trafigura’s global head of wet freight and a driving force behind its recent moves in shipping, said in a statement.

More Vessels from this deal

In addition to Frontline paying as much as $675 million in cash and shares for 10 of those Suezmaxes, the tanker operator has the option to buy four more of the vessels. The deal is expected to close between November and March.

New Rules

In the past, Trafigura has used its commodity-sector knowledge and access to relatively cheap capital to invest in the construction of pipelines and ports, eventually selling stakes in those assets while maintaining access for its commodity flows. Handling about 5.5 million barrels of crude and products per day, Trafigura is the second-biggest independent oil and metals trader.

Freight rates have been rising ahead of implementation of the International Maritime Organization’s 2020 sulfur regulations. The cost of hiring a Suezmax tanker is currently close to $13,000 per day, according to data from the Baltic Exchange. Rates have increased since the start of the month and are at their highest on a seasonal basis since 2015.

As part of the deal with Trafigura, Frontline agreed on long-term charters for all 10 vessels until the deal closes at a price of about $23,000 a day. That is “loss making on current spot rates” but “fair given the outlook for the balance of the year,” analysts at Fearnley Securities AS said in a note to clients.

Cash Boost

Over the course of this year, about 2,200 ships globally will install so-called scrubbers, allowing them to keep burning high-sulfur fuel oil once IMO 2020 comes into force. Much of the work is being crammed into the fourth quarter, threatening to drain capacity from the global fleet.

The deal will provide Trafigura with a cash boost amid pressures about its debt levels and criticism from short-seller Iceberg Research about how it values some assets.

Trafigura is highly leveraged, with adjusted net debt standing at nearly $7.6 billion at the end of March, equal to nearly 4.5 times its annual earnings before interest, tax, depreciation and amortization in its fiscal 2018 year.

Separately, Trafigura this month struck an agreement with Frontline and Golden Ocean Group Ltd., a dry bulk shipping firm also backed by Fredriksen, to form a marine-fuel joint venture.

How will it help Frontline?

Fearnley says the deal will make Frontline the largest Suezmax operator in what it rated “a very positive transaction” for the shipping firm.

According to the stock-cash deal, the shipping business will offer its 16,035,856 ordinary shares as a consideration at an agreed price of $8 per share, issuable upon signing, reports Ship Technology.

The company will pay between $538 to $547m following the completion of the transaction.

To fund the acquisition, Frontline is currently in discussions with lending banks.

An affiliate of Hemen Holding, which is also the largest stakeholder of Frontline, has offered $547m under a three-year facility.

Upon the completion of the deal, Trafigura will own nearly 8.48% of the ordinary shares of Frontline.

Until the deal is completed, Frontline will time-charter the ten vessels from Trafigura at a daily rate of nearly $23,000 to gain earlier access to the tankers.

The shipping company has agreed to charter five of these vessels back to Trafigura on three-year charters at a daily base rate of $28,400.

Frontline’s Outlook

Frontline Management CEO Robert Hvide Macleod said: “This transaction is backed by our strong belief in tanker market fundamentals and reflects our ability to act swiftly and decisively with the support of our largest shareholder. We welcome Trafigura as a strategic shareholder and believe the acquisition reflects the value Trafigura ascribes to our equity”.

“In addition to Trafigura being a long-standing customer of Frontline, we now have a unique partnership that we believe will lead to further synergies going forward”.

“The structure of the transaction creates an immediate impact on our earnings at a time when we expect freight rates to increase significantly. Moreover, we expect the Acquisition to boost our dividend capacity going forward.”

The deal enables Frontline to purchase four new Suezmax tankers by acquiring TML’s second special-purpose vehicle.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: Bloomberg , Ship Technology

![[Watch] Return of the Obra Dinn Schematic Timelapse](https://mfame.guru/wp-content/uploads/2020/10/maxresdefault-80x60.jpg)