- Navios Maritime Containers’ Q2 share price continues to be volatile.

- It operates in the cyclical container shipping market, and its balance sheet is on a knife-edge.

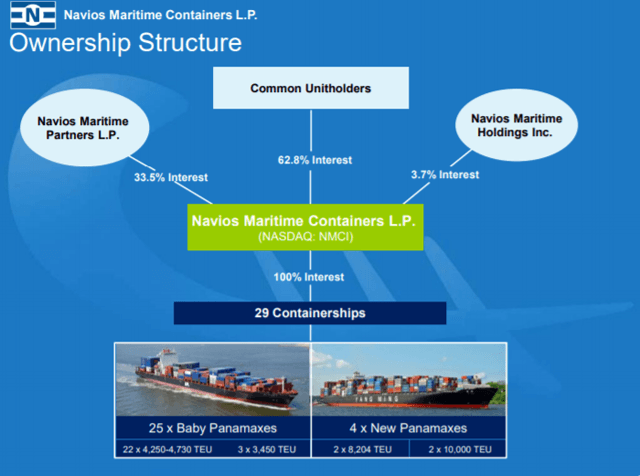

- NMCI is a small-cap shipping company, focused on the container shipping market.

- They own 25 small container ships and 4 larger ships.

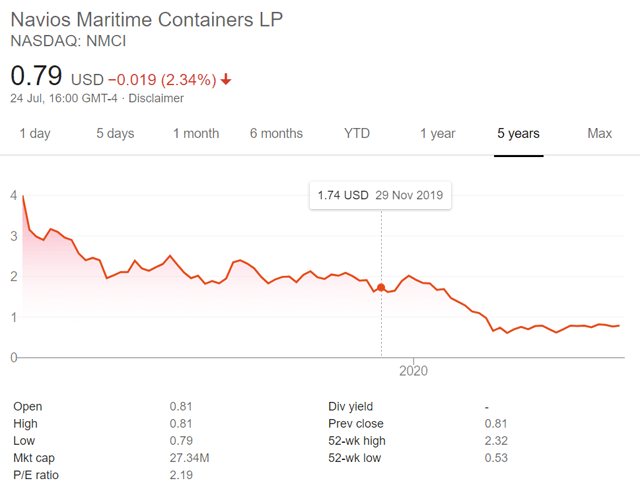

- The company has a market cap of $27 million and have not fared well since 2017.

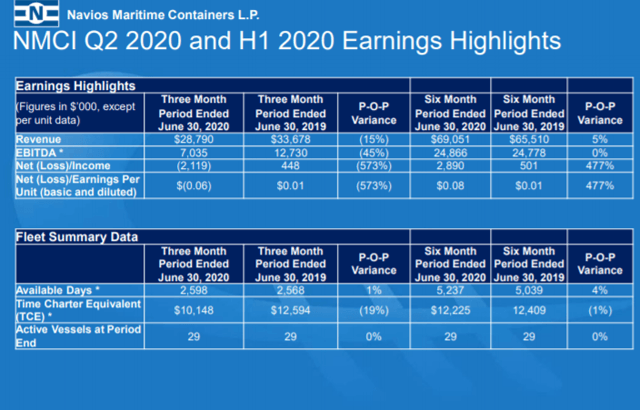

- With revenue of $28.79 million in Q2, NMCI ended up with a loss of $2.119 million.

- It is on a contract of $9,750 and should re-contract at approximately $18,000/day by Q4.

According to an article published in Seeking Alpha and authored by The Waltzy, Navios Maritime Containers’ share price has been – and most likely will continue to be volatile.

The balance sheet on a knife-edge

The company operates in the cyclical container shipping market, and its balance sheet is on a knife-edge.

However, overall, the stock remains cheap. Containership rates have been improving late. If they normalize in the near future, as we edge away from COVID-19, NMCI’s balance sheet will improve in short order.

At these prices, NMCI is a hold or an opportunistic purchase.

Who is NMCI?

NMCI is a small-cap shipping company, focused on the container shipping market. They own 25 small container ships, and 4 larger ships, with an average age of 12 years. The company was formed in 2017 and remains a member of the well known ‘Navios Family’.

Source: Q2 2020 investor presentation

Should you invest in NMCI?

The Navios name is well known for shipping. The overall group is active in dry-bulk, container-shipping, tankers, and in logistics.

NMCI is a containership focused growth vehicle, with 34.6 million units outstanding, which at July 26 trade for $0.79 each, giving the company a market cap of $27 million. The units have not fared well since they were issued in 2017.

Source: Google Finance

NMCI made a loss in Q2 2020, and it does not have a strong balance sheet. These are some early warning flags that I need to highlight here!

With revenue of $28.79 million in Q2, NMCI ended up with a loss of $2.119 million for the quarter.

Both of the above are from the Q2 2020 investor presentation.

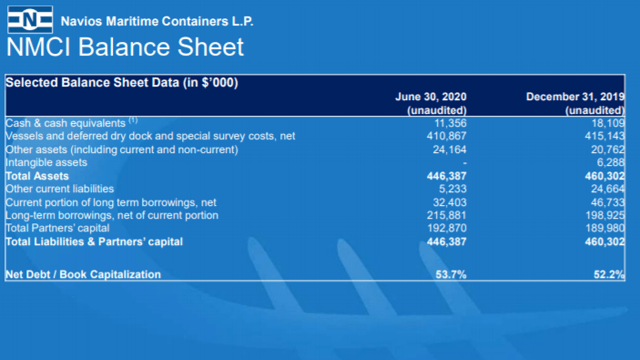

Total liabilities are $253 million, which is significantly bigger than the current cash assets NMCI has. Obviously, NMCI has significant other assets. However, I feel it is worth pointing out that NMCI’s liquidity looks somewhat strained.

As noted above, NMCI has a total market capitalization of just over $27 million. If you are a current holder of units, I think they remain a “hold“. Otherwise, if you have a high tolerance for risk, NMCI could be an add at these levels.

NMCI Potential

NMCI has a relatively large, standardized fleet. They primarily focus on the smaller containership market.

NMCI current fleet:

- 22 Baby Panamax (4,250 TEU)

- 3 Baby Panamax (3,450 TEU)

- 2 New Panamax (8,204 TEU)

- 2 New Panamax (10,000 TEU)

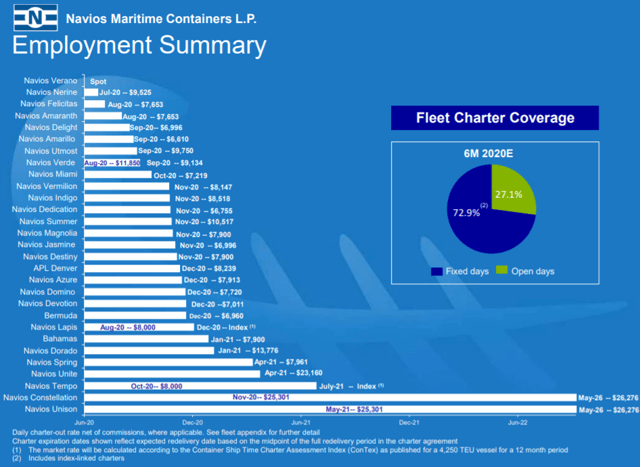

Their fleet employment status is below:

2 ships are on long-term contracts until May 2026. In addition, they have a few contracts expiring in 2021. But most of their contracts expire in 2020. Effectively, their ships can be considered “short term spot“. As a result, NMCI is highly leveraged to spot container shipping rates; with the underpinning of 2 longer-term contracts (the Constellation and the Unison).

Navios performance in Q2

We know how Navios did in Q2; and we have a very good idea as to how they will fare in Q3 & Q4. Using the details provided above, NMCI should have revenue of around $26 million in Q3. Clearly, this will not be a good quarter. Q4 will be somewhat better as the Navios Utmost will re-contract in September. It is currently on a contract of $9,750 and should re-contract at approximately $18,000/day. However, that one contract alone will not be enough to drag NMCI into profitability.

NMCI made a loss in Q2 and it looks very likely that they will lose money in both Q3 and Q4 2020 as well. In the very near term, NMCI’s finances do not look likely to improve.

2021 revenues

From the above, we know that 2020 will be hard on NMCI. We need to consider how 2021+ will look for the company.

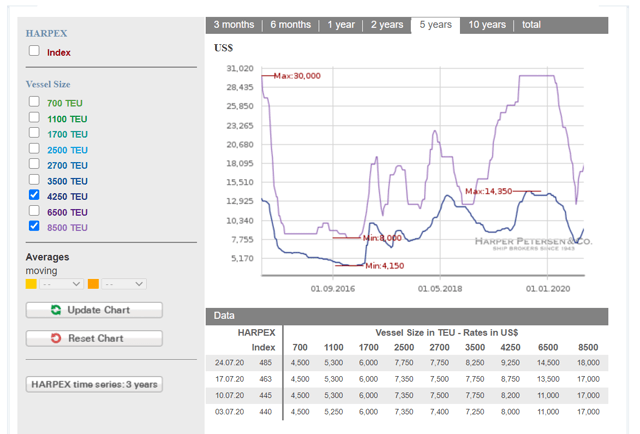

Below are the HARPEX rates at the end of July 2020. The graph shows the rates for the size classes most relevant to NMCI.

The 2 largest ships in the fleet are contracted out at $25k/day.

The 25 Baby Panamax ships are earning $9k/day and the 2 larger ships are earning approximately $18k/day.

We know what the 2 largest ships are earning. And we can use the above rates to work out what NMCI could earn during 2021. Based on the above, they would take in around $28 million in revenue per quarter. That is very much in line with Q2 2020, and in reality, is not enough for NMCI to improve its balance sheet significantly. Q2 2020 saw cash from operations of just $2.5 million.

At current rates, investing in NMCI represents “dead money“.

Take a look at the recent past, however. In early 2020, the Baby Panamax ships earned as much as $14,350/day – or $5k more than they are earning today. That $5k more would mean NMCI revenue would increase by over $10 million each quarter.

That is hugely significant for NMCI; their total market capitalization is currently just $27 million. If you think that rates will improve in the near term, NMCI’s results and balance sheet will improve significantly in the medium term.

NMCI Balance Sheet

From the above, it looks to me that an improvement in charter rates will have a massive impact on NMCI. I would like to state again that NMCI’s balance sheet is not in a good space. In fact, NMCI could have breached a covenant on its debt already!

Balance Sheet at June 30, 2020:

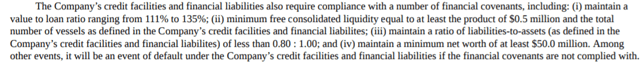

Cash was $11.356 million. NMCI’s credit facility details are outlined below:

I would draw your attention to point (ii) here: $500k/ship implies NMCI should have cash of $14.5 million! Now they clearly fall short of that at present. So they need to rectify this very promptly.

In the near term, it looks as if NMCI will need to rectify this position. In addition, they will have to complete surveys and ballast water treatments on a number of vessels in 2020. This is clearly a very big risk to NMCI. Will they complete these surveys? Or will they try and sell some of the assets to improve their balance sheet?

NMCI – some options left

All is not lost for NMCI here. They need rates to improve, that much is clear. They also have some levers that they can pull to improve their balance sheet.

1. NMCI was getting healthier in early 2020. It seems relatively logical that its lenders will grant them some flexibility to get through the worst of the Coronavirus / Chinese trade tensions.

2. Of their 29 vessels, 18 are subject to “sale and leaseback” transactions. So they have 11 vessels left which they could sell & subsequently lease; providing them with valuable financial flexibility. Additional debt won’t solve their problems, but it would buy them significantly more time.

3. NMCI could simply sell assets! In their Q2 presentation, they tell us that 70% of the debt was covered simply by scrapping ships. They don’t need to clean up the balance sheet immediately just realize enough cash to get them through Q3 and Q4 2020. NMCI could easily scrap, or sell, some of their older, smaller ships.

4. Containership rates are improving. It isn’t a wild outcome that rates continue to improve over the coming weeks and months. Improving rates will clearly have a huge impact on asset values as well.

Conclusion

Shipping is a volatile market. And small-cap shipping is clearly more volatile again! NMCI is now in a precarious position. It does, however, have a number of options. If NMCI can get through the next 6 months, it could easily have a much better future ahead of it.

Finally, it needs to be pointed out that NMCI units currently trade at less than $1/unit. They need to increase the price to over $1/unit by the end of 2020 or they will be asked to de-list. If the unit price doesn’t improve, NMCI will need to perform a reverse split before the end of the year.

Did you subscribe to our daily newsletter?

It’s Free! Click here to Subscribe!

Source: SeekingAlpha